Taxumo Consult

Taxumo Consult connects Filipino freelancers, professionals, and small business owners with expert tax accountants who provide personalized advice, BIR compliance support, and strategic financial planning. Simplify your taxes, stay compliant, and grow your business with confidence.

Taxumo Consult

Taxumo Consult connects Filipino freelancers, professionals, and small business owners with expert tax accountants who provide personalized advice, BIR compliance support, and strategic financial planning. Simplify your taxes, stay compliant, and grow your business with confidence.

Trusted by licensed CPAs and taxpayers for secured, reliable, and hassle-free online tax support

“I’ve been a partner of Taxumo since 2018, and I believe in [Taxumo’s] vision to make tax filing easier online. Taxumo is one of the first to do [online tax consultations.] It aligns with my vision is to help business owners modernize their accounting and tax filing process.”

“Our team recently had the opportunity to consult with them for tax-related matters. We are very pleased with the service and expertise they provided. They demonstrated mastery of the subject matter and offered practical advice that helped us navigate a complex situation with confidence. Overall, we highly recommend their services for anyone looking for reliable legal support in tax and compliance matters.“

Mon Bermudez

Chief Operating Officer – Squadzip

“What sets Taxumo apart in the industry is its strong commitment to user experience and support. Being a Taxumo consultant has been incredibly rewarding, as the platform’s advanced tools and user-friendly design make it easy to help clients navigate tax compliance easily. Partnering with Taxumo has genuinely elevated our consulting practice and provided exceptional value to our clients.”

Mary Grace Dela Cruz

Certified Public Accountant

Meet our Tax Experts

Consult with CPA Renee

Availability:

Weekdays from 8:00am to 1:00pm

Saturdays from 1:00pm to 4:00pm

Renee is an accomplished finance professional who has consistently held a seat as the youngest member in every management team throughout her career in both local and multinational corporations. As the Founder of Finnix Consultancy, she leads a team that provides expert tax, accounting, and advisory services, helping businesses minimize risks and maximize profitability. Beyond her profession, Renee enjoys gun-shooting sports, arts, and literature — interests that cultivate her sharp, strategic mindset in delivering practical and innovative solutions for clients.

8 years of accounting and advisory; tax and regulatory compliance; and finance business partnering

- Certified Public Accountant

- Certified Management Accountant (US)

- DMAIC-trained

- Taxation and Regulatory Compliance

- Accounting and Internal Controls

- External Audit

- Commercial and Corporation Laws

- Automation and Technological Integration (ERP, RPA, etc)

- Management and Business Consultancy

- Start-ups and

- SMEs

- Freelancers

- Fast-Moving Consumer Goods (FMCG) Industry

- Pharmaceutical Industry

- Manufacturing Industry

- Service Industry

- Other mainstream industries

English and Filipino

Consult with Atty. Getty

Availability:

Weekdays from 10:00am to 12:00pm

Saturdays from 9:00am to 12:00pm

Sundays from 8:00am to 10:00am

Atty. Dy, CPA focuses on simplifying business complexities in tax compliance, business registration, accounting, labor laws, and corporate regulations. He helps businesses streamline processes using modern tools, reducing the need for micromanagement. Atty. Dy values long-term relationships with clients, providing ongoing support to help them stay compliant and grow without the stress of financial and legal concerns.

