Congratulations! You’ve finally decided to resign from your job and go full time into your profession. Whether you’re going to become a freelancer, a licensed professional, or a small business owner, you’re now your own boss! Now to make sure that things are on the up and up, the first thing you’ll have to do is transfer your RDO – from the RDO of your employer to YOUR RDO. Fortunately, the process is easy and quite painless by using the BIR Form 1905.

Steps In Transfering Your RDO

Step 1

Find out in which RDO your TIN is now. Most likely, your employer moved your TIN to their RDO. To confirm, you can call the BIR Contact Center at 981-7003, 981-7020, 981-7040, or 981-7046. If they can’t help you, you may have to go to the RDO and inquire. It’s fairly quick though and they can look up in which RDO your TIN is in.

Step 2

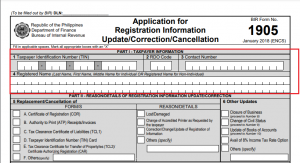

Fill out BIR Form 1905. You can get a copy here but we do recommend that you check the BIR website to see if there’s an updated copy. Here’s what you place in the fields:

Part I: Taxpayer Information

Make sure you fill out the following fields: Taxpayer Identification Number (TIN), RDO Code, Contact Number, and your Registered Name.

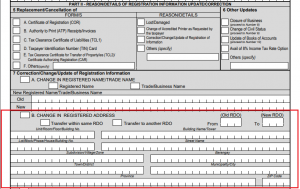

Part II

Change In Registered Address

Find Section 7 entitled “Correction/Change/Update of Registration Information”. You’ll be ticking Field 7B or “Change in Registered Address”

Chances are, you’re moving to another RDO. If you are, tick the box that says “Transfer of Home RDO,” then place the From RDO and the To RDO (the RDO of your new address). After that, write your new address (most likely your home address if you’re a home-based freelancer), your zip code, and your telephone number.

If you are transferring within the same RDO but a different address, then tick the box that says “Transfer within Same RDO”. Write your address, zip code, and telephone number.

Sign the Declaration

Write your name and sign. For the title, you may place your official title or just “Taxpayer”

Step 3

Bring the BIR Form 1905 to your OLD RDO. In around 1 week, processing should be done and your TIN should now be registered in your new RDO.

This is just the first step in legitimizing your new business. After this, you’ll fill out your Form 1901, get some books stamped, and finally get your Certificate of Registration (COR).

And after getting your COR, you can start filing taxes such as your annual income tax returns.

Do you want us to help you with your business registration?

Did you know that we can help you register your business…so that you have more time running and growing your business? Check out our Business Registration, click the button below

Hi sir, what if po from Luzon yung old rdo then transfer to visayas? Hope for your asap response.

Same exact process, Franz. You will have to go to your old RDO and file your 1905 there, unfortunately.

Sir. Can i have my 1901 delivered to me? i have a strict sched since i’m not working on a BPO company. if that’s possible what or whom should i contact?

The 1901 is a form that you can download and fill out on your home PC. Here’s a link to the form.

Just in case you meant 1905 and you need help with processing your 1905, we can help you with that as well via our BizReg service (link).

can i get a new TIN despite having an old one?

sir gusto ko lang po tanungin. Mga ilang days po ang processing kpag pinasend mu sa lbc ung 1905 form?para mapaliPat ung rdo ko?

Hello , pwede po bang ipatransfer yung rdo thru online ? kase po malayo po yung rdo na pinagawan ko po

Hi Good day, can you help me to transfer my RDO from 034 to 080?

How much?

paano po mgtransfer ng rdo from rdo 32 manila to rdo 56 calamba .. sa manila po kc niregister ung tin number ko nung nagpaassit ako onlin hanggang ngyon po hndi p ko nasahod dahil sa wla pkong bir sa provincial government of laguna po ako ngwwork .. pwede po bang hndi nko pmunta ng office sa manila pra itransfer nlng thru email o ipadala ko nlng ung form kko ng 1905 pra itransfer ako sa calamba thru lbc ..

Good day po.

