Good news Online Sellers! According to RMC 79-2024, BIR is extending the deadlines for Online Sellers to register their business through BIR until October 12, 2024.

With the deadline extension, here’s what you need to know to prepare for operating your business legitimately.

Business Registration

It’s important to understand that when registering your business, you need to go through these government entities in the correct order.

First is the DTI, where you will register your Business Name or Trade Name. You will also determine the scope of your business, defining how far it can reach your customers.

Next is your LGU, where it’s crucial to secure your business permits.

Finally, you’ll go to the BIR to register your business as a legitimate entity.

After Registering to BIR, What’s Next?

If you’re currently selling through online platforms, half of the Gross Remittances will be deducted with a 1% Withholding Tax.

However, there are certain exemptions for the 1% Withholding Tax if an online seller’s gross sales do not reach ₱500,000 within the taxable year.

To secure this exemption, the online seller must get a notarized Sworn Statement confirming that their online store does not exceed ₱500,000 in sales during the year.

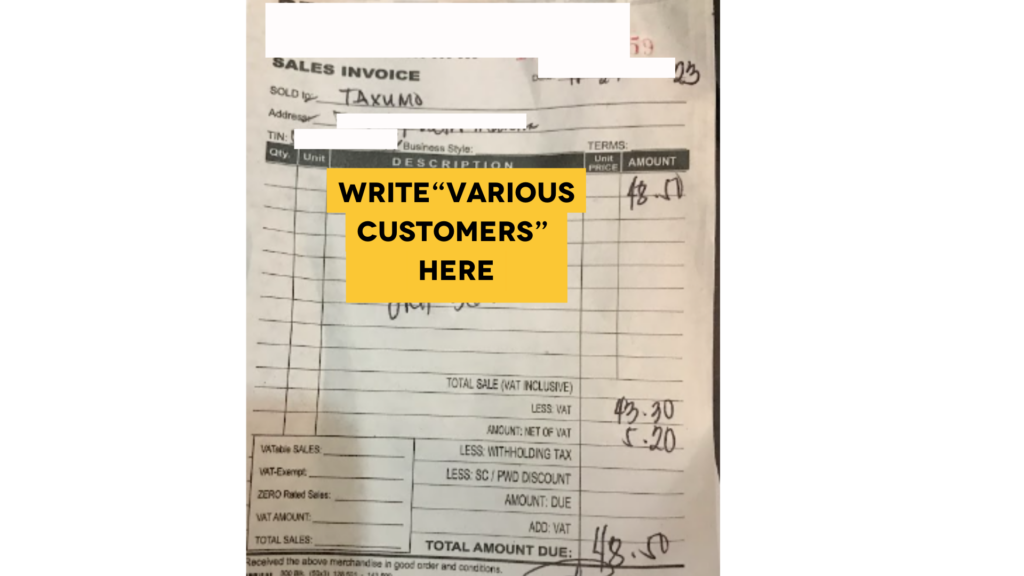

Issuing Invoice as an Online Seller

What if each transaction is valued at less than ₱500? Do you still need to issue an invoice?

For VAT-registered businesses, issuing an invoice is mandatory, regardless of whether the amount is ₱500 or below.

For Non-VAT businesses, an invoice is required if:

- The single transaction exceeds ₱500

- The buyer requests an invoice, regardless of the amount

- The total end-of-day sales transactions amount to less than ₱500. However if you have transactions with different customers that totals to ₱500 collectively, then you can list them on one (1) invoice as “Various Customers”. Make sure to have a break down of your transactions on your Invoice.

Please note that the ₱500 threshold will be updated every three years based on the Consumer Price Index, as published by the Philippine Statistics Authority (PSA).

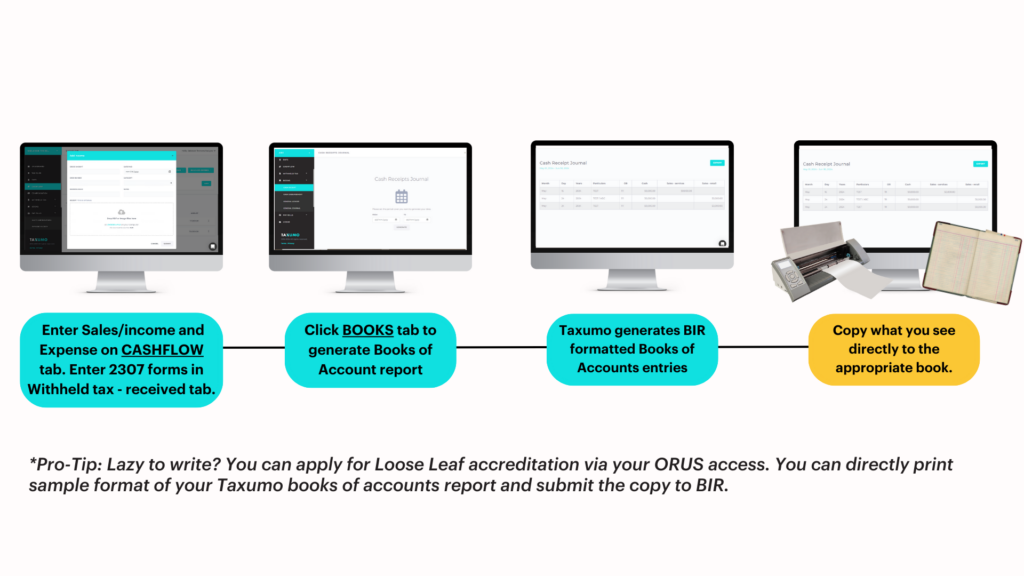

Writing Books of Accounts

When you register with the BIR, you’ll be given 4-6 Books of Accounts, depending on your taxpayer profile. These Books of Accounts will record and declare all of your business transactions. Typically, these books include a General Ledger, General Journal, Cash Receipt, Cash Disbursement, Sales Journal, and Purchase Journal.

You have two (2) options to record your transactions in your Books of Accounts:

- Handwrite everything: Just make sure your records follow BIR’s format.

- Apply for Loose-Leaf Accreditation: Print out your Books of Accounts, which you can report directly to the BIR. There’s no need for you to handwrite anymore.

With Taxumo, you can easily manage both options. Taxumo’s Books of Accounts are already in the correct format. Simply enter your income and expenses, click “Books” to generate your reports, and then you can either copy the format and handwrite it or print it out.