We recently published an article about the BIR new rules on receipts. For those who are still seeking for clarity, here are the top questions that we received from different customers and taxpayers with regard to RR 7-2024.

1. What are the specific changes introduced by BIR RR No. 7-2024 regarding receipts and invoices?

RR No. 7-2024 introduces a shift from Official Receipts to Invoices for documenting sales transactions. Businesses MUST issue invoices for sales or services valued at P500 or more, with adjustments for inflation every three years.

VAT-registered businesses MUST issue invoices regardless of the transaction amount. Official Receipts are no longer mandatory but can still be used optionally or converted to invoices following specific guidelines.

2. How do I convert my remaining Official Receipts into invoices, and is approval required from BIR?

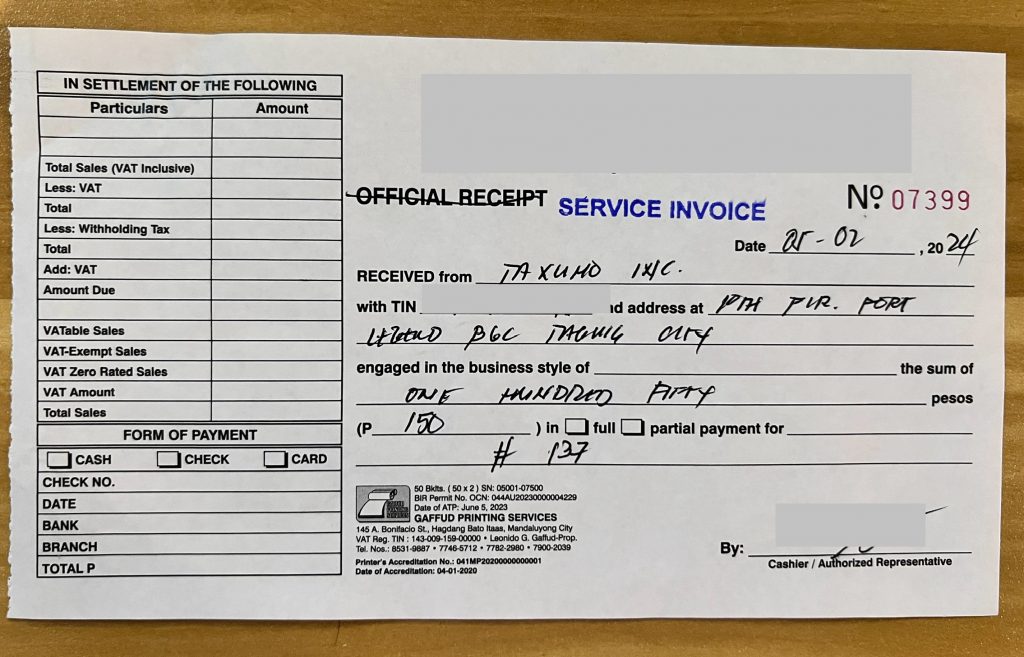

To convert unused Official Receipts into invoices, strike through the term “Official Receipt” and replace it with “Invoice” or a similar term.

Ensure these converted documents contain all required invoice information, including a prominent serial number, seller’s registered name, TIN, business address, and breakdown of sales if applicable. No approval from BIR is needed for this conversion, but businesses must obtain new invoices with an Authority to Print (ATP) before December 31, 2024, or before using up the converted Official Receipts.

3. What information must be included in an invoice to comply with the new BIR regulations?

Invoices must include:

- Seller’s registered name, TIN, and business address.

- Statement of VAT registration status.

- Label “Invoice” clearly printed on the document.

- Date of the transaction.

- Space for buyer’s details (not mandatory for B2C transactions).

- Prominent serial number.

- Quantity, unit cost, and description of goods or services.

- Total sale amount, with VAT shown separately.

- Breakdown of sales if applicable.

- Additional information for specific transactions.

4. How does Taxumo help in complying with the new invoicing regulations?

If you need to change your official receipts into invoices (have new ones printed), you can message customercare@taxumo.com and we will ask one of our partner CPAs / processors help you out.

Also, If you are in need of an online invoicing solution – join our waitlist to get early access through this reservation link.

5. What should I do with my remaining Official Receipts, and can I still use them after the new regulation takes effect?

Businesses can continue using their remaining Official Receipts as supplementary documents until they are used up. These receipts must be stamped with “THIS DOCUMENT IS NOT VALID FOR CLAIM OF INPUT TAX” upon the regulation’s effective date. Alternatively, businesses can convert unused Official Receipts into invoices by following the conversion guidelines. These converted documents are valid for input tax claims until December 31, 2024, provided they contain all required invoice information.

6. Can you discuss more about claiming VAT?

Each invoice now should have the breakdown indicated on the side. It should include VATable sales, zero-rated sales, VAT-exempt sales, and 12% VAT. So in the picture of the invoice above, VAT cannot be claimed for that since there is no breakdown.

Also, for non-VAT sales invoices, you should print “THIS DOCUMENT IS NOT VALID FOR CLAIM OF INPUT TAX” in bold letters at the face of the invoice. For transactions under VAT-exempted, it’s a must to have the word “EXEMPT” clearly indicated on the document.

