YES!

In this blog, you will have two (2) key takeaways;

- The advantages of filing your Annual Income Tax Return in advance

- The quick and more affordable way of filing Annual Income Tax Return

As a Filipino taxpayer, it’s important to understand the advantages of submitting your Annual Income Tax Return (ITR) ahead of time. While the tax season may be a hectic time for many people, getting your Annual ITR sorted early on can actually save you a lot of hassle and even help you save money.

Here are some of the key benefits of filing your annual income tax return in advance:

Avoid Penalties and Interest Charges

Avoid penalties and interest charges: The deadline for filing your Annual ITR in the Philippines for 2023 is on April 17, Monday. If you miss this deadline, you will be subject to penalties and interest charges on any tax owed. By filing your Annual ITR in advance, you can avoid these additional fees and keep your tax bill as low as possible.

If you’re a Taxumo user, the deadline for your Annual ITR filing is on Tuesday, April 11, 2023.

Receive Your Tax Refund Faster

Receive your tax refund faster: If you’re entitled to a tax refund, filing your Annual ITR in advance can speed up the process of receiving your money. The quicker you file, the sooner the Bureau of Internal Revenue (BIR) can process your return and issue your refund. This can be particularly helpful if you need your refund to pay for bills or other expenses.

Note: This will be a separate process and timeframe outside of the Annual ITR filing.

Plan Your Finances Better

Filing your Annual ITR early also gives you a better idea of your tax liability for the year. This can help you plan your finances better and make informed decisions about spending and investments. By knowing how much you owe in taxes early on, you can make adjustments to your budget and avoid any surprises down the road.

Avoid the Rush

Filing your Annual ITR early also gives you a better idea of your tax liability for the year. This can help you plan your finances better and make informed decisions about spending and investments. By knowing how much you owe in taxes early on, you can make adjustments to your budget and avoid any surprises down the road.

Maintain Accurate Records

Finally, submitting your Annual ITR early can help you maintain accurate records and stay organized. By tracking your income and expenses throughout the year, you’ll be better prepared for the tax season. This can also help you avoid errors and discrepancies in your return, which may lead to additional penalties and fees.

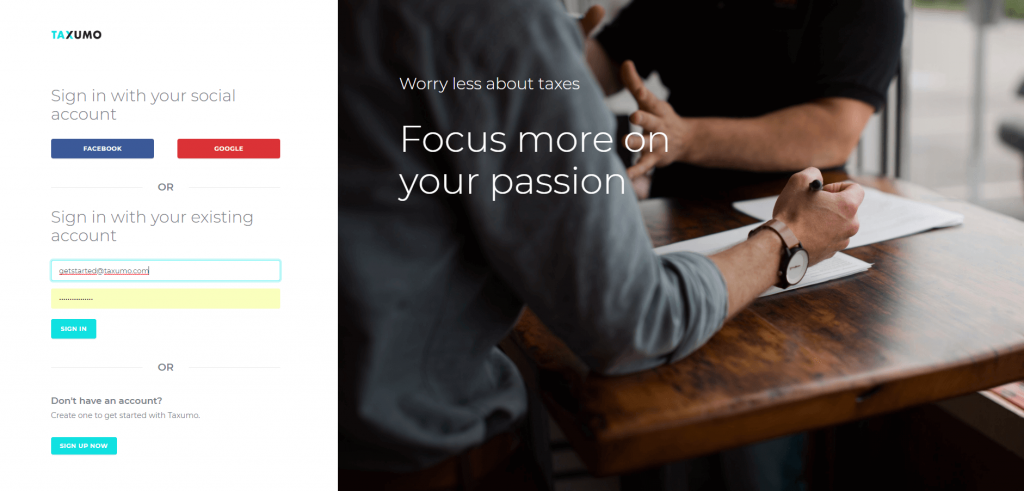

Now, you may wonder, is there an easier, faster, more cost efficient way to file your taxes in advance? The answer is absolutely yes: just sign up for a free account via Taxumo!

