What do you need to know about the new BIR Forms?

- Withholding Tax Forms

- Percentage Tax Form

- Income Tax Return Form

- Documentary Stamp Tax Form

Thanks to the Tax Reform for Acceleration and Inclusion (TRAIN) law, the government has taken the time to make changes to the old tax BIR Forms you filed before with a tax calculator in the Philippines.

With these new documents, you will find changes in filing dates, rates, and the number of pages. These differences were not only implemented to reflect the new rulings of the court in terms of the TRAIN law but to also make your life as a taxpayer easier.

If you use the old forms because of ignorance, you may not get punished, but you will have a harder time. Thus, these are different things you should know about the new BIR Forms.

Withholding Tax Forms

With withholding taxes in the Philippines, the main changes with the new forms are new filing dates and labels.

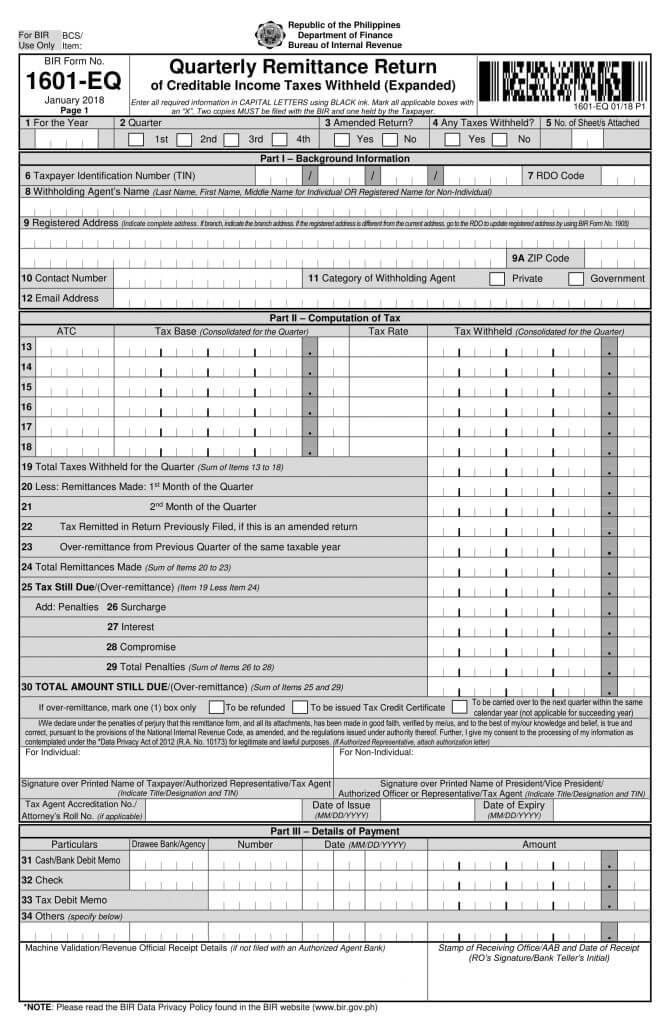

1601-EQ (Expanded Withholding Tax)

Expanded withholding tax should be paid by income earners who are professionals, medical practitioners, government agencies, and non-individual businesses.

The expanded withholding tax form before TRAIN Law only had BIR Form No. 0619-E and its filing covered two periods; 10th day of the first 2 months of the taxable quarter for non-eFPS taxpayers or 15th day of those months for eFPS taxpayers.

With the new BIR Form 1601-EQ, you do not have to pay for your company’s overall withholding taxes in the Philippines for two separate dates. Instead, the tax remittances you get from the employees will be paid during the last day of the month after the last tax payment quarter with form 1601-EQ.

