If you’re running out of time or just looking for a simple way to compute your taxes accurately, a digital income tax calculator in the Philippines—like the one offered by Taxumo—can help you save time, minimize errors, and file with confidence.

What Is a Digital Income Tax Calculator?

If you’re short on time or don’t have someone to compute your taxes for you, this tool does the math for you—automatically calculating everything based on the data you provide.

Here are a few reasons why it’s worth using:

- ✅ Time-Saving: Finish your computations in minutes.

- ✅ Real-Time Updates: Get the latest computations based on BIR tax rules.

- ✅ User-Friendly: No need for complex spreadsheets or calculators.

How Taxumo’s Digital Income Tax Calculator Works

Taxumo simplifies the process by calculating your taxes as you enter your income and expenses. Here’s a step-by-step guide:

Step 1: Sign Up for Free or Log In

Head over to www.taxumo.com/login and create an account or log in.

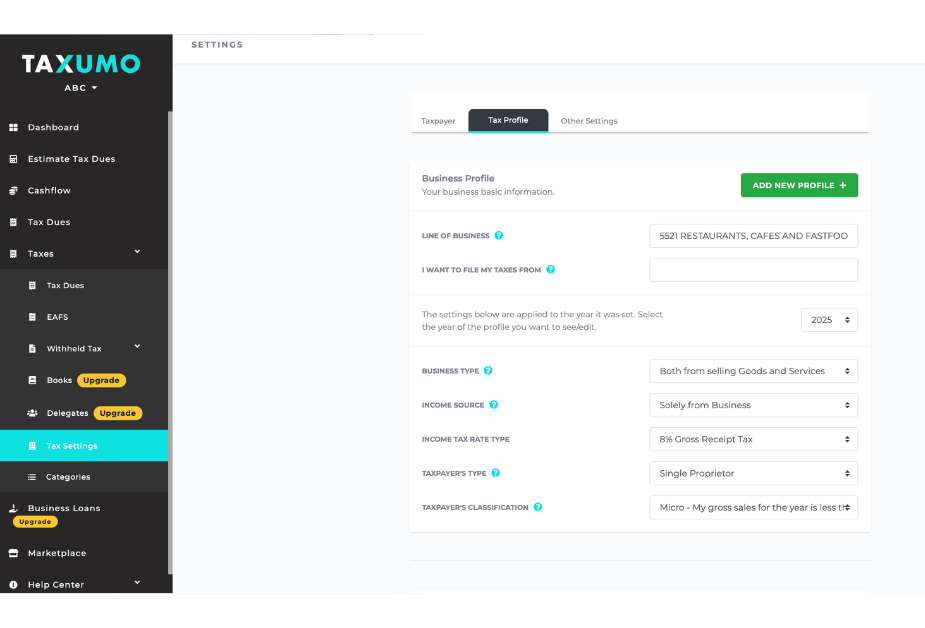

Step 2: Enter Your Business Profile

Set up your account by indicating:

- Business type (e.g., sole proprietor, freelancer, or corporation)

- Taxpayer type (VAT or non-VAT)

- Industry category

- Forms you need to file

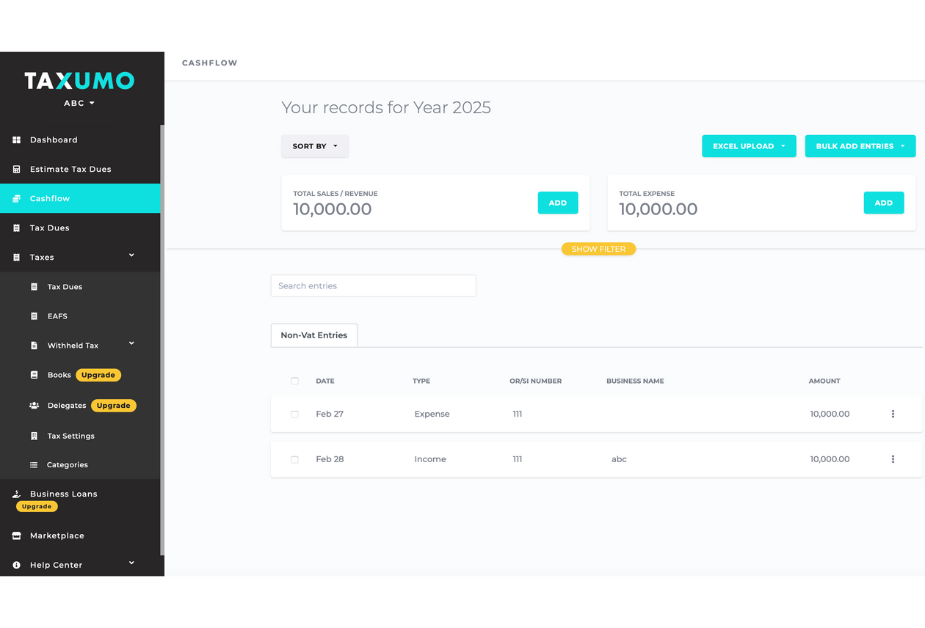

Step 3: Input Your Income and Expenses

You’ll be asked to:

- Add your monthly or quarterly income (If you have a lot of income and expenses, you can upload this in bulk)

- Record allowable business expenses

- Input withholding tax received (BIR Form 2307) in the withholding tax tab

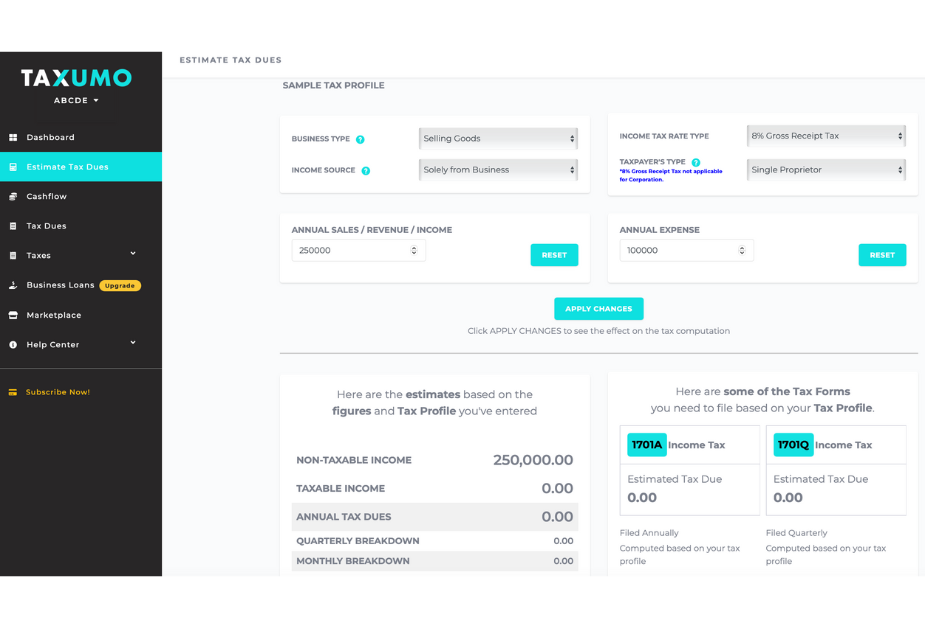

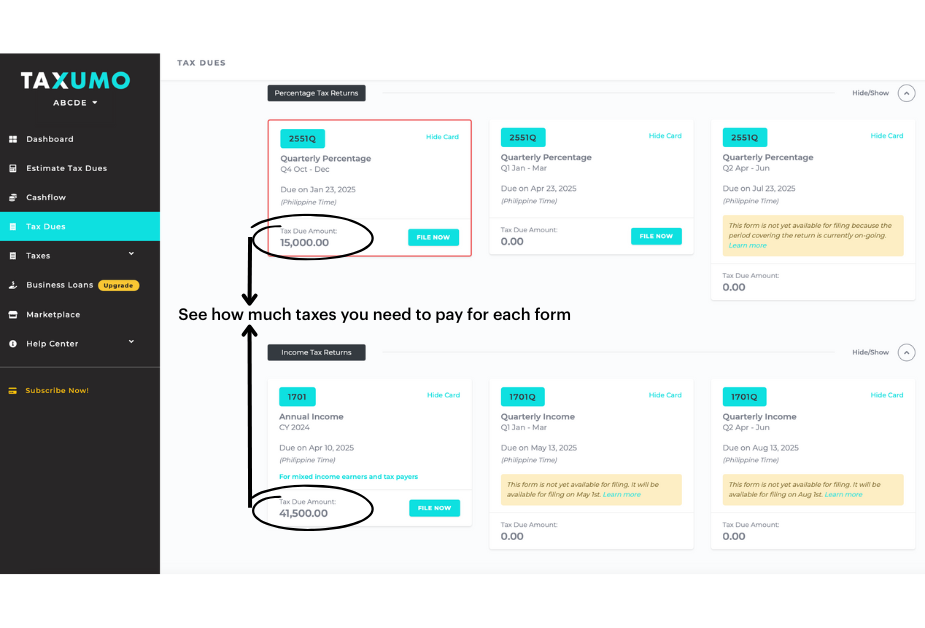

Step 4: Automatic Tax Computation

Taxumo automatically calculates the following based on your inputs:

- Quarterly Income Tax (1701Q, 1702Q)

- Percentage Tax or VAT (if applicable) (2551Q)

- Annual Income Tax (1701, 1701A, 1702 RT)

- Withholding tax forms (0619E, 1601EQ, 1604E, 1601C, 1604C)

Project your taxes in the next calendar year!

Taxumo also allows you to project your tax dues for the next calendar year based on your projected income and expenses, helping you plan ahead and avoid surprises. You can estimate your quarterly and annual taxes to prepare for future tax payments.