Hi,

Can you further clarify when exactly we need to get a new ATP. Can I still use up all my converted receipts well into 2025 or will I need to start with new invoices after Dec 31 2024?

Hello Jay,

You can still use your current OR until end of 2024. Just strikethrough the OFFICIAL RECEIPT and replace it by stamping SALES INVOICE on your actual OR. But, you need to submit an inventory of unused ORs to your RDO if you plan to do this. Then, come 2025, you should have a new set of Sales Invoices already. 🙂

Do Bir has a format or form to fill up for the inventory list of Unused OR? When is the deadline of submission?

Hello Leony,

Good day!

You can use our prepared template here: https://docs.google.com/document/d/1XmbUc7zbwI151r5M8Q3fFSmMKOvGoGz2i7-0DdbMP34/edit

For the deadline, some RDOs extended the deadline of submission from May 27 to July 31, 2024. You can check with your RDO if they are also extending their deadline on this. 🙂

Hello Millicent,

But, you need to submit an inventory of unused ORs to your RDO if you plan to do this.

— When is the deadline for this?

Should I submit inventory before converting these OR to to Invoice?

In what format would we submit this. Do you have sample?

Thank you!

Hello Alyssa,

Good day!

The original deadline was last May 27, but some RDOs extended the deadline until July 31, 2024. You can check with your RDO to know if they are also extending their deadline of submission.

For the sample template, you can click this link: https://docs.google.com/document/d/1XmbUc7zbwI151r5M8Q3fFSmMKOvGoGz2i7-0DdbMP34/edit 🙂

Good day, I am NON VAT, do I still need to maintain a Subsidiary Sales Journal and Subsidiary Purchase journal

Hello Goodlight,

For non-VAT, you only need to update and maintain your Cash Receipt Journal, Cash Disbursement Journal, General Ledger and General Journal. 🙂

Hello, question pls, same lang ba sa OR upon collection/receiving of payment ang issuance ng service invoice?

TIA

Hello,

Good day!

No po. Since we’re following Accrual Basis na, you should issue the sales invoice upon receiving the order of an item or service. Then you can issue an OR as a supplementary document once the item/service has been paid by the client na. 🙂

hi Mellicent,

So there’s still a need to issue OR after items were received or services were rendered? isn’t the ORs converted into invoices already?

Hello Luisa,

The Sales/Service Invoice should be issued when we received the order of item or sale while the collection receipt shall be issued once the payment has been collected. The issuance of Collection Receipt is only optional or if your client requested one. 🙂

Hi, Jay!

Thank you for this. Our company provides both goods and services to some clients, so we already have Sales Invoices (for the goods we sell). Can we issue the same Sales Invoices for the services we render to the clients, or should we produce new ones?

TIA.

Hello Cha,

Good day!

Yes, you can use the same Sales Invoice for your services as well. 🙂

Do you have a date for seminar so I can register to know about the RR 7-2024

Hello Resty,

Good day!

If you are pertaining to our FREE Tax 101 sessions, you may book your slot through this link: https://calendly.com/consultnow/free-tax-101-for-smb-microbusinesses?preview_source=et_card&month=2024-06

Hope this helps! 🙂

How about Vatable company. What books should we maintain?

Hello Cris,

Good day!

The Books for VAT businesses are the following:

Cash Receipt Journal

Cash Disbursement Journal

General Ledger

General Journal

Sales Journal

Purchase Journal

Hope this helps! 🙂

Can I still use my existing OR being use for Lease payment receipt ? The lease payment is non vatable since yearly gross amount is less than P3M . Only 18 pages of the first booklet had been consumed out of the 50 pages since Dec 2022 and I still got 24 booklets .

What is Primary receipt and Secondary Receipt ?

What category does my OR falls ?

I thank you in advance for the reply and info that you will give to “educate” me:

Respectfully yours,

Sir Cris Arriola

Hello Cris,

You can use your current OR as your sales invoice until its fully consumed. Primary and Secondary Receipts are your documentation for each sale or income that you are generating. The Sales Invoice is our Primary Receipt while Collection Receipts or Official Receipts are our secondary receipts following RR 7-2024. 🙂

Do O.R.s of non- vat businesses and professionals included in this change of O.R. format?

Hello Espie,

Yes, this applies to all taxpayers including non-VAT businesses and professionals. 🙂

Hi!

Good day! Can I still claim input VAT until June 30 for CRM/POS OR issuance? Additionally, if I have already used a billing invoice that states “This document is not valid to claim input tax,” can I cross it out, sign it, and use it as an invoice?

Hello Alliah,

Yes, you can still claim input VAT on purchases supported by these receipts up to that date. After June 30, 2024, the new rules outlined in RR 7-2024 must be followed. For your Billing Invoice, you can just use it as it is and no need to cross it out to change the label. 🙂

Do i need to bring SPA when i represent my brother in the submission to rdo 28 of List of Invty of unused ORs to be converted to INVOICES and Supplementary Receipts?

Since in Iloilo RDO 74, they did not ask for SPA or SEC Cert anymore.