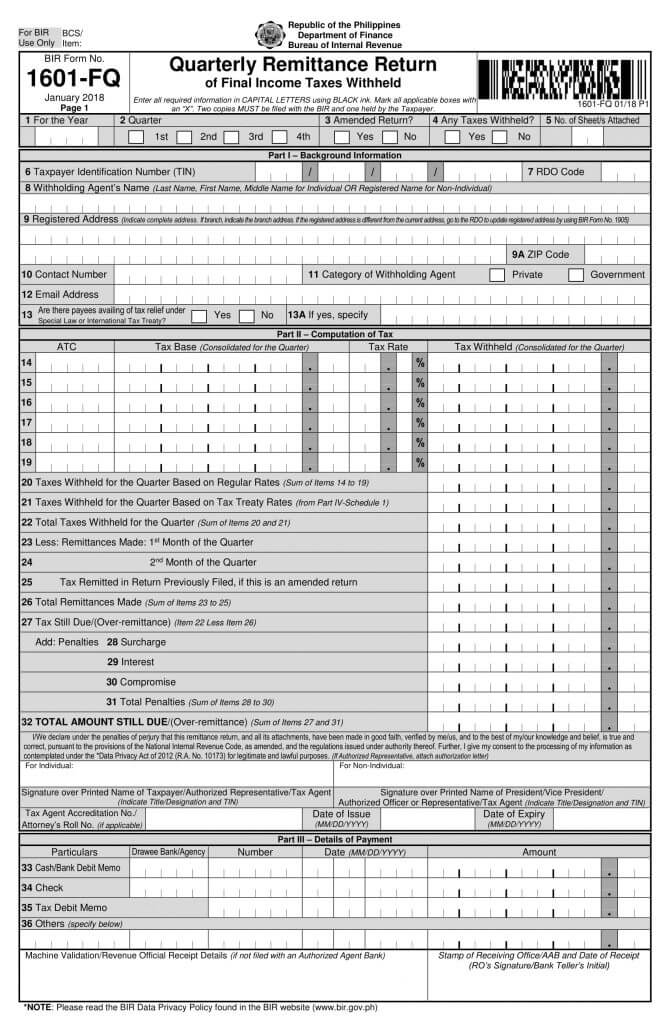

1601-FQ (Final Withholding Tax)

Final withholding tax is paid by income earners who are foreigners working locally in the Philippines.

The new BIR Form 1601-FQ replaced BIR Form No. 0619-F, which was filed during the 10th day of the first 2 months of the taxable quarter for non-eFPS taxpayers or 15th day of those months for eFPS taxpayers. With Form 1601-FQ, you just need to pay during the last day of the month after the last quarter.

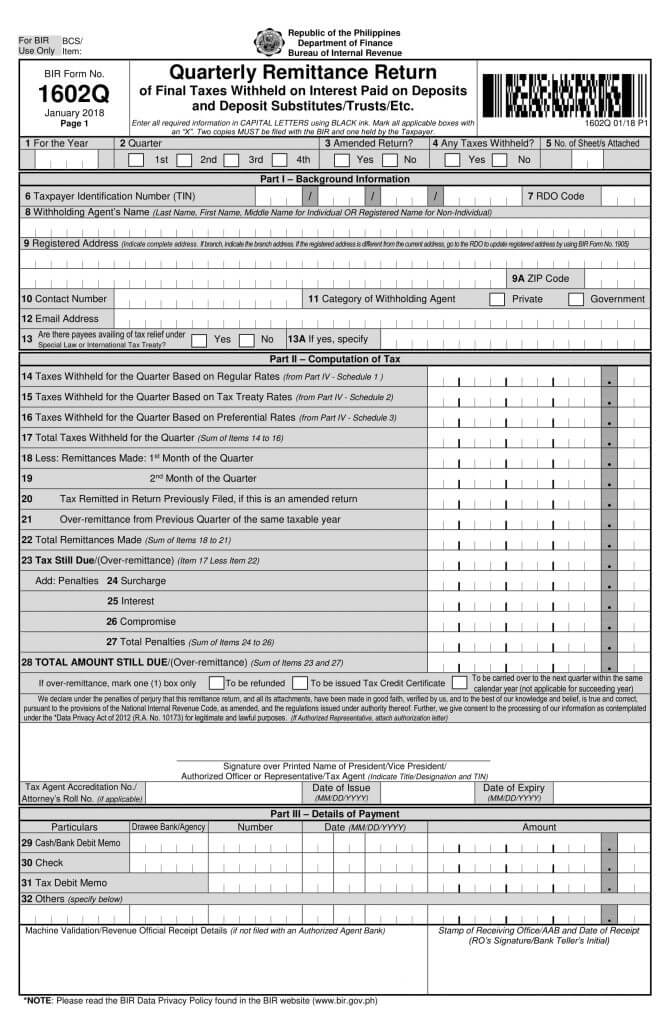

1602 Q (Final Withholding Tax Interest Paid on Deposits and Deposit

Substitutes/Trusts/Etc.)

