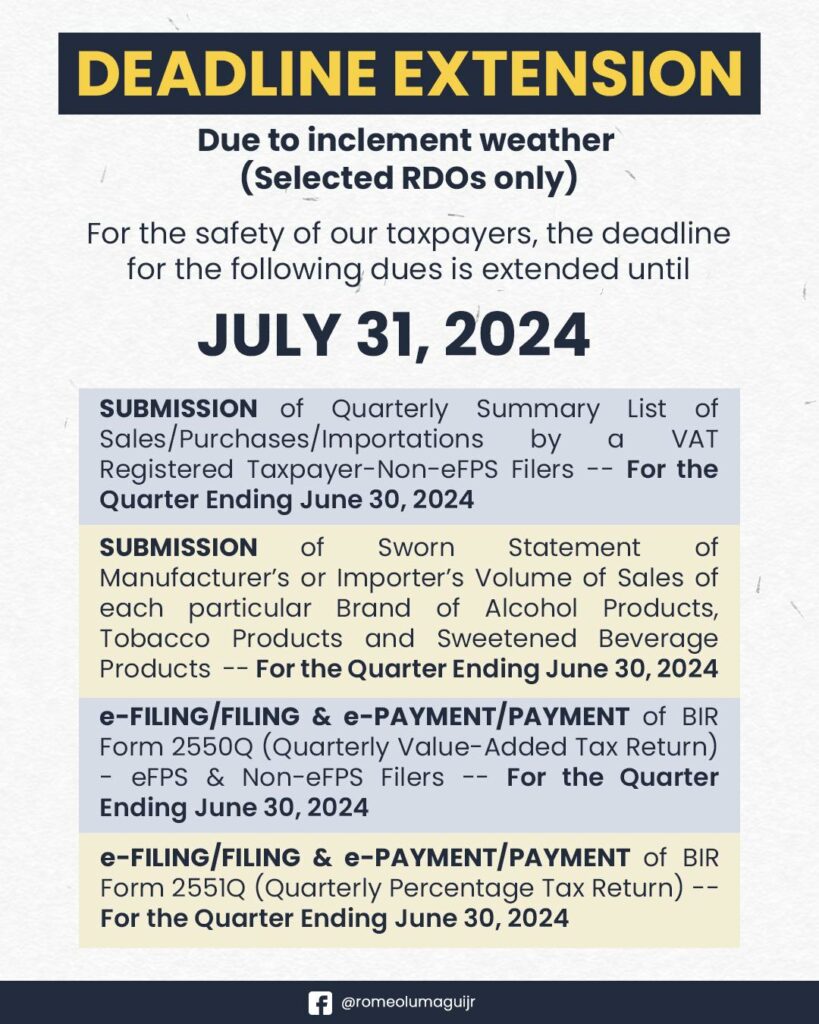

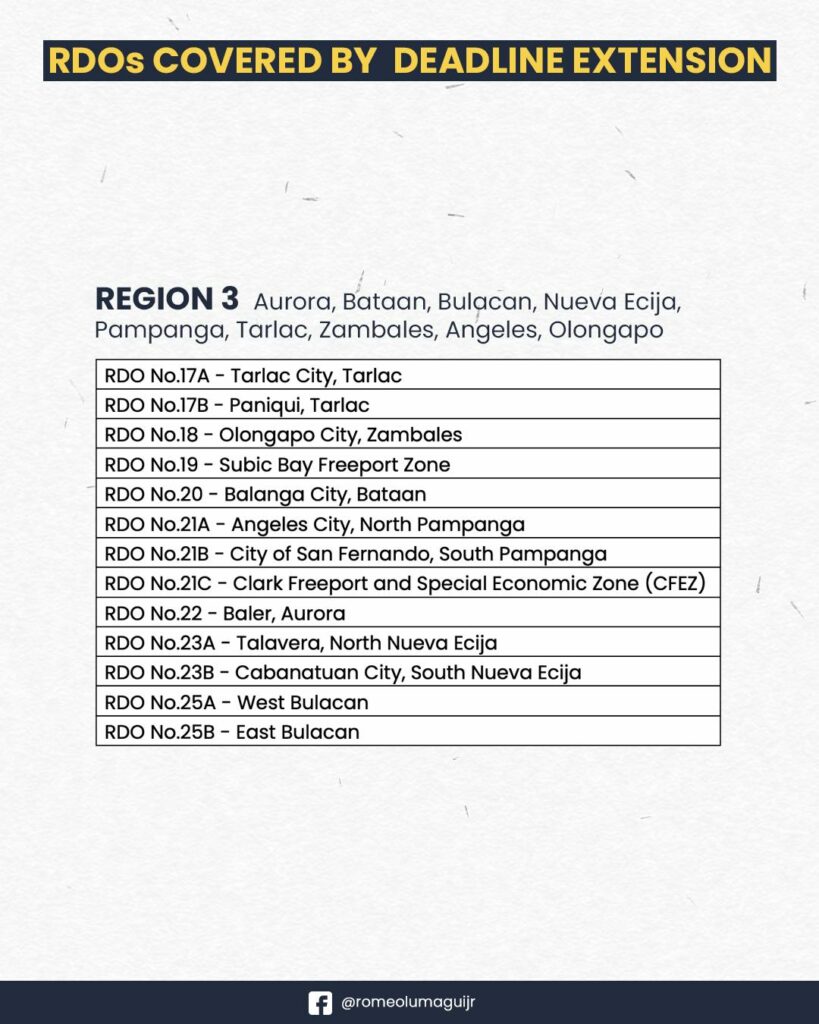

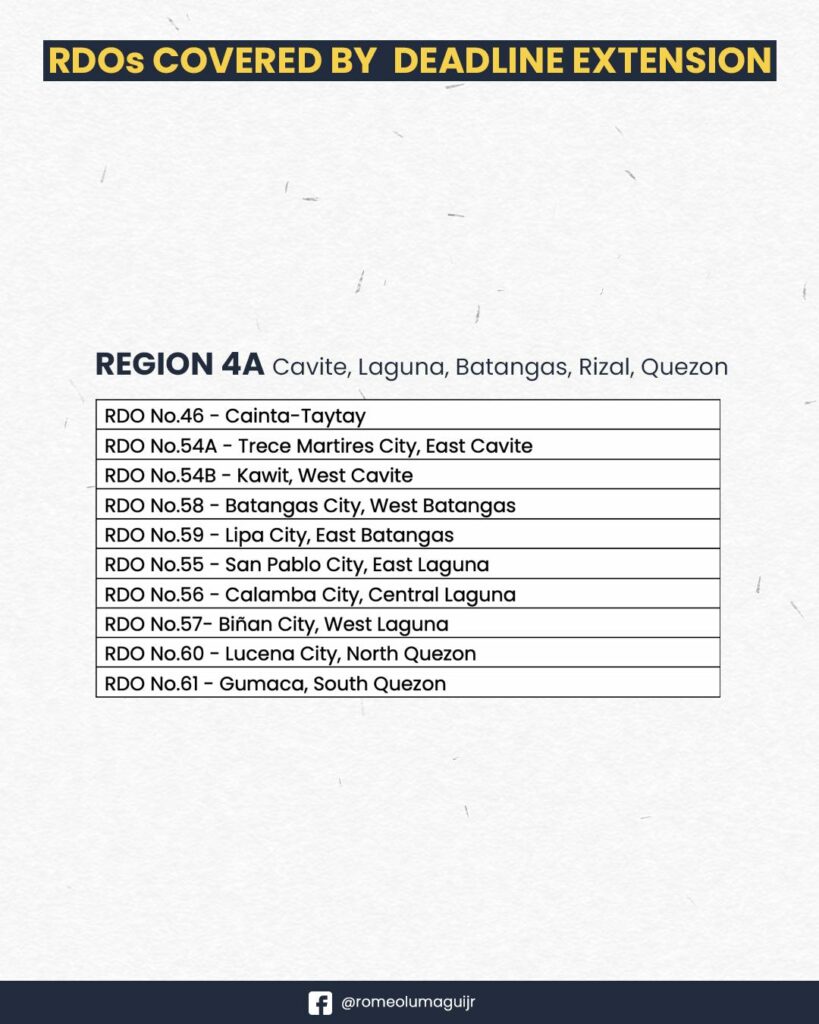

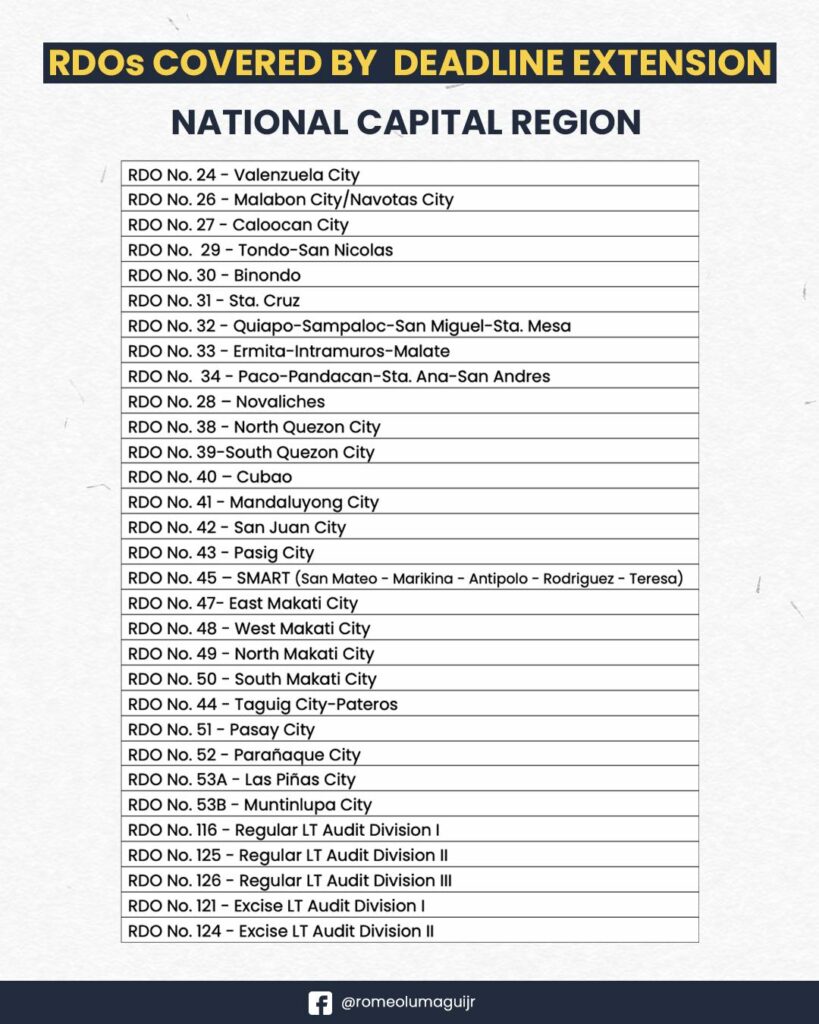

The Bureau of Internal Revenue (BIR) has extended the deadline for certain dues in select Revenue District Offices (RDOs) affected by Typhoon Carina and the Southwest Monsoon. The new deadline is now set for July 31, 2024. A formal issuance will be released in the coming days to provide more details on this extension. (Note: This extension also includes all RDOs under Revenue Region 6 located in Manila.)

For those using Taxumo and are taxpayers affected by this deadline extension, scroll down on what you can do so penalties are not computed when you file.

If you’re filing your Quarterly Percentage Tax Form or your Quarterly VAT Form via Taxumo, here’s what you can do:

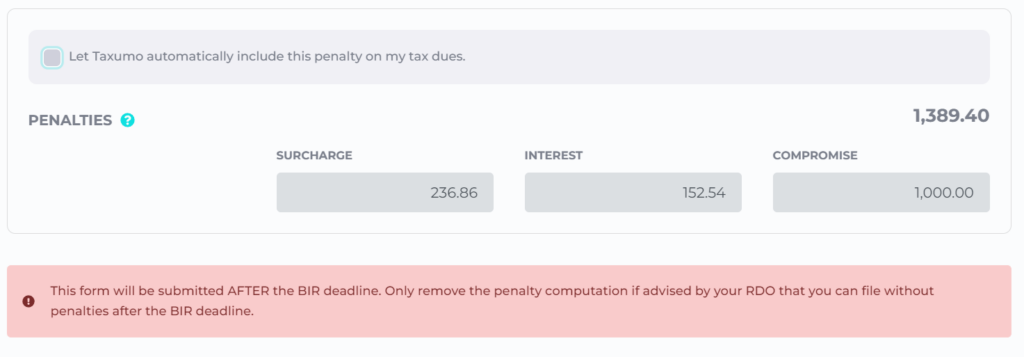

When you get to this part, just untick the box that says “Let Taxumo automatically include this penalty on my tax dues.” Make sure that that box doesn’t contain the check mark and then continue on to file your form. You can do this (untick the penalty computation box) until July 29, 2024 (Monday).

For any questions and inquiries, please feel free to chat using the chatbox that we have or email customercare@taxumo.com.

Stay safe, everyone!

Hello po, ask ko lang sana nagkamali po ako ng filing, yung na e file ko po dis july is 0609E it should be 1609EQ na, ano po dapat kong gawin or paano po ma correct. Do i need to pay again for 1609EQ?

Hello Alen,

If you mistakenly filed 0609E instead of 1609EQ this July, here are the steps you can take to correct it:

Amend the Return: File an amended return for the correct form, 1609EQ. This will ensure that the correct information is submitted to the BIR.

Pay the Correct Tax: If the tax amount due on 1609EQ is different from what you paid on 0609E, you may need to pay the difference.

Request for Refund or Tax Credit: For the amount already paid under 0609E, you can request a refund or apply for a tax credit for future payments. This usually involves submitting a written request to the BIR along with proof of the incorrect payment.

Consult the BIR: It’s advisable to contact the BIR or visit your Revenue District Office (RDO) to inform them of the mistake and get specific instructions on how to proceed.

I hope this helps. If you need further assistance, feel free to ask.