Hi, everyone! We just want to make a quick announcement.

As most of you would know, the Annual Income Tax Return Deadline for 2018 (previous year) will be on April 15. Taxumo’s deadline is earlier and our deadline will be on April 10. As of now, we are still waiting for the new form for 1701 or the Annual Income Tax Return form. The changes in the form were needed to comply with the changes brought by The Tax Reform for Acceleration and Inclusion (TRAIN) Act. We highly recommend you file the new form to make sure that you’re filing the correct form.

So while waiting, we encourage you to RESERVE A SLOT for 1701. We will be able to process the Annual Income Tax Return only for a limited number of people so to make sure you’re included, we’ll need you to reserve a slot. Needless to say, our Premium, MD, and Power Up Plans subscribers have a reserved slot automatically.

Now, the good thing about Taxumo’s 1701 or Annual Income Tax Return preparation is that we are open to preparing this form for NON-TAXUMO users. If this is the only thing that you want us to prepare for the entire year: Sure! We’ll do it for you!

Here are the steps so you can RESERVE A SLOT:

STEP 1 – Sign up at https://www.taxumo.com. Once you’ve created your account and you’re logged in, you will see this box at the upper right hand side of your screen (dashboard).

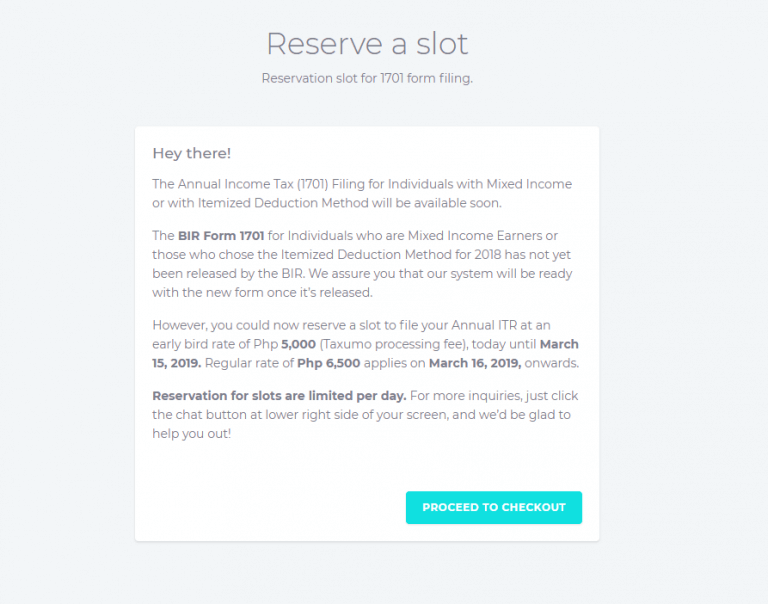

STEP 2 – Click on that and then you will see this message.

Note that our EARLY BIRD RATE for 1701/ Annual Income Tax Return for 2018 Preparation is only until March 15, 2019. Please secure your slot now! Our Premium and Power Up Plans subscribers need not reserve a slot. This is part of your package already. Our Regular Rate is at Php 6500 starting March 16, 2019.

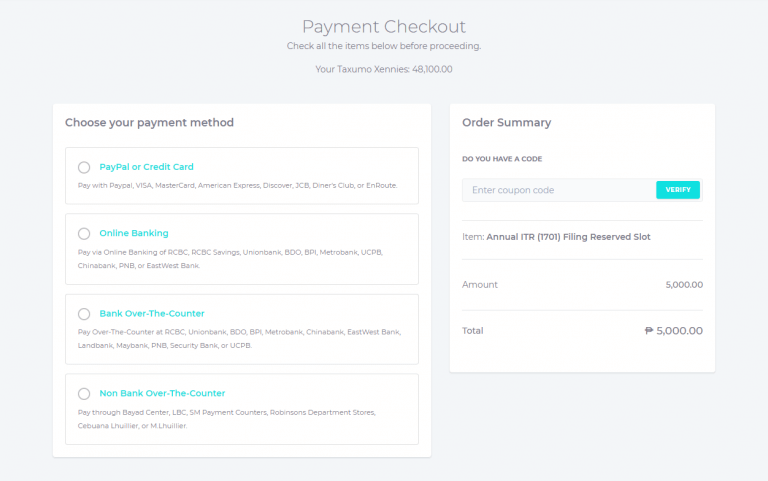

STEP 3 – Pay via any of the given payment methods. It’s that easy!

Once we get hold of the new form, we will inform all of our clients and those who have reserved a slot on what to do next.

For those who earned more than Php 3 Million Gross Revenue for 2018, you will need an Audited Financial Statement Preparation (AFS) that needs to be prepared by an independent party. For that, we can refer you to our partner auditor – they’re offering that service to our users for Php 12,500 only.

Do note that for those Individual Tax Payers who are filing using the Optional Standard Deduction (OSD) method or who are using the 8% Flat Income Tax Rate for 2018, you are required to file Form 1701A, another brand new form that was recently released by the BIR. This form is ALREADY AVAILABLE for use inside Taxumo, and we also welcome non-Taxumo users / filers to use this service. You can watch this video to see how to do so:

If you have any questions, feel free to comment on the comment section below and we’ll get back to you!

If you are not yet a Taxumo Subscriber, hope you can check out our Power up Plans or Taxumo Premium – by subscribing to a plan that works for you, you also automatically get a slot!