Creating a User Account in Taxumo

When I started my business, I didn’t know how to pay my taxes as a business owner. This made me feel uneasy. I thought the only solution was just not to pay it (since I couldn’t afford paying an accountant — a decent one costs Php 3000 to Php 5000 a month), even though I wanted peace of mind.

But then I discovered Taxumo. Taxumo is DIY tool that helps self-employed individuals, sole proprietors, licensed professionals and non-licensed professionals like freelancers, consultants, financial advisors, etc. compute file and pay our taxes online. There are also Corporations and Partnerships that use the tool for filing some forms (like VAT forms and EWT forms). There are also accountants and bookkeepers who use the system to file and pay forms for their clients.

Taxumo definitely makes life easier — since you don’t need to how to compute, you don’t need to file using eBIR Forms and you don’t need to line up at the Bank in the city of your business. You can COMPUTE FILE AND PAY at home or while chilling at the beach (as long as you have an internet connection).

How do I use Taxumo and how to create a user account in Taxumo?

We created different articles that you can use as a guide that shows the steps on how to use TAXUMO. This is the first article in the Taxumo Blog. In this article, we will teach you how to Create your own User Account.

1. Go to https://www.taxumo.com and click on sign up at the upper right corner of the page.

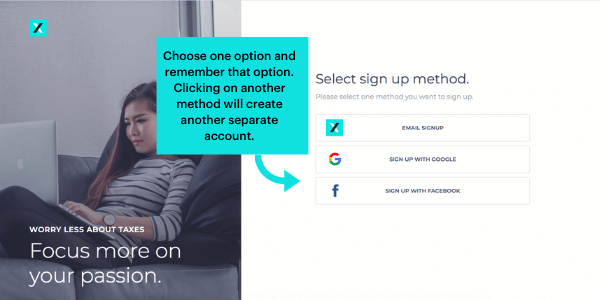

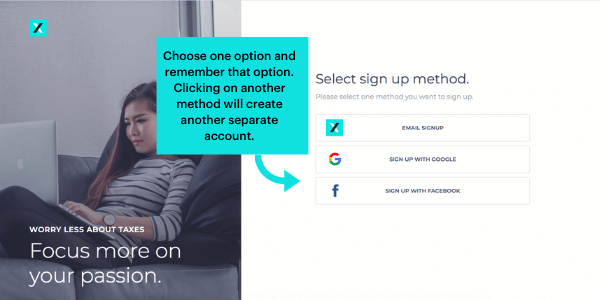

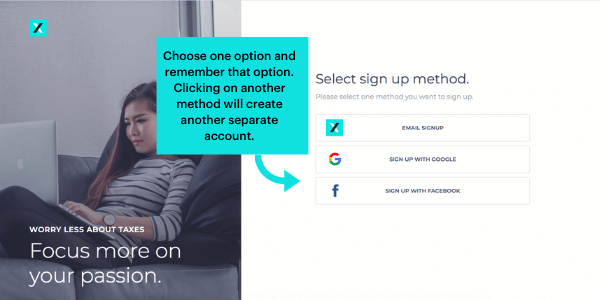

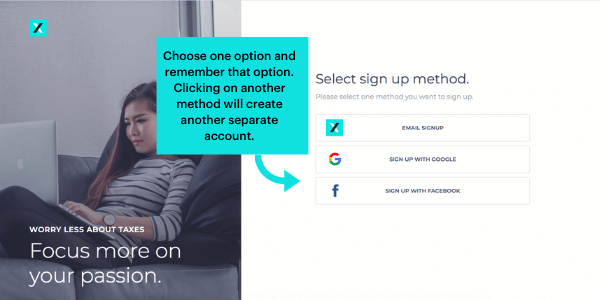

2. Choose how you want to create your user profile. Remember your choice, since choosing another option in the future will create another account.