- More than 10 years in Audit, Taxation, Accounting, and Business Consultancy

- 2 years in Corporate law and labor law

- Certified Public Accountant

- Lawyer

- Board of Accountancy accredited external Auditor

- Cooperative Development Authority accredited external Auditor

- Bureau of Internal Revenue tax practitioner

- Audit and financial reporting

- Tax Compliance and Tax Assessments

- Labor, Civil, and Corporate law

- Accounting and Bookkeeping

- Xero Accounting Software implementation

- Micro, small, and medium enterprises

- Large Enterprises

- Start-ups

- Professionals and Freelancers

English, Tagalog and Bisaya or Cebuano

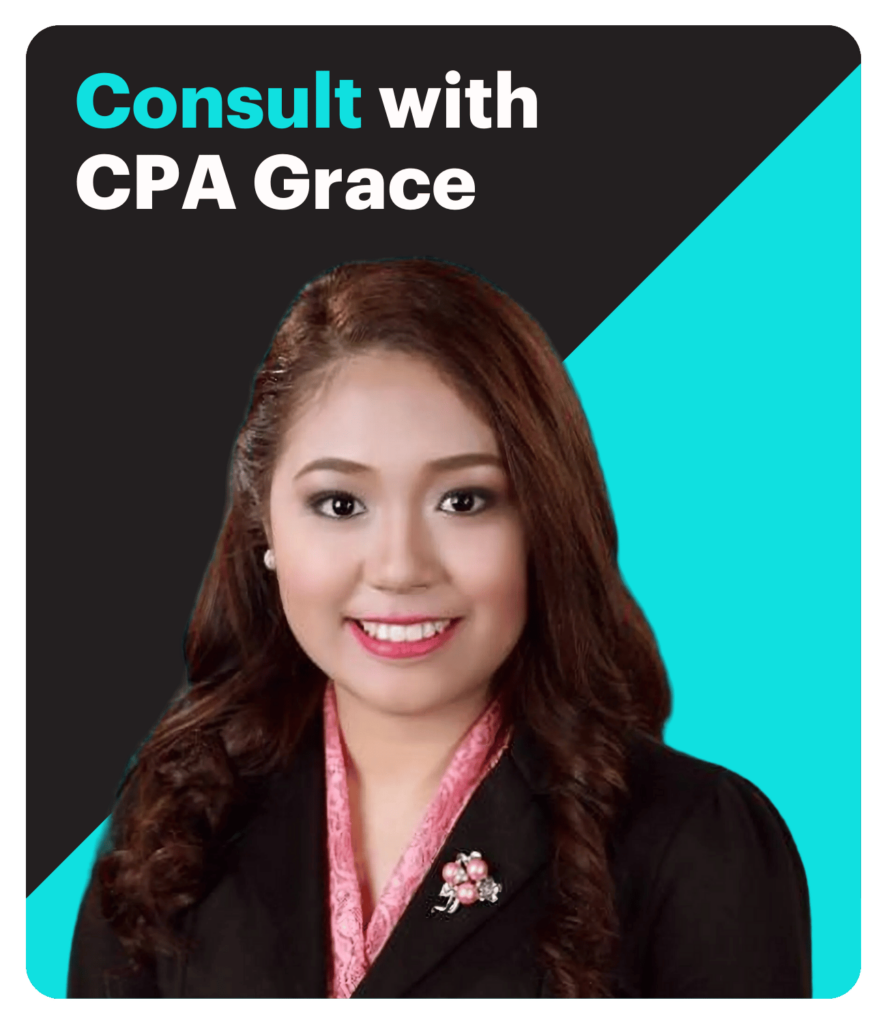

Consult with CPA Grace

Availability:

Mondays to Thursdays from 2:00pm to 6:00pm

Fridays from 4:30pm to 6:30pm

Mary Grace Dela Cruz is dedicated to advancing the field of accounting through innovative solutions, providing strategic financial guidance, and exceptional client service. Outside of work, she enjoys reading books and cherishing time with her family.

- More than 10 years in Accounting, Tax, Audit and Business Consultancy

- CPA in Public Practice

- BIR Accredited Tax Practitioner

- Certified Lean Six Sigma Yellow Belt

- Multi-Certified Oracle NetSuite Consultant

- Business Registration, IPO applications, Payroll, Tax Filing and Compliance

- ERP and Accounting Software Implementation

- Audit and Financial Reporting

- Professionals, Freelancers and Independent Contractors

- Micro, Small and Medium Enterprises

English and Filipino

Consult with CPA JM

Availability:

Weekdays from 9:00am to 6:00PM

Saturdays from 8:00am to 12:00pm

- Certified Public Accountant

- Accredited CPA in Public Practice

- Accredited Tax Agent

- Knowledgeable in cryptocurrencies

- Experienced in property transfer via capital gains, estate, and donor’s taxes

Consult with BIR Agent Beth

Availability:

Mondays to Fridays from 1:00pm to 6:00pm

Saturdays from 10:00am to 12:00pm, and 2:00pm to 4:00pm

Beth assists business owners in managing their tax obligations and ensuring accurate filing with the BIR and other relevant government entities. Her dedication lies in fostering the success of small businesses and offering guidance to those in need. Beyond her professional endeavors, Beth enjoys cross-stitching and unwinding with Netflix, presenting a relatable and approachable persona in any interaction.

30 years of experience in tax and BIR filing, and a total of 34 years in business advisory

- 24 years in Tax Filing and Compliance

- 24 years in Business Registration

- 25 years in Financial Reporting

- BIR Accredited Tax Practitioner

- QBO Certified

- Self-Employed Freelancers

- Self-Employed Coaches

- Online Sellers (Lazada, Shopee, TikTok)

- Warehousing and Manufacturing (Corporation)

- Importation of Spare Parts (Partnership)

- Clinic and Health Service Provider (Corporation)

- BPO Tax Accountant (Corporation)

- International Travel Agency (Corporation)

- Restaurant and Café (Sole Proprietorship)

English and Filipino

Consult with Atty. Jerwin

Availability:

Weekdays from 9:00am to 3:00PM

Saturday from 8:00am to 1:00pm

Jerwin Dave V. Patacsil is a CPA, Lawyer, and MBA holder with extensive expertise in tax, corporate law, civil law, and labor law. He primarily advises start-ups, freelancers, and SMEs, offering efficient and practical solutions to their legal and financial challenges. With a unique blend of financial acumen and legal insight, Jerwin helps clients navigate taxation, corporate structuring, and labor law complexities. Outside of work, he enjoys archery, bowling, and writing poetry.

8 years experience in tax, the majority of which as a BIR examiner

- CPA in Public Practice

- Lawyer

- Master’s in Business Administration

- Tax case (Letter of Authority) handling

- Tax compliance and financial reporting

- Corporate structuring and corporate law

- Civil law and labor law

- Start-ups

- SMEs

- Freelancers

- Medium to Large Corporations

English and Filipino

Ready to Simplify Your Taxes?

Sign up now to access expert tax advice, track your filings, and manage everything in one easy-to-use app. No jargon, just solutions.