Last RDO ko po ay sa QC pa po, then magpapa change RDO po ako para sa new work ko po dito sa Camarines Sur. Please help po. Hindi po kasi ako makakapunta na ng QC due to pandemic. Salamat po.

Hi Mary Grace, you may try sending your last RDO an email to request transfer of your TIN. Though you should take note that they do not respond to email inquiries as fast as you would want it to be. If you are in a rush to have your TIN transferred we have CPA partners who can assist you with this if interested to avail such service, let us know by sending us an email at customercare@taxumo.com. 🙂

Hi, i was hired last january in Taguig and i already paid the Annual income Tax (500php) then the pandemic happened so i decided to go to my hometown and recently i Applied as Contact Tracer. do i have to pay another 500 for the annual income tax again? since i changed my RDO?

Hi Sir,

My husband’s RDO is Manila. And we really need to transfer it here in Cebu? Do you have any idea about their email address? Since it’s very hard to travel due to the current situation. Your response is highly appreciated. Thanks in advance

May email add po… rdo_44css@bir.gov.ph

Nagrereply po ba sila via email?

Hello po. once nag email na po ano po next step?

I have same problem. Can’t it be done online? Me is Zamboanga & I am in NCR now

Sir, kelangan po ba personal na dalhin sa dating rdo yung form? Yung prev comp ko po kasi sa makati pero sa tuguegarao naka reg ang comp. kaya dun yun rdo nya. Pede po kaya ito via email? TIA po.

Hi, we have the same situation, what did you do?

Hellp po if employed then gusto na maging freelancer do I need to change my tax type from 1902 to 1901? If yes paano po siya i fifill up sa form 1905?

Hello Kenn,

Great day!

To assist you accordingly, you may send us an email to customercare@taxumo.com.

Thank you and we’ll be waiting for your email 🙂

What should I need to bring if I am the one who will change the TIN ID address of my sister?

Hello sir, question lang, is there any way na pwede mapa transfer from old rdo (sta cruz manila) to (trece martires cavite) without appearance. Can you help me with that Thanks 🙏🏻

Pano ponkung wala naman pong nabago sa adress ko kung san ako nkatira pano po akonkukuha ng verification slip

Hello I am currently confused ,what should I put on the address is it the address of my current work or my home address . Thanks

Hi Meyra! If this is for RDO transfer and you are asking about what to put in the Form 1905, it should be the address where you wish to transfer your TIN. 🙂

Parang d nsagot ung question mo if sa home address or sa current work ittransfer. Un dn need ko malaman

Hi Ghen! If your employer agreed that you can transfer your TIN to your home address then that is alright. 🙂

I filed 1905 last March 01, 2021 in BIR Digos to be transferred in Davao po. How would I know if it is successfully transferred? Pinaiwan lang po kasi sa drop box yung form po.

Sir EJ .. tanong ko lang po, is it necessary po na mag change ng RDO at address dahil may new employer na po ako? or pwde po bang mamalagi nalang sa dating RDO at address? ..Sana po mapansin niyo at matulungan niyo po ako, Thank You po.

You mean Sir Ej , We need to go to Manila just to submit this form 1905? There’s no other way to submit this form like to submit it online thru email to the BIR office,is it possible in order to avoid this strict compliance during this time of pandemic??

Hi Dionelo,

Unfortunately, there is still no online service for RDO transfer. One alternative you can take is to hire an accountant or bookkeeper to do transfer your TIN for you.

Can i get your service and just do the filing of 1905 on my behalf? From QC to Makati lang naman ang lipat ko. Thanks

Hi AAL, yes we can definitely do that! Send us an email at customercare@taxumo.com so we can get this started 🙂

How about kapag ang OLD RDO po ay sa taguig then transfer sa Batangas?

Hello Alecxa,

Some RDOs allow transfer of TIN via email request. Though if you do this process it may take a while before for the RDO respond to you so it is better done personally if you are in a hurry.