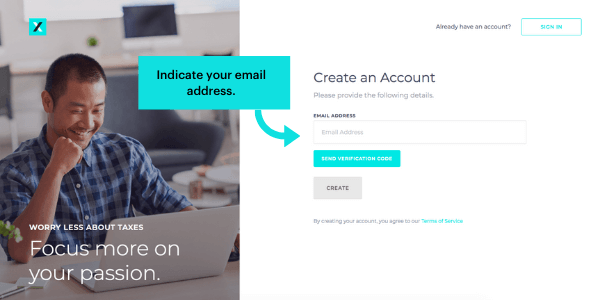

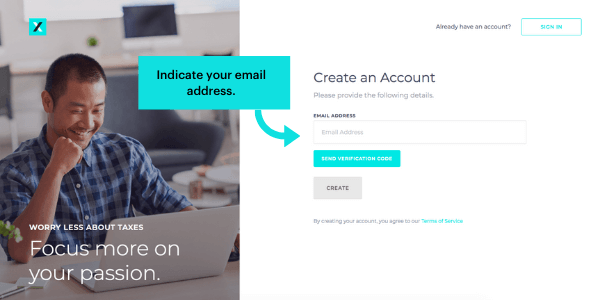

3. Just follow the instructions. (If you’ve chosen Email Sign up) Type in your email address. Click on Send Verification Code.

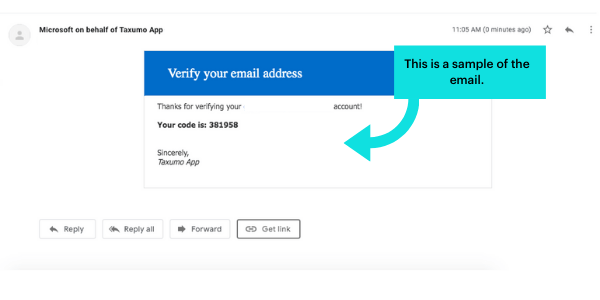

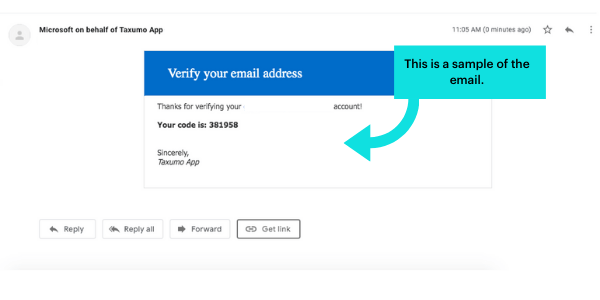

4. Check your email and copy the Verification Code that we have sent.

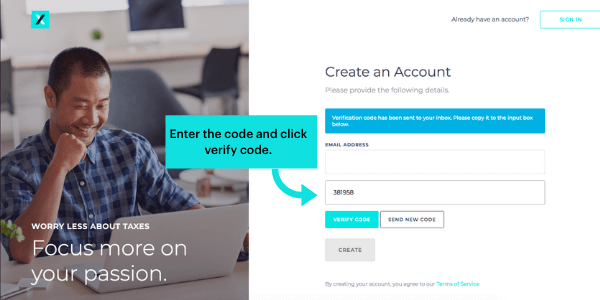

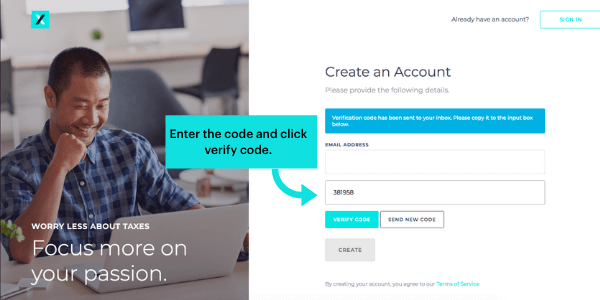

5. Enter the Verification Code and click on the button Verify Code.

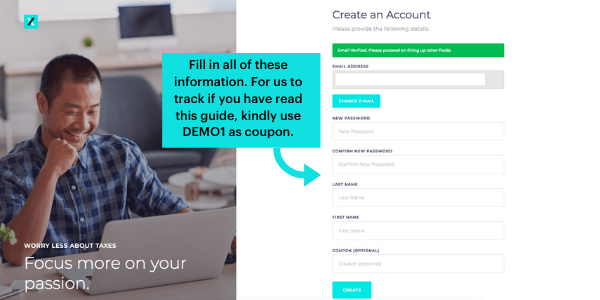

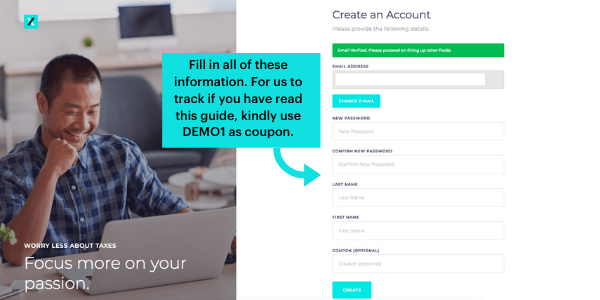

6. Fill in all of the required information:

– Password

– Last Name

– First Name

– Coupon Code (this is for our internal tracking): Kindly write DEMO1 to let us know that you have read our simple “how-to” blog.