Thank you.

Hello Emily,

Good day!

Best to prepare an SPA in case the RDO officer look for this upon receiving the inventory list. 🙂

Hello.

We are a non-VAT Homeowners Association. Are we included in this RR No. 7-2024? Do we need to change from Official Receipt to Invoice too?

Since the application for authority to print takes one whole day to process and printing takes 7-14 days, we purchased 50 booklets in March 2024 only.

Appreciate your thoughts. Thank you.

Hello Geraldine,

Good day!

Yes, all are required to change from OR to Sales Invoice regardless if under VAT or non-VAT. 🙂

Hi, what are the RDO requirements if I opt to have a new set of the new Service Invoices instead of using the remaining OR with stamped?

Hello Jane,

Good day!

You will need to have a new Authority to Print for your new sales invoice. If you have a proposed sales invoice format, you can have your RDO check it for approval before printing it through their accredited printing partners. 🙂

Hi, in case I would just obtain a new set of sales invoice instead of using up my old official receipts, do I still need to do the inventory of my old receipts?

Hello Shara,

Good day!

Yes, you should still prepare and declare an inventory of unused ORs for compliance and record keeping in BIR. 🙂

I have a client whose receipts belong to the old regulation that has a 5 yr validity. His OR just expired last May 7th. Can he still use the extension(RR 7-2024) or he’s totally obliged to reprint them right away? Thank you

Hello Julianne,

Good day!

If their OR was printed before July 2022, they need to have a new printed sales invoice because only those ORs that were processed starting July 2022 are exempted of the 5yr expiration rule (voided of OR expiry date). 🙂

Are non-vat entities required to comply with RR no 7? Do they need to stamp their ORs with Invoice and/or issue an invoice? Thanks

Hello Jona,

Good day!

Yes, even non-VAT entities/individuals are required to comply to RR 7-2024. They can either strikethrough their ORs and changed the title to SALES INVOICE (valid till Dec 31, 2024 only) or print a new set of Sales Invoice booklets. 🙂

When are we supposed to submit the inventory of unused ORs if you opt to continue using them? Is it after the end of the year? Or before May 27?

Hello Darnell.

Good day!

The original deadline was last May 27, but some RDOs extended the deadline until July 31, 2024. You can check with your RDO to know if they are also extending their deadline of submission. 🙂

Hello,

Is there a deadline to submit the remaining unused OR to the BIR?

If failed to do so what will be the consequences?

Hello Carol,

Good day!

The original deadline was last May 27, but some RDOs extended the deadline until July 31, 2024. You can check with your RDO to know if they are also extending their deadline of submission. 🙂

Do I need to submit a sworn statement for the inventory of unused official receipts? or Annex D will suffice (annex-d-inventory-list-of-unused-or-expired-receipts-and-invoices) thank you.

Hello Jerlyn,

Good day!

Two copies of Annex D will suffice but prepare your old ATP too just in case your RDO asks for this file. 🙂

What receipts are to be replaced and can i have a sample of the new receipts

Thank you

Hello Evangeline,

Good day!

All Official Receipts or primary sales receipts are required to be replaced with Sales Invoice. Basically, the Sales Invoices are now the main documentation for sales, while official receipts are just supplementary. For further details on the key points of this regulation, you may refer to the article linked below, which summarizes the important considerations:

https://www.taxumo.com/blog/bir-rules-on-receipts-transitioning-to-invoices/

Hi Taxumo,

If corp is non-stock non profit, do we need to convert our OFFICIAL RECEIPTS TO SERVICE INVOICE?

Thank you.

Hello Guada,

Good day!

Yes you are also required to convert your Official Receipt to Service Invoice too. Basically, the Sales/Service Invoices are now the main documentation for sales, while official receipts are just supplementary. For further details on the key points of this regulation, you may refer to the article linked below, which summarizes the important considerations:

https://www.taxumo.com/blog/bir-rules-on-receipts-transitioning-to-invoices/ 🙂

Hello Millicent,

But, you need to submit an inventory of unused ORs to your RDO if you plan to do this.

— When is the deadline for this?

Should I submit inventory before converting these OR to to Invoice?

In what format would we submit this. Do you have sample?

Thank you!

Hello Alyssa,

The deadline was extended till July 31, 2024 and it is best to submit the inventory and stamp your ORs with Sales Invoice label at the same time. 🙂

Hi Good day! Kindly clarify how to apply the 5% EWT? Say the amount of Invoice is 100K inclusive of VAT. Thanks in advance.

Hello Evelyn,

For this one, it is best to consult a professional or a CPA for a detailed information. 🙂

I have issued three (3) Official Receipts dated May 2024. I do plan to request printing of service invoice tomorrow. What do I need to do for those ORs issued in May ? If the ORs will be used as secondary document, what should be reported to BIR?