If you wish to send an email request for RDO transfer, you may check for your RDO’s contact details here:

https://www.bir.gov.ph/index.php/contact-us/directory/regional-district-offices.html

If you can not do it, you may ask someone to do it for you, or if you wish to avail of our services, we can assist you also.

If interested to avail services and see the rate, kindly contact us at customercare@taxumo.com.

Thank you and have a

Hi sir. May I ask, who will input my zipcode? The BIR staff says it is system generated. Our zipcode is suppose dto be 1608 but she is insisting in the system, its 1602.

How to change status from single to married

Hello JP,

To change your marital status from single to married with the BIR, follow these steps:

Prepare the required documents: a photocopy of your PSA marriage certificate, a valid ID, two copies of BIR Form 1905 or 2305, and a Taxpayer’s Information Sheet.

Visit your Revenue District Office (RDO) and get a queue number.

Present your documents and forms when your number is called.

The officer will process your request and provide a stamped copy of your form.

Hope this helps 🙂

Hi, Good day! Resigned na ako sa trabaho pero di ko pa din napachange ung RDO number ko, Laguna to Cavite. Hindi po ba ako mabibigyan ng Form 2316 kung di ko naitransfer?

Ngayon, magtatrabaho na ako ulit sa Laguna, need ko pa ba ipabago para makakuha ako ng Form 2316?

Nirerequire kasi sakin un ng next employer ko.

Thank you so much.

Your previous employer will still give it to you even if you transfer your RDO. It is best that you follow this up with them this January. 🙂

Pwede po ba ibang tao mag process nito sa RDO?

Hello Russel,

Yes this is possible but please do know that some RDOs allow transfer of TIN via email request.

If you wish to send an email request for RDO transfer, you may check for your RDO’s contact details here:

https://www.bir.gov.ph/index.php/contact-us/directory/regional-district-offices.html

Thank you!

Hi! How would I know where is located my old RDO? May last work was way 2018 in BGC. Thanks you

Hi! How would I know where is my old RDO located? May last work was way 2018 in BGC. Thanks you

Hello Jared,

You may try to call BIR’s hotline to inquire about this. Their main hotline number is 8538-3200.

hi sir can i ask pumunta po ako sa rdo bohol 084 update my status and so happened na rdo 081 pala ako belong .The staff of rdo bohol 084 advice me to email rdo cebu to process my application here in bohol pero wala po sumasagot sa email. do i need to go in cebu?

Hi Madette! Did you try calling na? But normally, need mo pumunta or have someone process it in Cebu.

Hi Sir! Ask lang po if may change address and transfer of RDO, yung mga printed service invoice po ba kailangan i-surrender at magpa print ng bago to indicate the new address? Thanks po a lot. God bless and stay safe

what if i change my RDO and my former employer dont want to give his TIN# to me? what should i do? we have a bad relationship.

Hi Jeric! There is no need to get the TIN of your employer for changing your RDO. Check this article: https://www.taxumo.com/blog/how-to-transfer-rdo-form-1905/

Hi Franz, call your new RDO. In RDO 003 La Union, they accepted my request for transfer of RDO. Sila na daw mag process. from Manila yung old RDO ko tapos La Union yung new RDO. Hindi ko alam kung yun na ba yung bagong process or iba iba tlga per RDO. Kaya mas okay talaga tawag ka sa new RDO mo 🙂 good luck!

I think it depends on you RDO. For me, ako daw kelangan mag-process, after that I need to go back to their office.

mam panu po ginawa nyo?

Wow nice naman ng new RDO mo po. Here in our place is the same I should go back to Manila and request for transfer pa ng RDO huhu.

hello maam, same concern…

Pero COVID pandemic ngayon, natatakot pa ko mag fly in and out sa manila. my old RDO is manila, now im here in Cebu. so medyo hassle to do that. sana they have a way of transferring through internet.