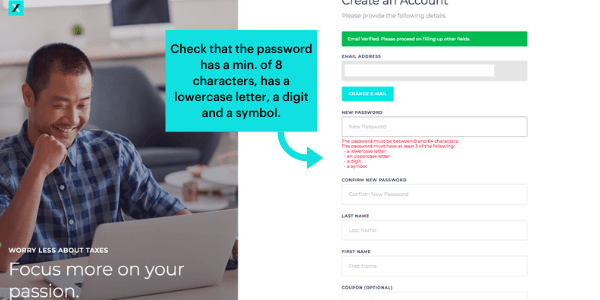

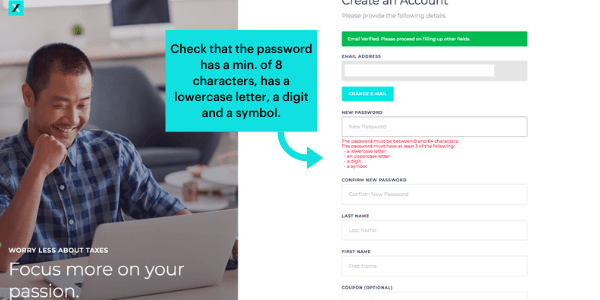

7. For your password, follow these rules in creating one.

8. Please then go through and read the following screens. These are some of the features of Taxumo.

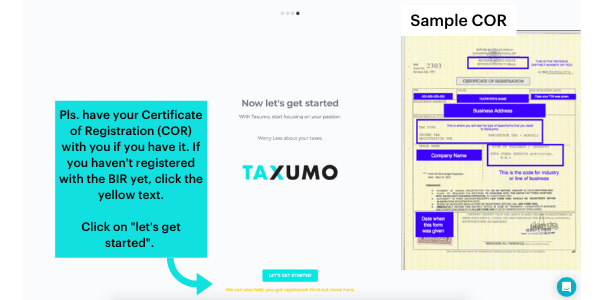

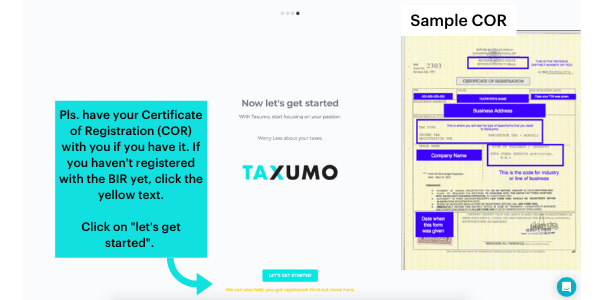

9. Have a copy of your Certificate of Registration by your side. If you don’t have a Certificate of Registration yet, Taxumo can help your register your business or profession if your business address