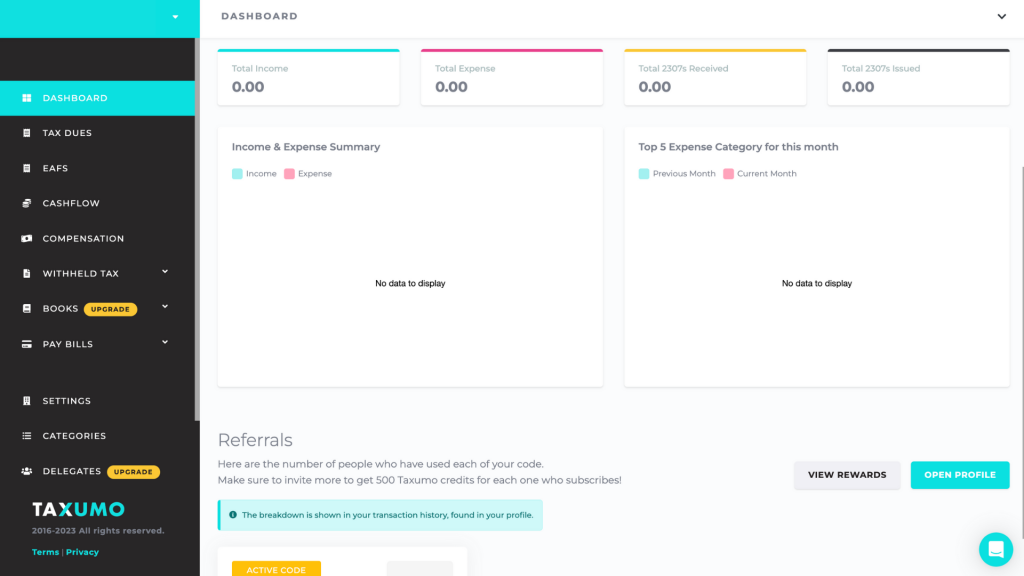

Filing and paying your taxes can be done ever so smoothly and and in just under 5 minutes!

Here’s a step-by-step guide on how to get started and be compliant faster:

Step 1: Sign up to the Taxumo for free.

To begin, start by setting up a Taxumo account and entering all necessary details. Once your account is created, you will receive a confirmation email, so be sure to check your inbox and confirm the account. Once your account is confirmed, sign in to the Taxumo platform and proceed with editing and completing your profile.

NOTE: Prepare a scanned copy of your Certificate of Registration, which you’ll have to attach as you edit your profile.

If you haven’t registered yet and do not have your Certificate of Registration, you can still file your AITR and make sure that you have inputted the correct information especially your TIN

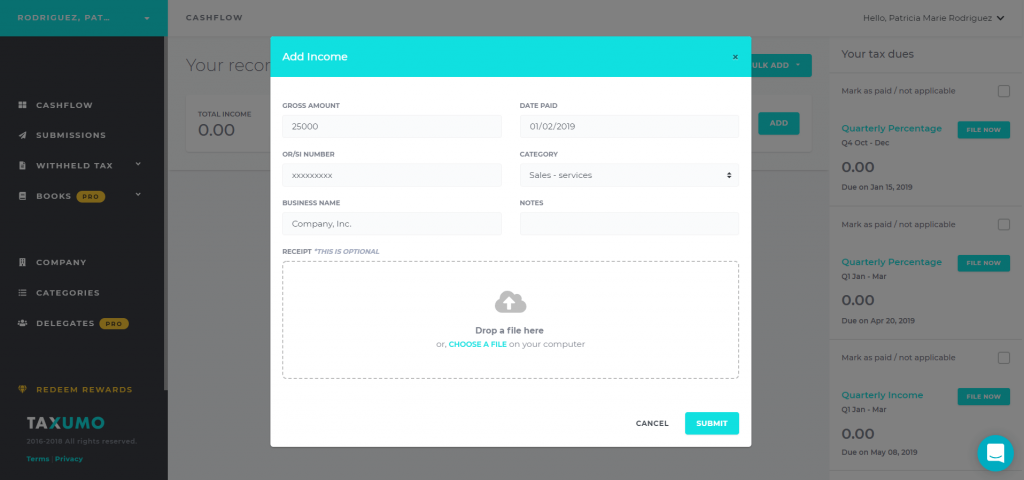

STEP 2: Next, complete all relevant details, such as your income and expenses.

Afterward, input all relevant details, such as your income and expenses. To accomplish this, navigate to the Cashflow segment located on the left side of the screen. This area will display the records for the current year.

NOTE: Don’t forget to have a scanned copy of your receipts ready, since you’ll have to attach this as you enter your income and expenses.You may opt to skip uploading the receipts if you are in a hurry. But, before moving forward, make sure to review your entries before proceeding.

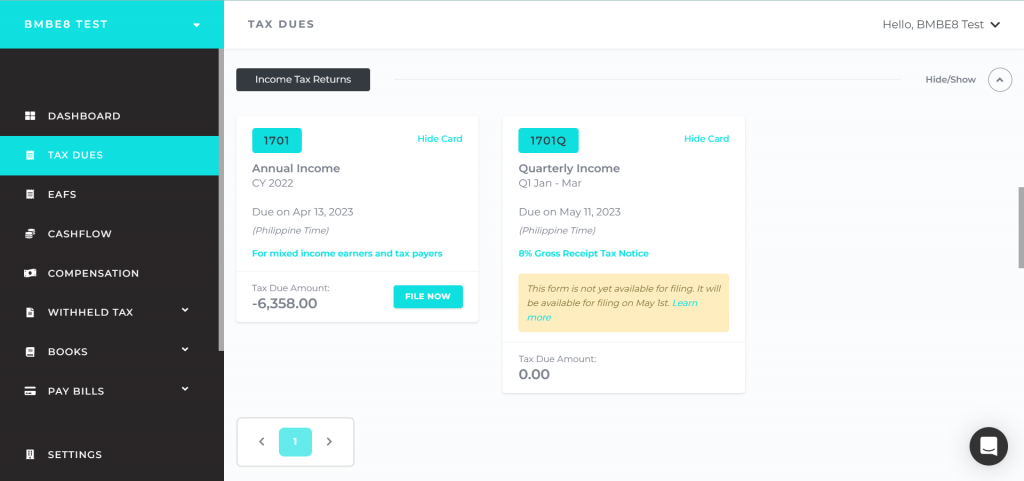

To submit your tax documents, click on the forms you want to file in the “Company” section located on the left side of the screen. These forms are automatically calculated based on the income and expenses you previously provided.