Hello Iris,

The issued ORs are still okay as we can still issue ORs until June 24, 2024. Moving forward just ensure that your main documentation is the Sales Invoice already. 🙂

Good day ma’am.can u show a sample of the inventory list for the unused OR that will be pass to BIR.thnks

Hello Pamela,

Sure! Click here to access our user-friendly inventory template. https://docs.google.com/document/d/1XmbUc7zbwI151r5M8Q3fFSmMKOvGoGz2i7-0DdbMP34/edit

Good day ma’am.can u show a sample of the inventory list for the unused OR that will be pass to BIR.thnks

Hello Lovely,

Sure! Click here to access our user-friendly inventory template. https://docs.google.com/document/d/1XmbUc7zbwI151r5M8Q3fFSmMKOvGoGz2i7-0DdbMP34/edit

Hi,

What if our stamp became available only this week?

Hello Chel,

That is fine. Just make sure that moving forward, your ORs are labeled as Sales Invoice already. 🙂

Hi. I would like to ask if there is a deadline for the submission of unused Official receipts in BIR? Some says it May 27, 2025.

Hello Rose,

The deadline has been extended until July 31, 2024. 🙂

Good day,

How about for those who are SEC registered as Non Stock / Non Profit Organization like Churches who does not have a sales of goods and services and using Official Receipt because their cash collections came from Tithes and Offering and not from Sales, Do they need to use a “Sales Invoice” even if their collection does not came from Sales?

Thank you

Hello Emil,

Yes, they should also use Sales Invoices for their collections came from Tithes and Offering. 🙂

Hello! What is the most applicable “invoice” term to use if the nature of business is medical services? Is it the “service invoice”?

Hello Daniel,

If you’re a medical professional, it should be Service Invoices. 🙂

For condominiums (non-stock, non-profit) which is applicabe, sales or service invoice?

Hello Dhing,

It should be Sales Invoice. 🙂

Can I submit this inventory to other RDO other than where I am registered?

Hello Maya,

Your inventory list should be submitted to your registered RDO. 🙂

Hi.

apologize for the request, i need you help please.

If can you clarify the changes in issuing a billing statement related to the rr 7-2024?

Hello Marvs,

Basically, the Sales Invoices are now the main documentation for sales, while official receipts are just supplementary. For further details on the key points of this regulation, you may refer to the article linked below, which summarizes the important considerations:

https://www.taxumo.com/blog/bir-rules-on-receipts-transitioning-to-invoices/

Hello, we do have both Sales Invoice and Official Receipt. Can we record both the services and goods acquired by the client in one sales invoice ?

Hello Amber,

Yes you can. 🙂

I recently registered with BIR and my source of income is from a foreign client. They do not require OR but for documentation and tax reporting purposes, I fill up one OR per month (consistent with my pay schedule). I have approximately 400 unused ORs. Can I use these up before transitioning to the new invoice? Or do I have to apply and print new invoice starting 2025?? Your advice is greatly appreciated.

Hello,

You can use your current ORs as your Sales Invoice until fully consumed. :0

Pingback: How to Issue the Inventory List of Unused Official Receipts

Good day,

Where can I find the Annex D for the inventory of ORs?

Thank you

Hello Norma,

Good day!

You can click this link to get our prepared template: https://docs.google.com/document/d/1XmbUc7zbwI151r5M8Q3fFSmMKOvGoGz2i7-0DdbMP34/edit 🙂

Hello,

May I ask how to apply for the new invoices?

Do we still need to go to our respective RDOs to request for ATP and approval?

Thank you.

Hello Kat,

Good day!

Yes, you should process this directly through your RDO, get a new ATP for the sales invoice booklets and have it printed via your RDO’s accredited printing partners. 🙂

Hello,

What invoice should i use? Sales or service invoice? I am in janitorial services industry but also supplies janitorial supplies.

Hello Cham,

Good day!

Kindly use Sales Invoice. 🙂

For non-vat, i can opt to just print “THIS DOCUMENT IS NOT VALID FOR CLAIM OF INPUT TAX” in bold letters at the face of the invoice.

I dont need to change it and will still be useful even after Dec 31, 2024?

Hello Elle,

Good day!

You will also need to strikethrough the OFFICIAL RECEIPT title and replace it with SALES INVOICE title. You will also need to submit an inventory list of your unused ORs too. 🙂

What invoice should we use for rental of commercial/residential spaces? Thank you

Hello Cynthia,

Good day!

You should use your Sales Invoices for this type of transaction. 🙂

I am one of the officers of a homeowners’ association, my question is, do I need to comply with RR-7-2024 since homeowners’ associations are tax exempted. We collect monthly dues and other fees from homeowners to be used as payment for our security guards, maintenance of facilities and amenities, utilities, salaries of staff and other expenses. Upon collection of these fees, we issue an official receipt. Can you please enlighten me on this. Thank you very much

Hello Albert,

Good day!

Yes, you will also be required to transition from using Official Receipts to Sales/Service Invoice. Basically, the Sales Invoices are now the main documentation for sales, while official receipts are just supplementary. For further details on the key points of this regulation, you may refer to the article linked below, which summarizes the important considerations:

https://www.taxumo.com/blog/bir-rules-on-receipts-transitioning-to-invoices/ 🙂

My husband is Non-vat. Can we just stamp unused ORs with “this is not valid for claim of input tax”?

Can you also clarify the removal of the expiration for ORs?