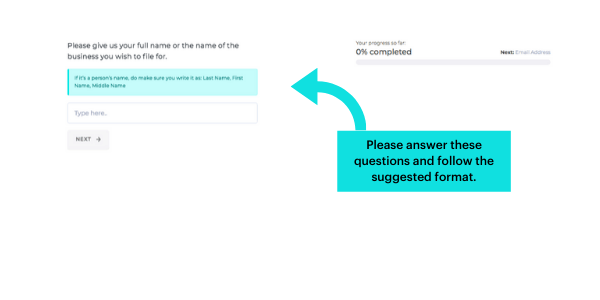

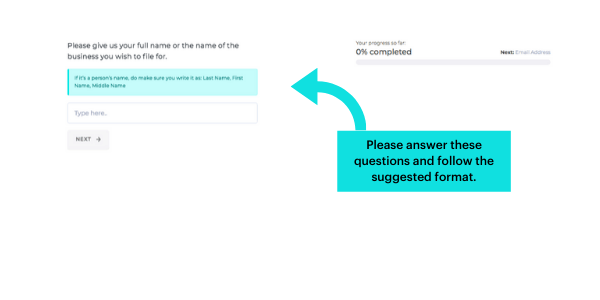

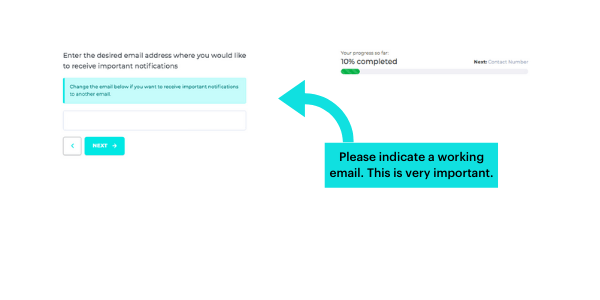

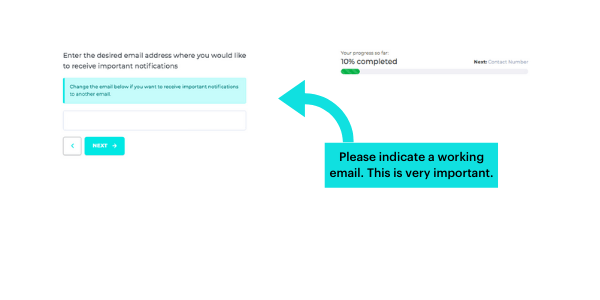

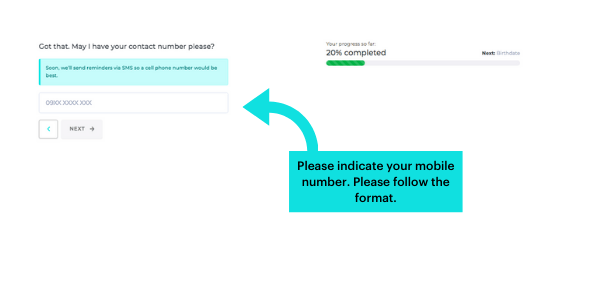

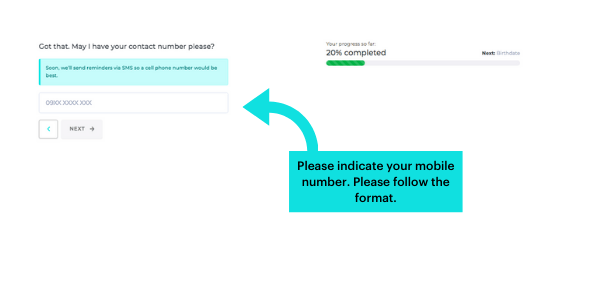

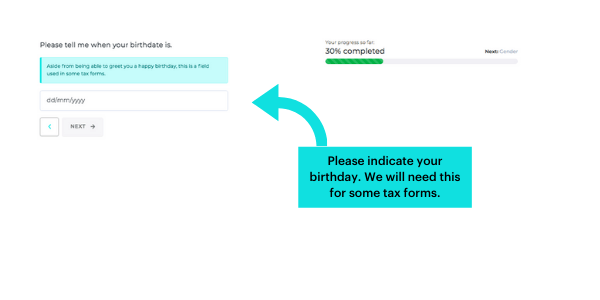

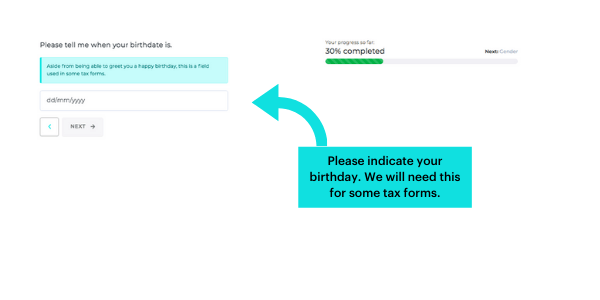

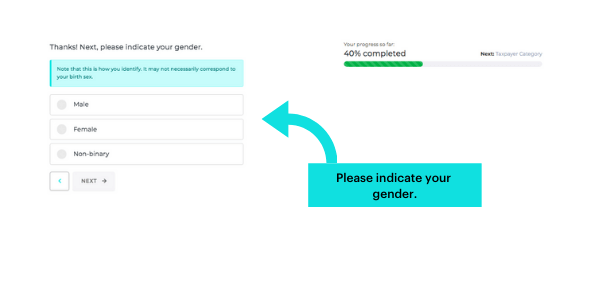

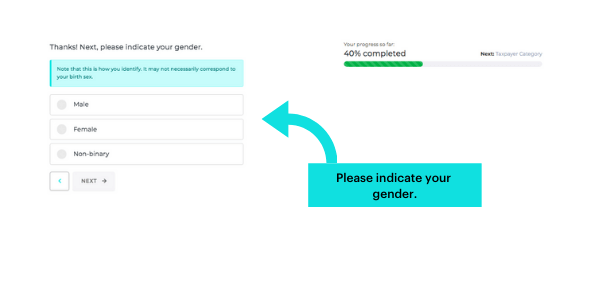

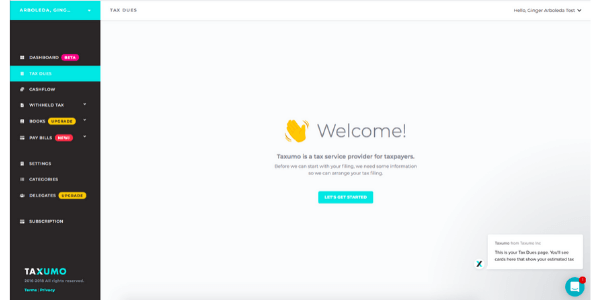

10. Once you have clicked “Let’s Get Started!”, please start answering the given questions. Please follow the format indicated.

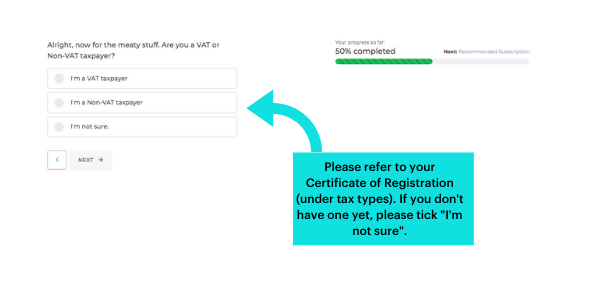

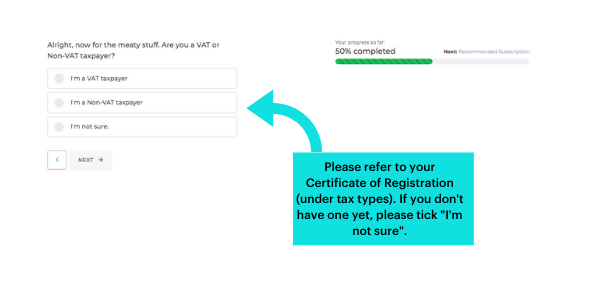