Ung tinanong ko kanina e lbc lang daw ung form 1905 mo sa OLD RDO with picture then inform ur NEW RDO kailan darating ang form 1905 sa OLD RDO mo…

Actually, you can process your 1905 online. They allow transfer through email. You just have to attach of course your accomplished form 1905 and 2 valid IDs (preferably government-issued) and send it to your old RDO’s email address or you can also fax it to them. Although after transfer, you have to file your 1901 in person in on your new RDO. 🙂

same problem…pinaghintay ako n almost 3 months den sasabihin di nia kaya itransfer para sakin..sa caloocan ung old ko then ipatransfer ko d2 sa cotabato city need dw na ako ang magprocess sa caloocan…covid pa naman…

Hi, First time ko pong kumuha nang Tin number. Pero nakita pong registered ako sa ibang RDO. Is that possible

Gud morning po,

Sa caloocan RDO 27 po to RDO 36 paanu po ang gagawin ko kc pandemic pwedi po bang e apply sa online at anu po ang account ng BIR ang pweding gamitin

Hi sir,paano po ba mg transfer ng old RDO 112 to RDO 113 ppunta po ako ngayon sa BIR tagum to say transfer my old to new RDO galing po ako kahapon sa BIR davao punta ako tagum city to transfer how po sir?

Hi Rex, pupunta po kayo sa old RDO – doon nyo sya marerequest. Nasa article po paano. 🙂

Hi sir, pwede bang via email ang pagpatransfer ng rdo po??

Kindly give me email adress of Maam Ma.Delacruz? were I can EMAIL my 1905 Transfer from Rdo41 to Rdo15..I fax ko po sna pero ang sabe email n lng daw po…kc wala fax machine. THANK YOU…

Hi Rachelle, we don’t have that information. Also, just to be sure we’re on the same page, we are not the BIR. 🙂 It may be better to call the BIR contact center for this concern at 981-7003, 981-7020, 981-7040, or 981-7046.

Hi EJ! Is the 1905 also the same form to use to change name? Say from single to married name? Is it also required to change everything like passport, prc id, license to that new name? Thank you!

Hi Michelle! Yes, that’s the same one. 🙂

Is it required to change all other IDs as well? Thank you!

Change what in which IDs po? RDO? I don’t think your RDO will be in your other ID’s naman. 🙂

I mean if i change to my married name does it follow that i need to change my prc id as well? So that registered TIN name is same as license name? Or i can have my maiden name on my ids? Thank you!

You may have to check with the PRC po for that. 🙂 But, ideally, all your official IDs should have your updated official name.

Hi sir, pwede bang via email ang pagpatransfer ng rdo po?? Or pwedeng i fax

Hi po, ok lng ba magpalipat ng RDO from makati to cubao, pero ung employer ko sa makati pa dn. ililipat lng sa quezon city kasi may irregister lng na business. Hindi po ba affected ung employer sa makati? Thanks

Good morning. My employer is in mandaluyong as well as my rdo. I have a new business in qc. Do i need to transfer my rdo to qc? I am not resigning with my employer. I am using just one tin for my business and as employee.

Hi Erickson, I assume that you want to register your business in QC, right? If it’s a sole prop, yes, you’ll need to transfer your RDO.

Hello, Sir EJ. Pwede ba employer yung mgdadala nung form ng resigning employee sa BIR? o yung employee mismo dapat pupunta dun?

Another person can file your 1905 for you. As long as you give them special power of attorney. Most likely your employer, however, won’t be able to do that — you’ll likely have to do it yourself.

need o ba SPA di pwede authorixation letter?

what are the requirements needed for changing of RDO besides filling up form 1905? do we need to bring anything? thank you!

When I submitted my 1905, I didn’t really bring anything else. Just that! To be sure though, best to bring a government issued photo ID at least.

Oh, also bring P500 for the processing fee.🙂(edit: Randy is right, wala pong processing fee!)

Wala po bayad.

hi can you process the transfer while you’re still rendering or you’ll have to wait until you’re officially unemployed from ur prev company before you start the transfer process? thanks!