Thank you

Hello Deb,

Good day!

Aside from the stamp of “this is not valid for claim of input tax”, you will also need to strikethrough the OFFICIAL RECEIPT title and replace it with SALES INVOICE (through stamping as well).

For the ORs please be advised that we do not have expiry dates for ORs created from July 2022, however we are still required to use the Sales Invoice starting this year to comply with the new RR 7-2024 regulation. 🙂

Hi. Is this also applicable for NON-VAT taxpayer? How does this affect the “Removal of 5-year validity period on receipts/invoices”? Could you please explain? Thank you in advance!

Hello MC,

Good day!

Yes it is applicable to all taxpayers including non-VAT individuals or business owners. Basically, the Sales Invoices are now the main documentation for sales, while official receipts are just supplementary. For further details on the key points of this regulation, you may refer to the article linked below, which summarizes the important considerations:

https://www.taxumo.com/blog/bir-rules-on-receipts-transitioning-to-invoices/

For the ORs please be advised that we do not have expiry dates for ORs created from July 2022, however we are still required to use the Sales Invoice starting this year to comply with the new RR 7-2024 regulation. 🙂

Hi

Please enlighten me, if the transaction was billed prior EOPT and the collection was made after the effectivity of EOPT, should I already issue invoice instead OR? or still OR?

May i know the basis? What RR/RMC?

Thank you.

Hello Ynna,

Good day!

You should use the Service Invoice and basis will still be the RR-2024 since this regulation is applicable for the year 2024. 🙂

Hi! I am non-VAT. I have a few questions regarding this:

1. Am I also required to submit the inventory of unused receipts on my printed ORs?

2. I have not been able to submit the Inventory of Unused Receipts since I only learned about this today, the date of the deadline. Can I opt to not use the printed ORs and just get a new set of ORs printed instead? If yes, what should I do with the unused ORs? If no and I really need to submit the inventory, is there a penalty for late submission?

3. What did you mean by updating and maintaining journals in your prior response Goodlight’s questions above?

Hello James,

Good day!

1. Yes you should still submit an inventory of unused receipts for your OR booklets.

2. The original deadline of inventory submissionwas May 27, 2024, but some RDO’s extended the deadline to July 31, 2024. You can check with your RDO and see if they also extended their deadline of submission for the inverntory list of unused ORs. If you will opt to print new sets of sales invoice, it is still best to prepare an inventory of unused ORs. 🙂

Good day!

What shall I do if I gave the OR to my client in June 2024 and I just recently submitted the list of unused ORs to the BIR? They were asking for the new receipt. Should I give them a new receipt with the strikethrough invoice? Or should I add a strikethrough to the one I released in June 2024?

Please enlighten me.

Hello Tin,

You can assure them that what they have is okay since we are allowed to issue ORs until June 24, 2024. 🙂

Hello, May I know when is the deadline for the inventory of old OR to the BIR?

Hello Mario,

Good day!

The original deadline was May 27, 2024, but some RDO’s extended the deadline to July 31, 2024. You can check with your RDO and see if they also extended their deadline of submission for the inventory list of unused ORs. 🙂

what is the requirement in availing new service invoice in BIR?

Hello Marifel,

Basically, the Sales Invoices are now the main documentation for sales, while official receipts are just supplementary. For further details on the key points of this regulation, you may refer to the article linked below, which summarizes the important considerations:

https://www.taxumo.com/blog/bir-rules-on-receipts-transitioning-to-invoices/

Hello,

May I ask how to apply for the new invoices?

Do we still need to go to our respective RDOs to request for ATP and approval?

Thank you.

Hello Kat,

Yes, you will need to process this directly to your RDO. 🙂

Hi, I would like to confirm the new RR 72024, here’s my scenario, I am a lessor of residential apartment, and I have my OR, my business is considered non vat. Do I still need to update my ORs? Thanks in advance for the response.

Hello Mc,

Good day!

Yes, you will need to update your ORs to Sales Invoice. Basically, the Sales Invoices are now the main documentation for sales, while official receipts are just supplementary. For further details on the key points of this regulation, you may refer to the article linked below, which summarizes the important considerations:

https://www.taxumo.com/blog/bir-rules-on-receipts-transitioning-to-invoices/ 🙂

Hi, what are the requirements and process of submitting the inventory of unused official receipt to RDO?

Hello Mary,

Good day!

You will only need to prepare your Annex D Inventory List of Unused ORs, and Authority to Print for your current ORs. You may check this template that we prepared for your reference:

https://docs.google.com/document/d/1XmbUc7zbwI151r5M8Q3fFSmMKOvGoGz2i7-0DdbMP34/edit 🙂

Is there no extension for this?

Hello Lorgina,

Good day!

Some RDOs extended their deadline until July 31, 2024. You may check with your RDO and see if they also extended the deadline of submission too. 🙂

Hi! I registered my private practice as a physician (non-VAT). I was given the following books:

1. ledger

2. cash disbursement

3. journal

4. patient registry book

5. PWD/Senior citizen

I was not given a cash receipt book. Please advise.

As for the books, what should I write in each? What is the format in each book?