11. For the next questions, please base your reply on your Certificate of Registration (FORM 2303) from the BIR when you create a user account in Taxumo. If you don’t have the COR / Form 2303, just answer to the best of your ability and you can go back to these settings in your settings page once you have your Certificate of Registration or COR.

* If you earn more than Php 3 Million Gross Revenue in a year, then you are a VAT Taxpayer. If you earn less, you are a Non-VAT taxpayer. But again, check your Certificate of Registration. If you have “Percentage Tax” under Tax Types, then you are Non-VAT.

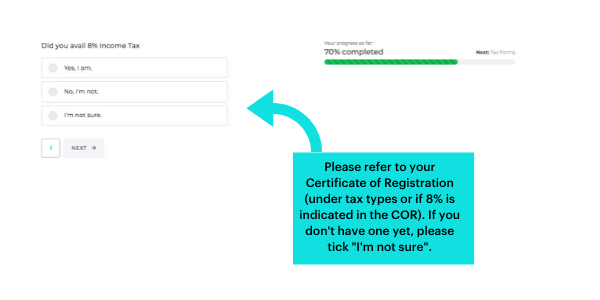

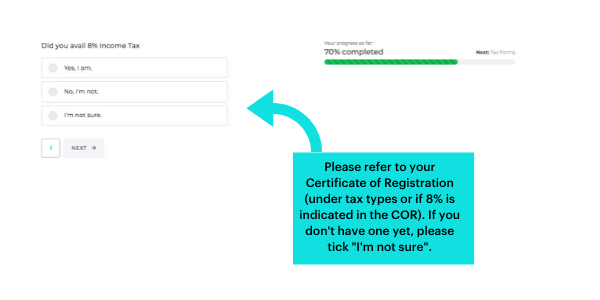

*To be sure on what the process is to avail of 8%, please call your Revenue District Office (RDO) to know the process: https://www.bir.gov.ph/index.php/contact-us/directory/revenue-district-offices.html

