With the recent changes due to the Ease of Paying Taxes, a lot of people have been asking themselves “What is my taxpayer classification?” This is a new classification system implemented as part of the Ease of Paying Taxes. The most obvious impact of this is that penalties are cut to half for Micro and Small Taxpayers. So let’s get started, how do you find out your taxpayer classification?

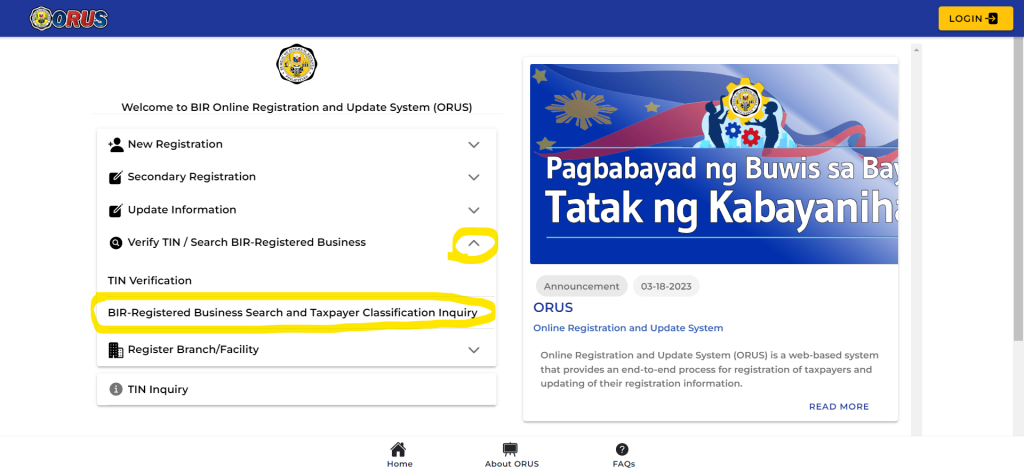

The easiest way to check would be via BIR’s ORUS (Online Registration and Update System). Once there, click on “Verify TIN / Search BIR-Registered Business” and then on “BIR-Registered Business Search and Taxpayer Classification Inquiry” as can be seen in the photo below:

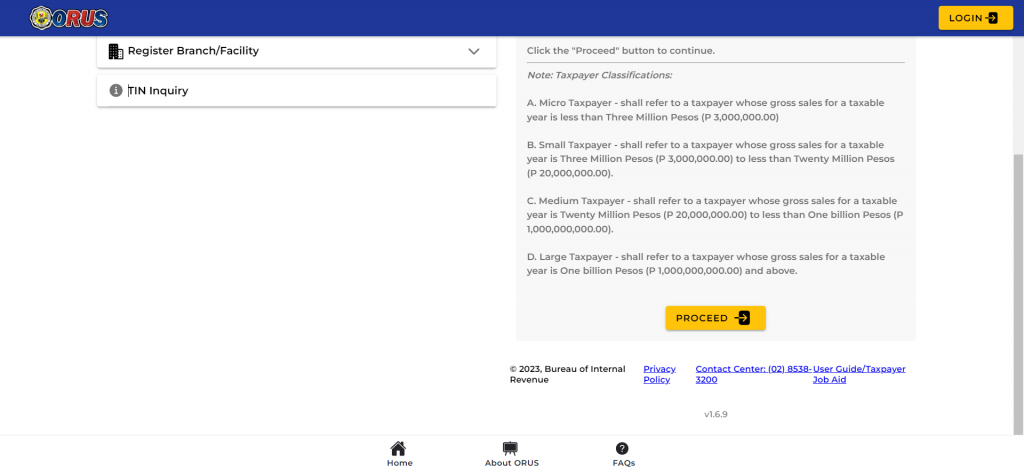

The little window on the right will change, scroll down that section and then click on Proceed:

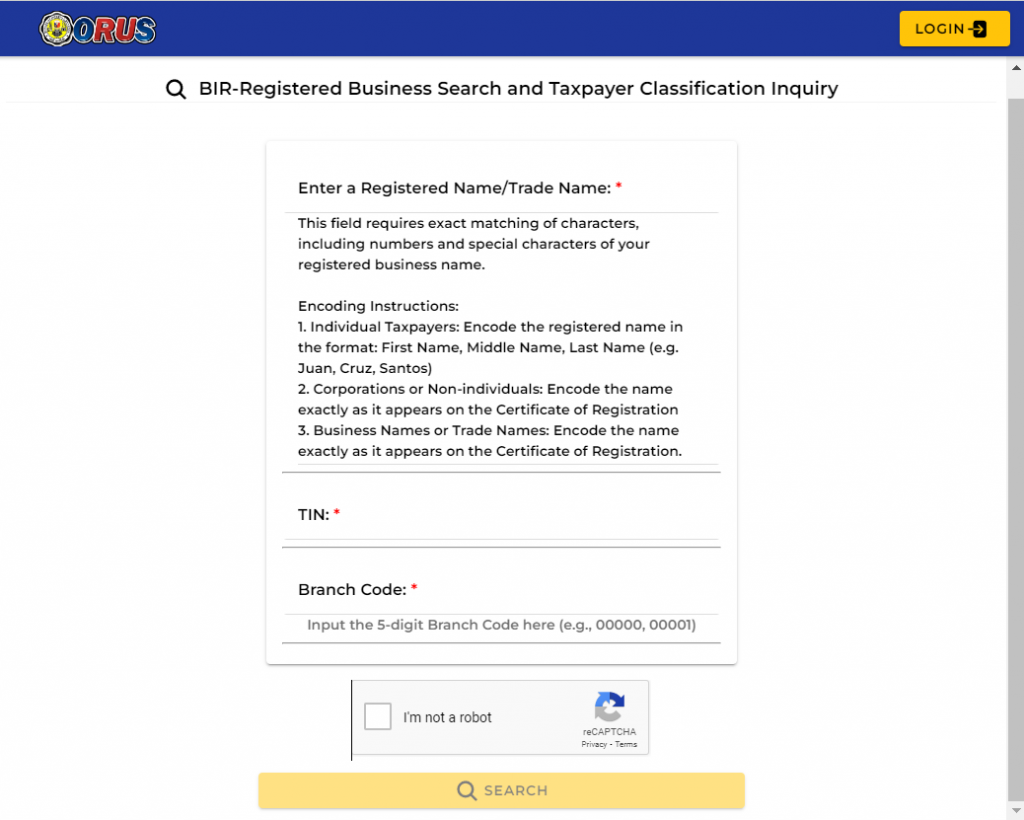

You’ll now be greeted with the inquiry screen:

Input your Trade Name, your 9-digit TIN, and the Branch Code. Some note and observations: I noticed that entering my Taxpayer name did not work, entering my Trade Name instead worked. The TIN is 9 digits. As for the branch code, if you don’t have any branches, then this would just be “00000.”

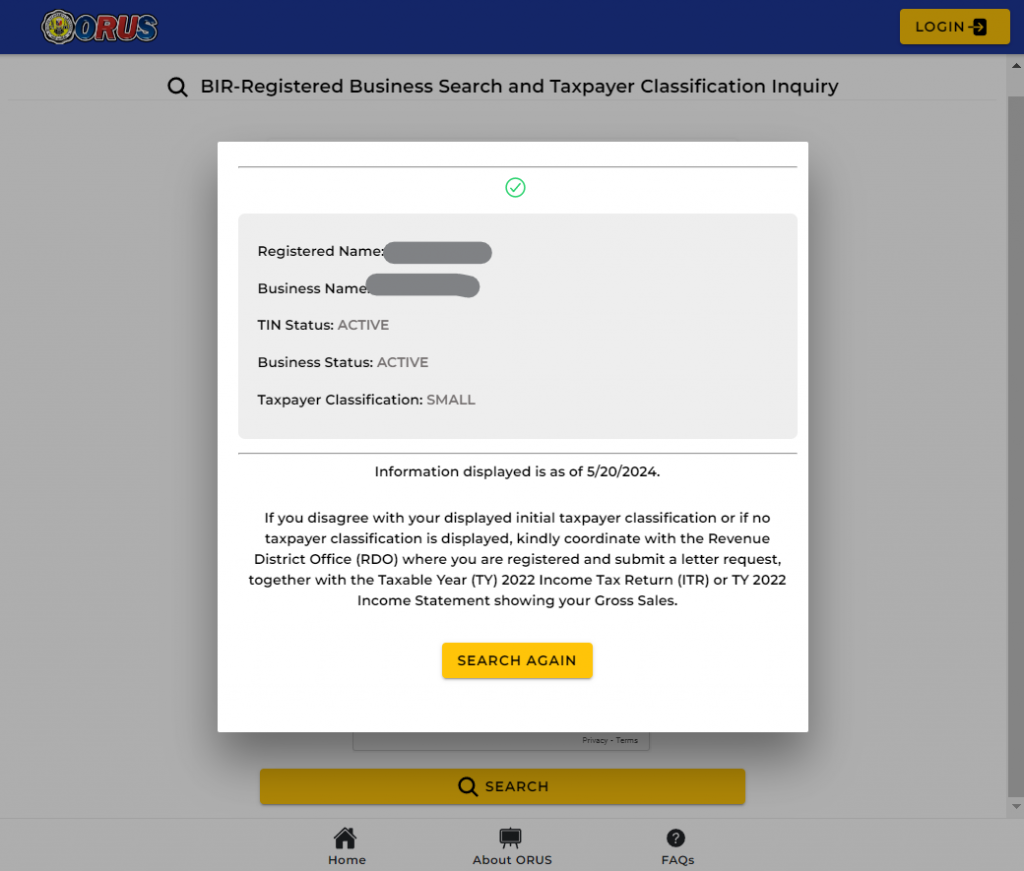

Click on “the “I’m not a robot” (reCAPTCHA) checkbox and then click Search. If the details you entered are correct, you will be presented with a new modal that shows the details, including the taxpayer classification:

And from there, you’ll see your taxpayer classification.

The other way of determining your classification is seen in RR 8-2024. You can read more about that in our article entitled BIR Taxpayer Classification Under the New Revenue Regulation No. 8-2024.

Can individuals (freelancers) check using ORUS? Nothing came up when I used my details.

Hello Ryuu,

Good day!

Are you already registered in BIR and have an ORUS account? If yes, then you can check your classification via ORUS too. 🙂