Hey there, fellow hustler! Have you heard of the new BIR RMC No. 55-2024? Basically BIR granted extension to online sellers for tax compliance until July 14, 2024. Good news is you still have more time to figure out how to do your taxes, and the greater news is you can do taxes even without hiring a bookkeeper and an accountant (for now!)

We know you juggle a million things: snapping amazing pics of your products, crushing it on social media, keeping customers happy, and yes, even dealing with taxes! Running an online business is awesome, but tax season can feel like a monster you never signed up to fight for. That’s why we made everything easy for you here in Taxumo.

We at Taxumo get it – tax forms, deadlines, calculations – it’s all enough to make your head spin. That’s why we built a platform specifically for online sellers like you. We want to help you ditch the confusing spreadsheets and jargon, so you can focus on what you do best – growing your business!

Your secret weapon to comply easily with your BIR taxes as an Online Seller

Here’s how Taxumo makes Tax filing easy for you:

- Start with your Income and Expenses: In order for Taxumo to generate your Tax forms, you need to start with inputting your Income and Expenses on our Cashflow dashboard. You have the option to add transactions one-by-one or you can upload all of your income and expense transaction in bulk (which is one of our highly recommended steps). You can easily import your data using the Excel file upload template, then after uploading, you can see these entries in your cashflow tab. You can also “filter” them accordingly.

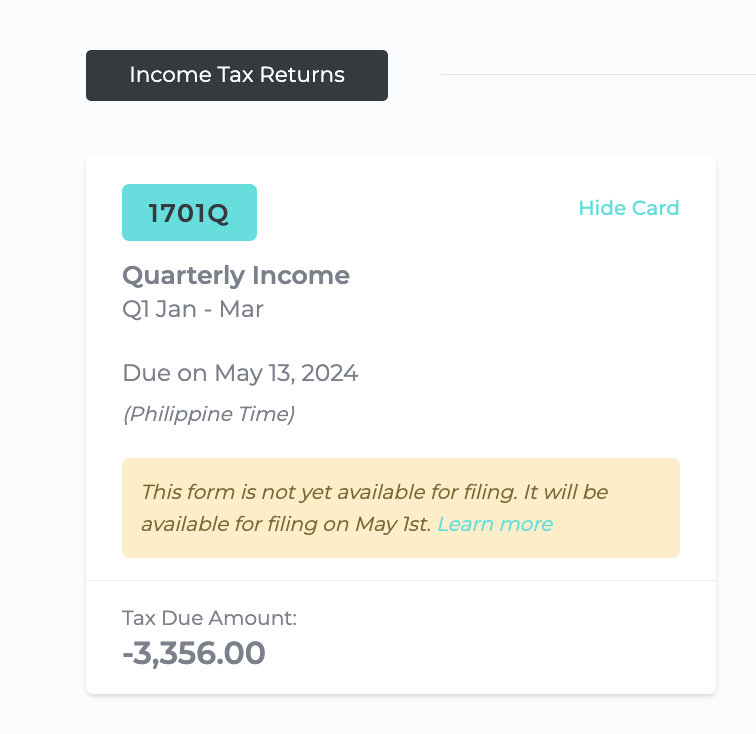

2. No more Tax formulas, Taxumo does the calculation for you: Once you’ve inputted all of your Income and Expense transactions, Taxumo will then forecast how much taxes you need to pay (or set aside on the next tax due). Also take advantage of this free feature, many seasoned taxpayers worry about not knowing how much taxes they need to pay in advance. Good thing is Taxumo can do the forecasting for you. This is a sample of the real time tax calculator of Taxumo (each tax card is a tax form).

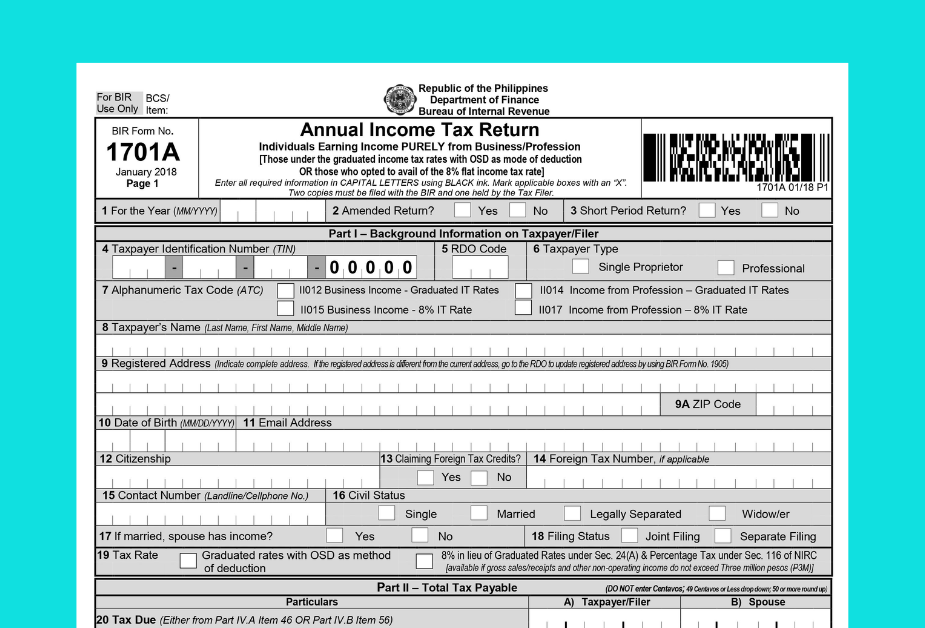

3. Automated Tax Form Generation (No more filing your Tax forms one-by-one): When you add your income, expenses and any data from received 2307 data or any withheld tax data, Taxumo does the hard work of creating your tax forms for you. You don’t have to worry about knowing which parts to fill in on those complicated BIR forms. Taxumo just makes it all for you automatically. Easy, right? No need to use eBIR Forms or EFPS.

Bonus Level: Streamlined Bookkeeping and Invoicing

We know how hassle it is to manually input information of your income and expenses on your books and on your invoice, so we made sure to make this easy for you as well.

- Effortless Loose Leaf Accreditation: Keeping track of income and expenses (aka bookkeeping) can be a chore. But Taxumo simplifies it! Use our Books of Accounts feature and secure a loose-leaf accreditation from the BIR. Just enter your transactions, and Taxumo will generate BIR-formatted reports with a few clicks. No more bookkeeping headaches for you.

- Coming Soon – Generate BIR Format Invoices: We know how important it is to have BIR-compliant invoices. We are currently developing a feature that will allow you to generate BIR-formatted invoices with ease. Stay ahead of the game and join our waitlist to be notified when this feature is available: https://www.taxumo.com/reserve-invoice-early-access/

We want online sellers to focus on their passion, and we’ll handle the tax stuff behind the scenes. So you can keep selling awesome products and leave the tax battles to us.

Learn more about using Taxumo and how to set up your account: https://www.taxumo.com/blog/how-to-file-your-taxes-using-taxumo/

Book a FREE Tax 101 with us!

Schedule your preferred date below