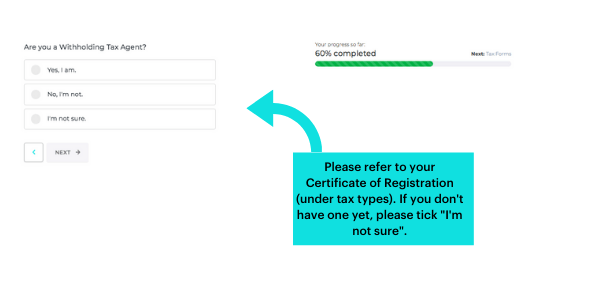

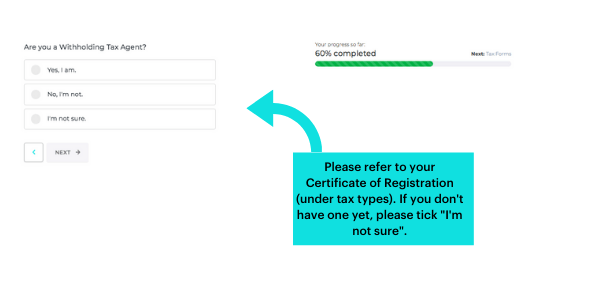

*If you have “Withheld Taxes – Expanded/OTH” in your COR, click “Yes, I am”. If you don’t have this tax under Tax Type, click “No, I am not”. If you don’t have your COR yet, “I’m not sure”.

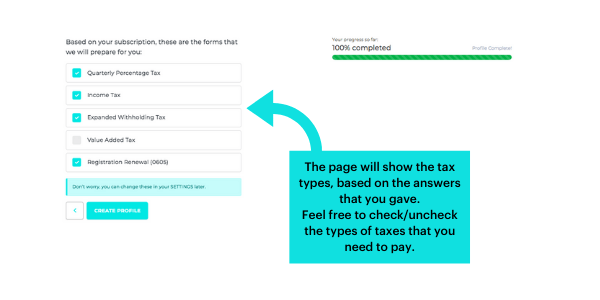

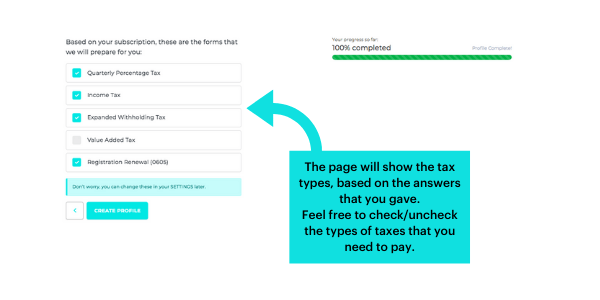

*Double check the list of the taxes that you need to file.

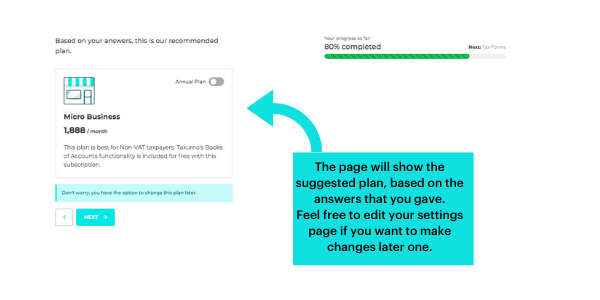

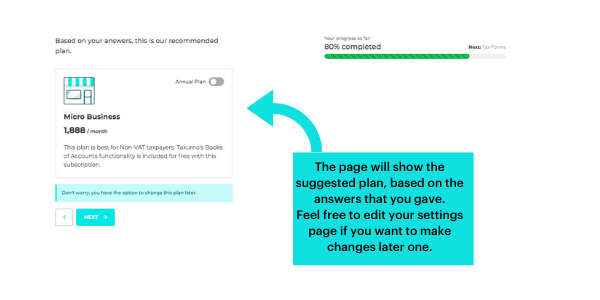

*The system will then show the recommended subscription plan. Note that our recommendation is based on the answers that you gave for your settings. Especially for those without COR, you can finalize your settings page once you have a copy of your COR.

These are the steps on how to create a User Profile in Taxumo.

To create the company profile, stay tuned for our next “How To” article.

Keep calm and file away!

If you are ready to subscribe, click here!