Hello GJ,

For this one, it is best to clarify this with your RDO and confirm if you can really skip the Cash Receipt book. For the writing of books, it is best to consult a professional on this one. 🙂

Hi,

Good day!

Our customers use prepaid accounts, requiring them to make an advance payment before using our system. Previously, we recognized income based on the transactions rather than the customer deposits. However, under the new RR 7-2024, we are unable to issue a Sales Invoice for these advance payments since the service has not yet been provided.

Our customers have been requesting a Sales Invoice for their advance payments, but we have explained that we cannot issue one until the transactions have occurred.

Here are my questions:

1. Are we correct in issuing an acknowledgment receipt or collection receipt for the advance payment?

2. Are we correct in issuing a Sales Invoice once the advance payment has been used, or the service has been rendered?

3. If so, is it correct that we cannot issue a Sales Invoice for the same amount as the advance deposit based on the transactions? Our customers are demanding a Sales Invoice equivalent to the advance payment for their liquidation purposes.

Thank you.

Hello Eny,

Here’s how to handle advance payments under the new RR 7-2024:

Acknowledgment Receipt for Advance Payment: Yes, it is correct to issue an Acknowledgment Receipt or Collection Receipt for advance payments. Since the service hasn’t been provided yet, this receipt serves as proof of payment received.

Sales Invoice for Service Rendered: Yes, you should issue a Sales Invoice once the service has been rendered or the advance payment has been used. The Sales Invoice should reflect the actual service provided, not the advance payment.

Sales Invoice Amount: You cannot issue a Sales Invoice for the same amount as the advance deposit until the service is actually provided. However, you should ensure that the Sales Invoice issued later accurately reflects the transaction or service provided, even if it differs from the advance amount.

If your customers need a Sales Invoice for their records, you may need to explain this process or provide them with the necessary documentation that aligns with RR 7-2024.

Re: To convert unused Official Receipts into invoices, strike through the term “Official Receipt” and replace it with “Invoice” or a similar term.

Can we just hand-write the word SERVICE INVOICE instead of using a rubber stamp? It feels very wasteful to purchase a stamp that will only be used until end of year.

Thank you.

Hello Ann,

No, you should use a stamp 🙂

Is the claim of INPUT VAT still valid if the received/ provided document from seller is still an Official Receipt?

Hello Jenny Lyn,

Under BIR regulations in the Philippines, if you are now using Sales Invoices, you must ensure that these invoices are used for claiming Input VAT. The Sales Invoice should include all necessary details such as the seller’s TIN, name, address, transaction date, VAT amount, total amount, and a description of the goods or services provided. To claim Input VAT, the Sales Invoice must comply with BIR requirements.

Hello TAXUMO Team. For the converted official receipt to an invoice, is it required to be supported with a copy of the inventory of the unused ORs upon collection of payment, to show that it was authorized by the BIR?

Hello Jocelyn,

Yes, when transitioning from Official Receipts to Sales Invoices, you are required to submit an inventory list of unused Official Receipts (ORs) to the BIR. This inventory helps ensure that all old receipts are accounted for and that the transition to Sales Invoices is properly authorized.

Hi Millicent,

We’ve been using SERVICE INVOICE (for our preventive maintenance services) & SALES INVOICE (when we supply parts/items). We give this to our clients once we finished the project to bill them. And when they pay us, we issue them ORs. We just printed 20 booklets of Service Invoice last Feb 2023. Can we still use this? If not, what (name of) document should we use to bill our clients?

Thank you.

Hello JoJC,

You can continue using your printed Service Invoices and Sales Invoices from February 2023 for billing your clients until they are exhausted.

When it comes to acknowledging payments, you’ll need to issue an Electronic Receipt under the new EOPT Law. This replaces the traditional Official Receipt (OR) for payment confirmation.

Hi,

How about for nonprofit organizations like foundations? Is it necessary to transition to an invoice moving forward (Jan 2025 and beyond)?

I’ve read about the deadlines (May 27 or possibly July 31, depending on RDO) for presenting the old receipts, but should the same apply to foundations that generally accept donations? Nothing specific about foundations is in rr7-2024.

Thanks.

Hello JJ,

Yes, this applies to non-profit organizations as well. 🙂

The company billing statement has a phrase below the document ” This document is not valid for claiming input tax. Can the company use the billing statement as converted invoice if below has the phrase of no valid of claiming input tax?

Thank you.

Hello Marjorette,

No, the company cannot use the billing statement as a converted invoice if it has the phrase “This document is not valid for claiming input tax.” This statement indicates that the document is not acceptable for VAT purposes. To claim input tax, you need to issue or obtain a proper Sales Invoice that meets the requirements set by the BIR.

Hi,

Question po, our client was requesting the original copy of the service invoice kahit wala pang payment, PO pa lang. Ok lang po ba yun? TIA

Hi JB,

Yes, it’s okay for your client to request the original copy of the service invoice even if payment hasn’t been made yet and you only have a Purchase Order (PO). However, issuing an invoice before payment is made is common practice and helps in the documentation of the transaction.

Just ensure that the invoice is clearly marked as “Provisional” or “For Reference” if the payment hasn’t been received yet, to avoid confusion.