Final Withholding Tax Interest Paid on Deposits and Deposit

Substitutes/Trusts/Etc. is meant to be paid by financial institutions such as banks For this, BIR Form 1602 Q replaced BIR Form 1602. With this new form, these institutions would now have to pay quarterly instead of monthly.

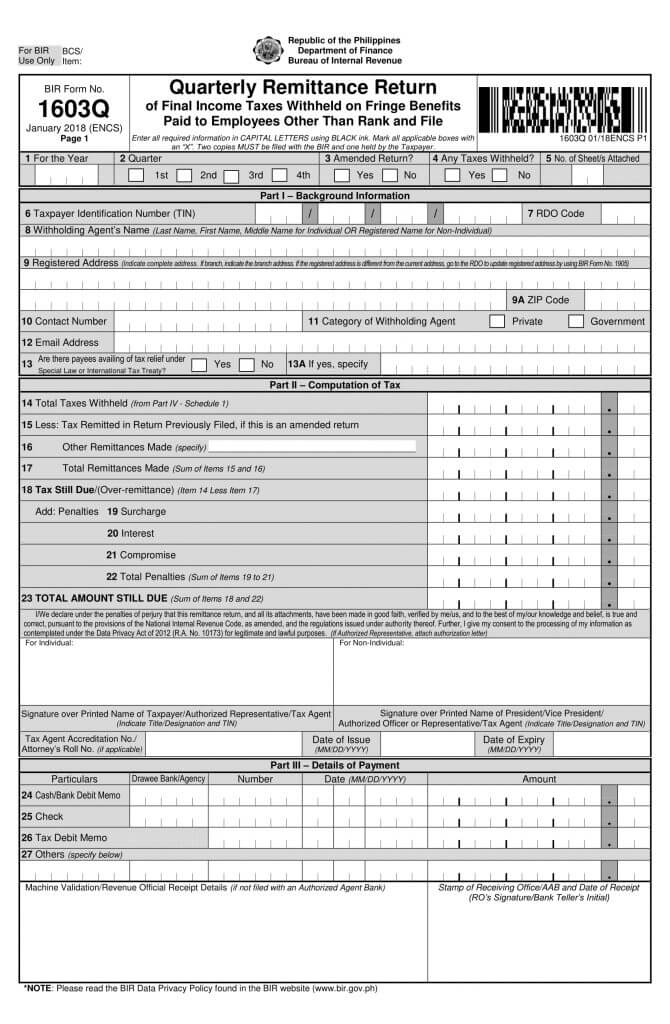

1603 Q (Final Withholding Tax Fringe Benefits)

Fringe benefits are benefits granted to employees outside of their salaries such as housing and vehicles. With 1603 Q, companies can pay the tax remittances of their employees by deducting these instead of their salary.

BIR Form 1603 Q replaced BIR Form 1603 because of two reasons. One, the filing date of the new form is moved to the last day of the month after the tax quarter’s end and tax rate increased from 32% to 35%.