Hi Lalaine, you can start the transfer of RDO even while employed. 🙂

Sir ang tin number k is single at gusto ko po matransfer to married yng tin ko ay from quezon city pa at single gusto ko po ma transfer dito sa Masbate. Naka fill up na po ako ma process ba agad ito kasi kailangan ko na talaga ang sabi ng teller sa Masbate BIR na tawagan k number ng BIR kaya lang diko makontak hi

Po ba agad ma transfer sir pls…..help

Hi Mary Ann, if you want, we can help you with your RDO transfer. You can check out this article for more details: https://intercom.help/taxumo-inc/en/articles/2532436-how-much-for-rdo-transfer-and-what-do-i-need-to-give-to-you-to-make-it-happen

Sir/mam wat if po kung close n ung old company na pinagtrabahuan ko anu po gagawin?

Hi Maricel, if the company you worked for before closed and you moved to another company, you will have to file your income tax yourself. Only those who were with one company within the year can get substituted filing. Hope I was able to answer your concern!

Good day. I have a new employer today. I was told to transfer my tin from my old rdo to their rdo. Is it my job or is it theirs? Thanks

Yours. No one else can change that information since it’s YOUR TIN. Now some companies may have a runner who can help but, ultimately, it would be your responsibility. 🙂

Hi sir! My new HR told me that BIR 1905 is no longer required. Hence, neither I nor them need to process the change of RDO. My colleague also told me it’s in the RMC of BIR. Can you confirm? Thank you!

Sir Can I get your service? Patransfer akong RDO from Rizal to Batangas po.

what process to be done sir ? I also need to transfer my RDO now? thank you.

Hi Judy, some RDOs allow TIN transfer via email request, have you tried contacting your RDO? Take note if you will request this via email this may take a while as sometimes RDOs do not respond to emails immediately. If you are in a hurry, you may go to your RDO and submit a filled-out Form 1905 with the business address you will use together with a photocopy of your proof of billing and ID.

Hi, I need to transfer my RDO as well, Do i need to go to the NEW RDO after requesting on my old one, or i just need to go to my old RDO and request it? Thank you

If you only need to transfer your TIN no need to go to the new RDO after requesting. But if you need to register as a self-employed individual, yes you still need to go.

Good morning sir, ask ko lang kc yung sa anak ko is nag end of contract na po sya last year pa.. At nung kkunin nya na back pay nya, need daw po ng tin id. (Since ung employer nya po ang nag apply ng tin pero wla po narelease na i.d sa kanya) then nung nagpunta nman po sya ng BIR dun din po nakita na mali ung last name nya. So nag file nman po sya ng 1905 (change in trade name) at nung kkuha na po ulit ng i.d sabi ng BIR na need nya magtransfer ng rdo from 039 to rdo 036. At kailangan nya pa mag fax, contact sa old rdo. At bnigyan nnman sya ng form 1905 (change in registered address). Paano po ba talaga ang gagawin? Parang pinagpapasahan na kasi eh..

Hi Irene, your child’s employer is most likely in RDO 039. So when they registered for your daughter/son, they likely registered in their own RDO. Now that your child is dealing directly with the BIR and updating her records, she first has to change the RDO to HER RDO (not her company’s). In this case this is RDO 036. Once that’s done, then she can request for all the changes she needs. All of this passing people around is an unfortunately consequence of the RDO being decentralized.

If your child is registered and s/he needs to file her/his returns, s/he may want to try out Taxumo. It works NATIONWIDE, regardless of RDO so s/he can file her/his returns from anywhere. 🙂

Panu po kung nasa makati ang RDO ko tapus may bago akung work dito sa davao.. anu ang dapat gawin!

The prudent thing to do would be to change your RDO. 🙂

sir possible poh b process ng change of residence add from RDO 038 to RDO 001 through email lang poh,..d poh kc aq mkakapunta ng manila dto n poh aq nka base s ilocos,..and penge n dn poh email add kung possible. tnxs

As far as I know, hindi po eh. You may want to call up the BIR contact center to see if there’s a different option you can take: (02)9817003 or (02)9817020.

Hi! Thanks for the useful info. Ask ko lang po if same process po ito in changing the name on their system? Apparently all my BIR papers (1902, previous 1905s, 2305 and 2316) have the correct spelling of my name however when they checked my name via my TIN on their system, the spelling of my name is wrong.