I hope this helps!

I understand the issuance of sales invoices or Collections Receipts be on series or sequential. However, there are instances that there are multiple invoicing clerk thus each invoicing clerak has been issued their individual booklet.

In this case there will be some skip series (in between booklets)

Question. Is this a violation with compliance on tax? if so any related issuances for our reference?

Hello Jaime,

If multiple invoicing clerks are using separate booklets, it might result in skipped series numbers when the booklets are used simultaneously. However, as long as each booklet is sequentially numbered and properly accounted for, this setup can be acceptable. 🙂

Paano po for example eto po sales ko paano ito ilalagay sa cash receipt journal saka date sa resibo (non-vat po ako)

July 1 – 89 pesos

July 2 – 70 pesos

July 3- 500 pesos

July 4 – 100 pesos

Paano ko ito ilalagay sa resibo. salamat po

Hello Jenny,

For sales with 500php above gawan nyo po sya ng separate na resibo. Yung below 500php po pwede na pagsamahin sa isang sales invoice tapos pwede po pangalanan nalang ng Various Customers. 🙂

Are service invoice sent by email or viber valid per BIR po?

Hello Dorie,

BIR sales invoices sent via email or viber (scanned copies or photos) are okay po. 🙂

Is there a penalty for late submission of unused ORs?

Hello April,

Yes there is. It is best to submit it now while we are still within the given deadline. 🙂

Hello April,

Yes, there can be penalties for late submission of unused ORs. To avoid fines.

If you’re late, contact the BIR to find out about any penalties and how to fix the issue.

Hi, do we need permission to print sales invoices? We are non-VAT rental business. I am told that we need to get an SPA to print this. This property belongs to my sister who is working abroad.

Thank you so much.

Hi Relda,

Yes, you need permission to print sales invoices. Since the property belongs to your sister, you’ll need to get a Special Power of Attorney (SPA) from her. After that, you should register the invoices with the BIR before printing.

I hope this helps!

Hi,

I am wondering do you have any release date for online invoicing on your platform?

Hello Mae,

The Receipt/Invoice feature will allow you to generate BIR-compliant receipts and invoices. You can create single or bulk receipts with it. You will be notified in advance about the final details once the feature becomes available.Please let us know if you further questions or concerns. Thank you!😊

Hello Mae,

We do not have a definite timeline for this new feature yet but we will let you know once this is up and running in the platform. 🙂

hi,

if what we have are already labelled as “non-vat sales invoice” issued last february 2024, do we still need to file for unused inventory of receipts??

or is this only applicable to those issued with “non-vat official receipt”?

we’re confused if we still need to submit unused invoices as well..

Hello Christian,

If the label is Sales Invoice already, then there’s no need for you to submit an inventory list of unused ORs 🙂

Good day!

I have questions po, hoping ma assist nyo po ako.

Regarding expired receipt sa supplier po. nasa resibo nila na mag expire po Feb. 28, 2023 then at that time po we request new OR for our transaction kasi expire nga tapos sabi nila ok parin daw gamitin ang OR nila and they send us the RR No.6-2022 (Subject: Removal of Five(5)-year validity period on the receipts/invoice.

https://gyazo.com/c702da1e8a8a94498b7783a8238dd58f

1.) Ang ibig po bah sabihin nito na OK pa rin gamitin nila ang old receipt kahit expired na last Feb. 2023?

2.) If YES, until when they can used it?

3.) OR do they need to change the OR by year 2025 since the use of OR only until Dec. 2024 based at RR No. 7-2024?

Thank you.

Hello Ar-Ar,

Good day!

Sure, I’d be happy to assist with your questions regarding the expired receipt from your supplier.

Validity of Old Receipt: Yes, based on RR No. 6-2022, the removal of the five-year validity period means that the old receipt is still valid even though it expired in February 2023.

Duration of Use: They can continue to use the old receipt until December 31, 2024, as per the guidelines in RR No. 7-2024.

Changing the OR: Yes, they will need to change the OR by January 1, 2025, to comply with the new regulations set forth in RR No. 7-2024.

I hope this clarifies your concerns. If you have any more questions, feel free to ask!

Thank you!

ho much is the penalty for late submission of the Inventory list of unused ORs converted to “Invoice”

Hi Rosalie,

So far BIR hasn’t released an update regarding the penalties for late submission of the inventory list of unused ORs. But it’s best to check with your respective RDO on this.

Hi. I bought some products from 7-eleven. This is for a business trip. The store gave me an OR. But when I submitted my reimbursement to my company they rejected it because of this new rule of the BIR.

Will it really be not accepted? What should I do?

Also, another transaction from a car rental. They provided me an OFFICIAL RECEIPT striked through but the INVOICE is handwritten beside. Can I remain it as is then just put a stamp above the OFFICIAL RECEIPT?

Hello. Since the invoice is now the basis of recording for the income but not the collection of the said income. Some clients are hesitant to issue invoice since it’s issuance is like issuing an official receipt that means payment has been initiated. Example: A company asked for an invoice to initiate payment of the said income, but the individual refuse to issue an invoice coz he feels that issuance of invoice means collection of payment. and fears that he might not be paid.

pls help. thanks

HI ,

Is “collection receipt” with the stamp ” not valid for claiming input tax” can be converted to invoice and as become as primary receipt?