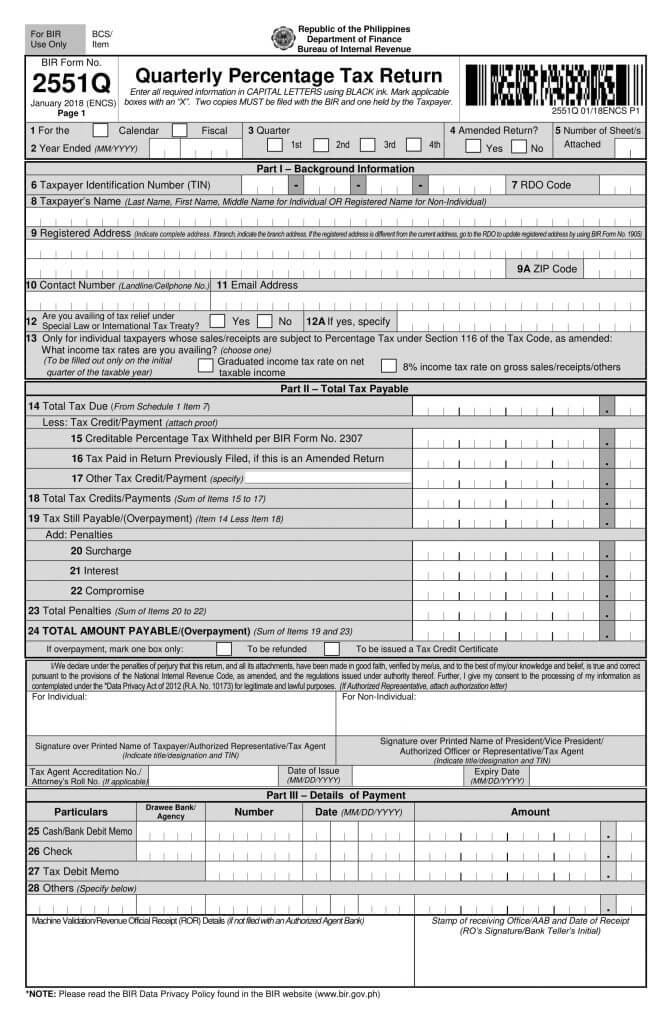

Percentage Tax Form

Percentage Tax is paid by businesses that earn less than 3,000,000 pesos annually, financial institutions, franchisees with annual revenue less than 10,000,000, and shipping carriers.

With the new BIR Form (2551 Q), percentage taxes have to now be filed on a quarterly basis, on the 25th day after the taxable quarter. The BIR Form 2551 M will no longer effective, thus, there is no need to pay a percentage tax on a monthly basis.

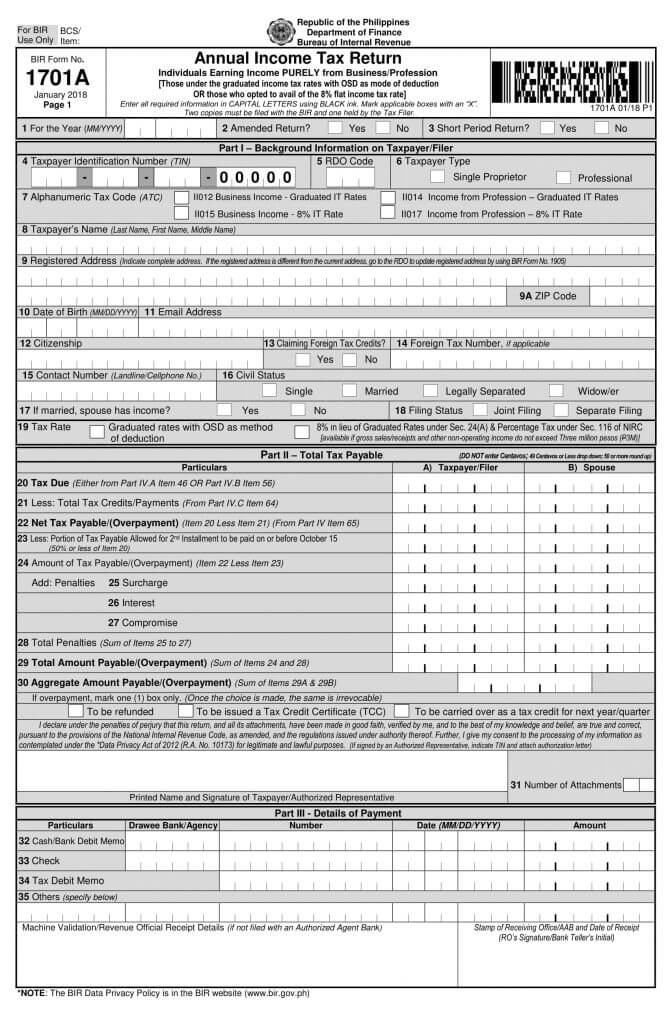

Income Tax Return Form

TRAIN did not change the labels of the different annual income tax return forms that were created in 2013 by BIR:

- 1700 — for compensation only income earners

- 1701 A — for freelancers and employees. Professionals are only allowed to file their taxes annually every April 15th if they have the 8% optional standard deduction (OSD).

