BIR released a new memorandum regarding the invoice compliance for VAT and Non-VAT taxpayers. Let’s take a look on some of the details on how to issue your invoice if you’re a VAT of Non-VAT business.

Invoice Compliance and Requirements

According to RMC 77-2024, businesses are now required to issue “Sales Invoice” for every transactions.

It’s important to note that VAT taxpayers are required to issue a VAT Invoice regardless of the amount of the transacted sale/s.

While Non-VAT are required to issue a Non-VAT Invoice for transactions valued at ₱500 and above.

Invoice for transactions less than ₱500

But what if for every single transaction it is valued less than ₱500, would you still need to issue an invoice?

VAT businesses are still required to issue an invoice regardless if it’s ₱500 or below.

However for Non-VAT, invoice can be issued if:

1. Single transaction is more than ₱500

2. Buyer requested for an invoice regardless of its amount

3. End of the day sales transactions is less than ₱500

Take note that the threshold value of ₱500 will be adjusted every three (3) years according to the the present value of the Consumer Price Index, as published by Philippine Statistics Authority (PSA)

Service-based Business on Invoice and ATP

According to RMC 77-2024, service-based businesses are required to issue invoices. Following this purpose, an ATP should be secured in order for the Accredited Printer to print the invoices. But during transitory periods, they can choose to use the remaining unused Official Receipts by converting them into invoice.

Different date transactions

For sales of services with different transaction and payment collection dates, the following documents can serve as evidence for each transaction:

| DATE OF SALE TRANSACTION | DOCUMENT TO BE ISSUED | COLLECTION DATE | DOCUMENT TO BE ISSUED |

| Prior to April 27, 2024 | between January 22, 2024 & April 26, 2024 | Official Receipt | |

| Prior to April 27, 2024 | On or after April 27, 2024 | 1. Invoice 2. System generated and printed Official Receipt converted to Invoice (strike through and stamped) until December 31, 2024 or until completion of reconfiguration/enhancement whichever comes first 3. Manual Official Receipt Converted to Invoice (strike through and stamped) until full consumption 4. Back-up manual Official Receipt converted to Invoice (strike through and stamped) until full consumption | |

| On or after April 27, 2024 | 1. Invoice 2. System generated and printed Official Receipt converted to Invoice (strike through and stamped) until December 31, 2024 or until completion of reconfiguration/enhancement whichever comes first 3. Manual Official Receipt Converted to Invoice (strike through and stamped) until full consumption 4. Back-up manual Official Receipt converted to Invoice (strike through and stamped) until full consumption | After April 27, 2024 | Payment Receipt/ Official Receipt / Collection Receipt/ Acknowledgement Receipt |

Official Receipts to Invoice

However BIR still allows all businesses to use their unused Official Receipts to be converted to invoice. But starting the effectivity of RR 7-2024, Official Receipts are considered as supplementary documents only.

Taxpayers have the option to continue to use ORs as supplementary documents or convert Official receipts as Invoice. If you want to learn how to convert the unused Official Receipts to Invoice, click here: https://www.taxumo.com/blog/inventory-list-of-unused-official-receipts-how-to-issue-this-to-bir/

Official Receipt as Supplementary Document

All unused Official Receipts can be used as supplementary until fully consumed. However these must be stamped with the phrase “THIS DOCUMENT IS NOT VALID FOR CLAIM OF INPUT TAX”. Failure to stamp will make the document invalid to replace invoice.

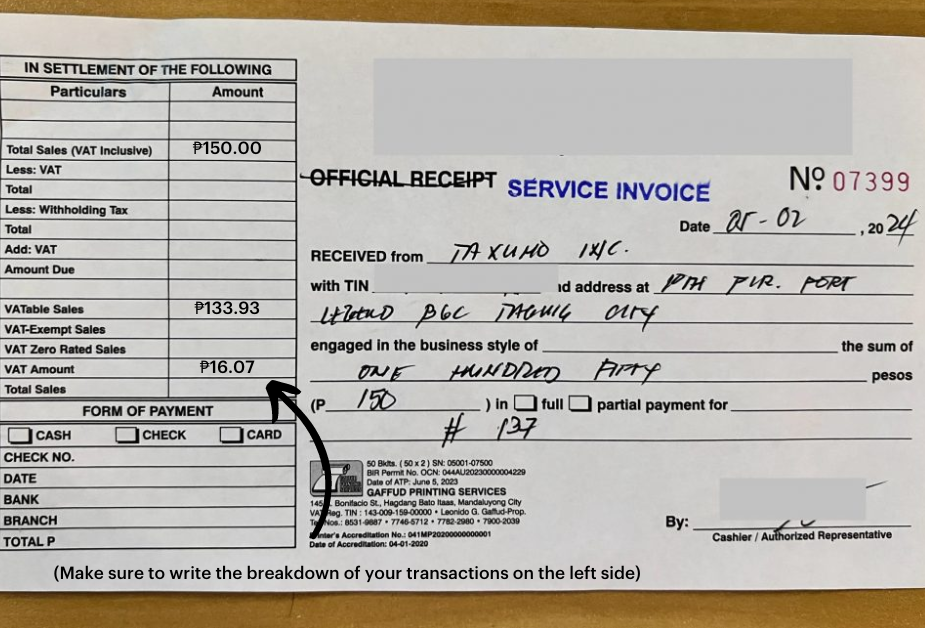

Converting Unused OR Booklets

Businesses can convert the remaining unused OR booklets as long as the word OFFICIAL RECEIPT/BILLING STATEMENT/STATEMENT OF ACCOUNT/STATEMENT OF CHARGES into INVOICE. Stamping of invoice can be according to the type of business. The stamp can either be INVOICE, CASH INVOICE, CHARGE INVOICE, CREDIT INVOICE, SERVICE INVOICE, BILLING INVOICE, or any name describing a transaction for which such invoice shall be issued to its buyers. Businesses must start issuing invoices or converted ORs as this has been mandated on April 27, 2024.

As for recurring billings, an invoice should be billed to the customer upon billing instead of Billing Statement or Statement of Account.

Issuing Inventory List of Unused Official Receipts

All taxpayers are required to submit an Inventory List of unused Official Receipts to be converted as Invoice. Read this article here to check on the format of the Inventory List to submit to BIR: https://www.taxumo.com/blog/inventory-list-of-unused-official-receipts-how-to-issue-this-to-bir/

Taxumo on Servicing New Invoices

If you need to convert your official receipts into invoices (and have new ones printed), you can email customercare@taxumo.com. We will connect you with one of our partner CPAs or processors to assist you.

Take note! By 2026, there will be a mandatory shift to Electronic Invoicing System (EIS) ifor Online Sellers and Professionals. Secure your spot today to be among the first to experience hassle-free, BIR-compliant e-invoicing by clicking here.