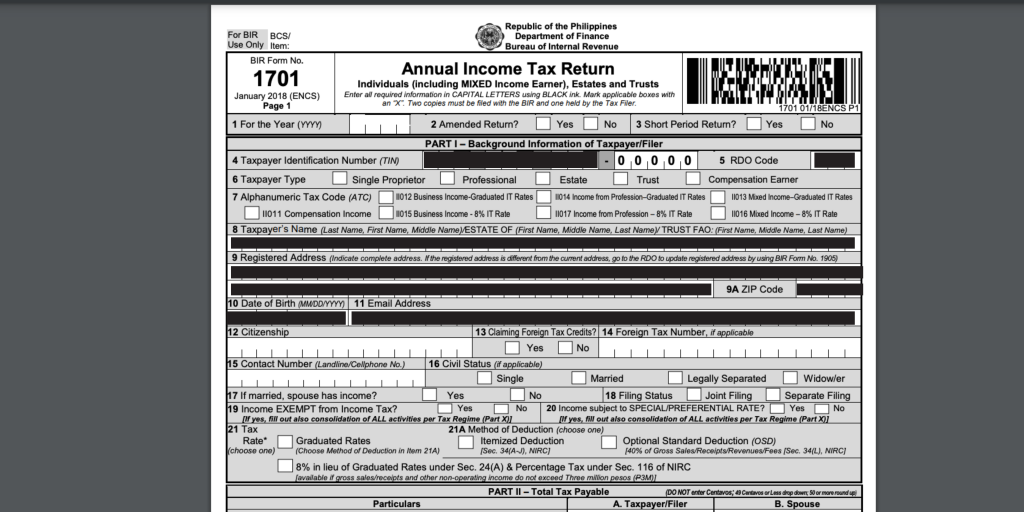

There are various types of AITR Forms but your Taxumo account will assign the appropriate form for you based on your Taxpayer Profile.

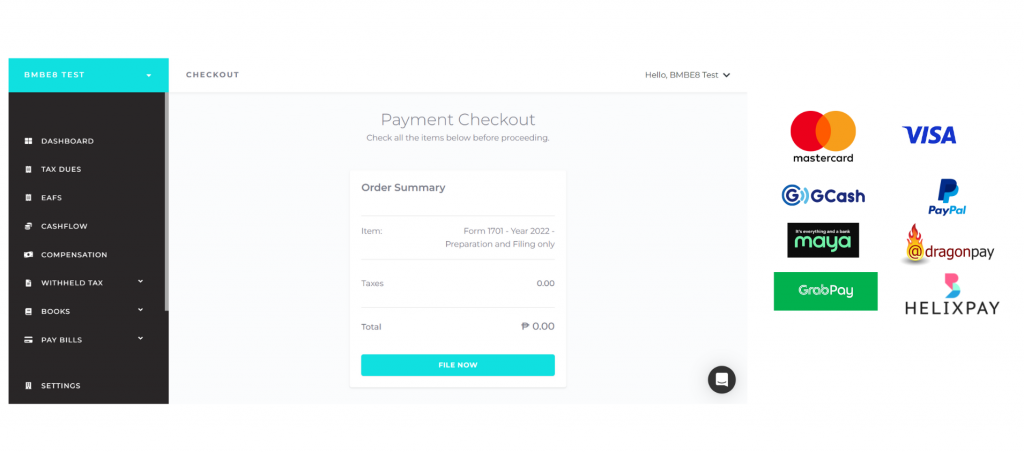

STEP 3: Pay at your own convenience via our available and broad payment channels.

By clicking on either “File Now” (This is an option for those who do not tax dues) ) or “Pay Now,” (for those with computed tax payable) you will be redirected to the actual payment option, which you can choose from the available payment partners. It only takes a few seconds to record your payment.

After this, just leave it up to Taxumo! We will submit and pay to the BIR on your behalf. That’s it. There’s no longer a need to go through long queues to the bank nor to the BIR Revenue District Office.

Overall, filing your annual income tax return in advance can be a smart move for Filipino taxpayers. But, there is a smarter way to do things now that you know about Taxumo. So, if you haven’t filed your Annual Annual ITR yet, consider doing it early this year and consider filing and paying your Annual ITR via Taxumo– your wallet (and your sanity) will thank you!