- 1701 Q — for freelancers and employees. Professionals are only allowed to file their taxes three times per year; April 15, August 15, and November 15.

- 1702 RT — for non-individual taxpayers who are subject to a regular tax rat

- 1702 MX — for non-individual taxpayers who are subject to a special tax rate

- 1702 EX — for non-individual taxpayers exempt from income tax

The only changes with the form are the new filing deadline and the number of pages. Now, the pages were cut down from 13 to just 4 and income tax has to be filed April 15 every year.

Everyone knows how difficult and time-consuming tax filing can be. You have to remember the date and coordinate with your employees who are just as stressed out like you on the day itself. Forgetting doing any of this will lead to penalties.

Therefore, to make your life easier, you should subscribe to Taxumo Premium. Taxumo Premium is an award-winning full-service tax concierge that includes an online tax calculator in the Philippines. Taxumo Premium provides your business services such as business renewal, tax filing, income tax return, and bookkeeping services! And the best part? You can enjoy full tranparency with our user-friendly dashboard. Stop worrying about filing your taxes and start focusing on your business with Taxumo Premium!

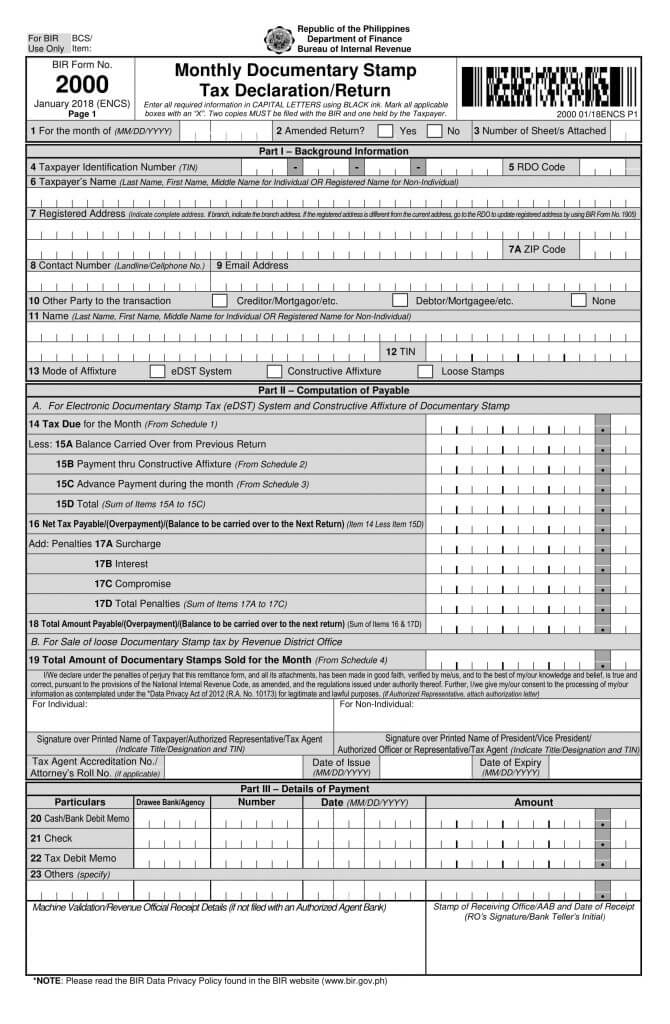

Documentary Stamp Tax Form

The documentary stamp tax is a form of excise tax applied to documents and papers showing a paid transfer of obligations, rights, and properties between two parties. The one who ends up paying for it is the person who usually benefits the most from the exchange and this concept will be dependent on the nature of the transfer itself.

With the revised form, what has changed are the increase in tax rates depending on what is sold. These are the current types of rate changes:

Rates Doubled

Life insurance policies, bank checks, mortgages, pledges, deeds of trusts, charters, certificates and warehouse receipts

Rate Increase

Debt Instruments (From 1,000 to 1,500 pesos)

Key Takeaway

A number of BIR Forms have been formally updated as an implementation of the official TRAIN Law. In this list, you will see how these taxes have been changed in different ways for the benefit of all taxpayers including you. By knowing what you need to know about the new BIR forms, the filing process will become easier for you.