We all know how our government loves abbreviations… BIR, DTI, LGU, etc. One of the abbreviations that we need to know about is RDO, and this is the BIR RDO. Every taxpayer in the Philippines is assigned to a specific Revenue District Office (RDO), an essential arm of the Bureau of Internal Revenue (BIR). This designation plays a vital role in managing and organizing taxpayer records, much like the unique assignment of a Tax Identification Number (TIN). In a scenario where BIR operations are decentralized, correctly identifying and using your RDO code is crucial for maintaining orderly and compliant tax records.

The Crucial Role of Your RDO

Your designated RDO is more than just a repository of records. It’s your go-to for frontline services, including TIN registration, business registration, issuance of official receipts and certificates, and is also the venue for conducting BIR audits and investigations to ensure compliance. Familiarizing yourself with your RDO code is key to a seamless interaction with the BIR, especially for tax filings and queries.

The Significance of Your RDO Code

With over a hundred RDOs scattered across the Philippines, each taxpayer is linked to only one, due to the nature of the BIR’s record-keeping. This unique RDO code plays a pivotal role in:

- Tax collection within a specific region.

- Processing and recording tax returns.

- Handling remittances of tax payments and withholding taxes.

- Managing registrations and overseeing audits.

Given its importance, this three-digit code, either numeric or alphanumeric, is indispensable for every BIR transaction, highlighting the need to know and correctly use your RDO code for all tax-related documents.

Verifying Your RDO Code

Uncertain about your RDO code? There are a few ways to confirm it:

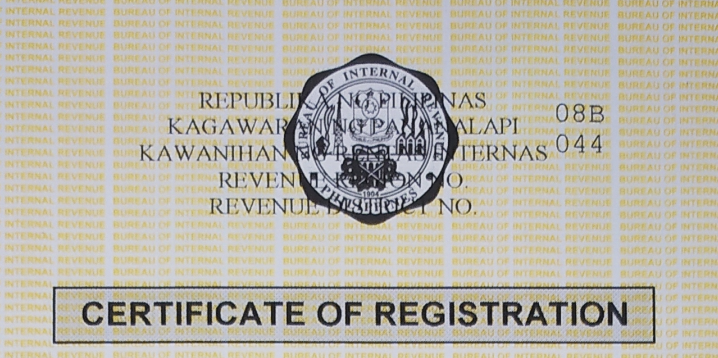

- Review Your BIR Forms specifically your Certificate of Registration: Your RDO code is typically noted at the top of your Certificate of Registration (COR) or Form 2303.

- Use Revie’s services: Revie is the BIR chatbot. Just go to BIR.Gov.PH Then click the robot on right side. That’s Revie.

- Contact BIR via Hotline: The BIR Customer Assistance Division can provide your RDO code upon verification of your identity. Keep your personal details handy for this call.

- Visit Your RDO: Directly visiting the nearest RDO. It might be the most straightforward way to obtain your TIN verification slip and RDO code, especially if other methods are impractical.

Preparing for Tax Filing (now that you know your RDO)

A smooth tax filing process starts with knowing your RDO and its associated code. Preparation involves:

- Document Organization: Early gathering of necessary receipts, and withholding tax certificates (2307s) is essential.

- Utilizing Taxumo: Set up an account in Taxumo and then file away. It is important that you make time out to attend one of the schedules for Intro to Taxumo. Click here to book a session. Don’t worry! It’s free!

- Manual Filing Option: [If your internet fails you] For those who prefer or require in-person filing, feel free to file manually via your RDO. Remember that this will be your last alternative as BIR recommends tax filing to be done digitally already.

Conclusion

Your RDO is a cornerstone of your tax filing and compliance process. Understanding its role, knowing your RDO code, and how to verify it are fundamental steps to efficiently navigating the tax season. Organization and timeliness are your allies in ensuring a hassle-free tax experience, underscored by the support and services provided by your RDO.

Here is the complete list of the Regional and Revenue District Offices of the BIR (BIR RDO): https://www.bir.gov.ph/index.php/contact-us/directory/regional-district-offices.html

For those who need to transfer RDO, here is a guide that we made:

Ready to file taxes in the most simple and easiest way possible? Sign up for a FREE Taxumo account today.

Find my tin number

What RDO Codes BIR

Kukuha lang po Ng TIN I’d

I just want to know my old tin number

Can I ask what is my tin number?, I forgot it already

Hi Ricardo! Better if you can go to your BIR Revenue District Office and check this 🙂

Hello Good day!

I would like to know where can I find my rdo?

Hi Sophia! You can check it by using Revie (the robot) on the BIR website 🙂