Hello po. ask ko lang po kung kasama po ba yung collection receipt na kailangan palitan ng sales invoice? ayaw po kcng tanggapin ng client namen yung collection receipt na gamit namen dahil kailangan daw po is sales invoice.

Hello,

Yes, under the new eOPT law from the BIR, it is essential to issue a Sales Invoice instead of a Collection Receipt if your client requires it. The law emphasizes the importance of using Sales Invoices for documenting sales transactions.

Hello,

I have some clarifications lang po for the issuance of a receipt for rendered service.

This is our receipt issuing system before.

If goods/item: Sales Invoice and Collection Receipt (for payment)

If services: Billing Statement and Official Receipt (for payment)

Q1: Can we convert the billing statement to a billing invoice and pair it with the OR? or we stick to a billing statement and then pair it with a service invoice if the payment has been made?

Q2: Before converting the OR to a Service Invoice, do we still need to submit an inventory list of unused ORs?

Which is more acceptable po to the BIR. Sana po masagot.

Thank you.

is there a ruling in the receipt that ” this served as your sales invoice or official receipt” ?

Hi, we have both Sales Invoice and Service Invoice currently in use, is it necessary to maintain Official Receipt and Collection Receipt? or is it okay to retain Official Receipt and discontinue the Collection Receipt?

Thank you

May I ask the following:

1 . Will this memorandum apply to a government agency, in the performance of its governmental functions, subject to internal revenue taxes and so required to apply and issue invoices?

2. Is there’s a need to strikethrough or stamp the Accountable Form No. 51 (Official Receipts of the Republic of the Philippines)?

This new thing of businesses issuing invoices to their customers instead of ORs reflects the practice of Asset Based Accounting (as opposed to cash based accounting).

With this the BIR is taxing every *delivery* of goods, not cash received for goods, as every delivery leaves the business owner with either cash or a receivable (or a combination of both) which are both considered income, unless the receivable has to be booked as a loss due to failure to pay.

For the customer however, the invoice is an I Owe You (IOU) to the business owner reflecting his duty to pay for the service or goods delivered. Without issuing a receipt of payment to the customer the business owner holds a claim to pay on the customer in perpetuity.

This will get important as soon as a business goes bankrupt and the bankruptcy accountant will find a stash of invoices with no copies of receipts of payment.

This means he will have the duty to go to each and every customer to ask if he/she can show proof of payment (receipt) and if receipt can not be shown, claim payment (again) of service or goods delivered, including accrued interest and collection expenses.

No need to state this is a very undesirable situation.

So I’d suggest a business owner, although relieved by the BIR’s ruling RR 7-2024 with regards to his duties to the BIR, still owes *the customer* a receipt as proof of payment for the customer to hold.

What’s you opinion on this?

Just wanted to clarify the period of claiming input vat

The input vat invoice was dated January 2024, can I still claim the input vat against output vat in November 2024?

Any reference BIR ruling will help too. Thank you in advance.

Hello po.

We are a human resource service agency. Before, we use billing statements containing a breakdown of fees to bill our clients, and use a combination of official receipt and acknowledgement receipt to recognize payment. Our official receipt contains our agency fee that would be taxable, and the acknowledgement receipt contains the salary due to our employees that is not taxable.

Now, if our official receipt is changed to service invoice, how will we recognize the difference between the agency fee and the amount due to employees?

If we put the whole total amount due (including the salaries to be distributed to employees) in the service invoice, our taxable income would be overstated.

How do we comply without overstating our income?

Good day.

For doctors who are VAT registered, what are the documents that are needed during BIR visit?

Also, what is the proper way/format of entering values in the books of accounts?

Thank you very much!

Hi,

Just want to ask if a taxpayer is Real Estate dealer, selling lots payable in 5 years.

How to issue invoice for the downpayment and the monthly payment?

Thank you in advance for your help.

Gie

In case the supplier has no collection receipts but already issued sales invoice for services/goods delivered, then the client impose him to issue a collection receipt upon payment, what should the business owner do?

Hi Grace! According to the BIR RR (Revenue Regulations (RR) No. 18-2012) Sales Invoice alone is sufficient. No Collection Receipt (CR) is required. The CR is not a tax requirement, but it is used by some businesses for internal tracking so just create one 🙂

We are a Cooperative providing water service in our community, servicing 5 barangays. My question is, what should be our primary invoice is it our official receipt which will change to service invoice and our supplementary document will be our water bill is that right?

Hi Sheila! This seems right. But best to check with the RDO as well 🙂

Hi, if we are a nonstock nonprofit organization engaged in collecting monthly/yearly membership dues, what kind of invoice do we need to print?

Hi Deah,

It depends on the BIR authority printers on what they will issue for your organization 🙂 feel free to ask one of our accountant partners to check on your case, kindly check them out here: https://marketplace.taxumo.com/search?q=consult+as&options%5Bprefix%5D=last