Yes ma’am. It’s the same. You just have to tick & fill out the relevant fields, of course. 🙂

Ilang days po ba ang process kapag lilipat ka ng RDO?THANKS

Press release is around 1 week. But they took around 2 weeks for mine. I believe it does vary by RDO so may be good to check with them.

Hi sir, how can I request to transfer my RDO code since nka address pa yung RDO ko sa Pasay pa and now I find it hard dahil dito na ako sa Province nagtatrabaho. Hopefully matulungan niyo po ako for the email address ng Pasay BIR po. Thank you!

Hi Roman, we’re trying out a new service and we may be able to help you with that. Email us at bizreg@taxumo.com to find out more. 🙂

Ilan araw po ang process kung magtatransfer po ng rdo?

Hi Sir,

I’m currently employed but planning to start a business at the same time. After the transfer of RDO, what is the process for updating the status in the new RDO? Also, would transferring of my RDO have any effect on the filing of ITR by my current employer?

You’re basically going to register your new business with the BIR. If you’re planning to open it as a sole prop, you can check [this guide].

Hello sir! Wat if po ang old RDO q is from manila and im from cebu! Then im advised po na e fax ask q po wer can i get my new 1905 form na transfered na and at the same time may stamped na

The BIR will only provide a stamped 1905 form once they accept and process your form. If you want, we may be able to help you by filing your 1905 for you. We’re piloting a new service to help taxpayers with that. If you’re interested, email us at bizreg@taxumo.com and we can send you the details.

Hello sir , my registered rdo is 050 which is from makati and my new employer will be at rdo 083 here in cebu . What should i do sir since i cant go to makati just to process this changes . Can you help me sir for alternatives ? Thanks

Hi Jerald, we may be able to help you for that. Send us a note via the chat button in Taxumo.com and we’ll see what we can do. 🙂

Hi Sir.

I am currently employed and planning on pursuing a business at the same time. Upon checking, I need to transfer from my employer’s RDO to the RDO near my residence. If I transfer to another RDO, will there be any effect on the part of my current employer when filing my ITR? Also, what is the process when updating status to the new RDO?

There won’t be any impact. They can still file for you. However, if you need to update any information (such as new dependents), your employer can’t do that for you anymore. You’ll have to do it yourself. 🙂

Good morning po sir! Anong procedures po ba ang dapat gawin kapag magpapalipat ng RDO from RDO 38 to RDO 27 kapag OFW or Seafarer po.? Thanks po and GOD bless

You mean po kung wala yung taxpayer sa Philippines or, at least, near their RDO? You can have someone else file it on your behalf, if you wish. We’re trying out a service right now for that. Send us a note at [bizreg@taxumo.com] and we can help you with the RDO change. 🙂

Is there anyway to verify where my current rdo online?

You can try calling the BIR Customer Assistance Division at 981-7003 or 981-7020. 🙂

Hello, ask lang po when ang deadline ng filing ng 1901? Sa RDO 54A po sya trece martires cavite. Sabi ng iba nung march 31 pa. Sabi naman ng accounting on april 30? 🤔

Wala pong deadline for filing 1901. If you mean 1905 to avail of the 8%… it differs per RDO. So best to check with your RDO.

So sir kung ang rdo nasa visayas(cebu) at ipapalipat sa luzon(pangasinan) pupunta pa rin ba sa visayas para sa Old RDO??

YES!

Good day sir!

Tanong ko lang po how to change may RDO from RDO 032 to RDO 25A? Kailangan po ba na pumunta pa ako ng RDO 032? From Bulacan pa po kasi ako . Bali ipinakuha ko lang po yung tin ko and then dun po nairegister sa RDO 032. April 12, 2018 po sya nairegister. Ililipat ko po kasi yung work ko po ay sa Deped Pandi South District. Salamat sir.

Hello Mary Ann,

For RDO transfer, you need to do is to visit RDO 032 and request to be transferred to RDO 25A. Nothing to worry, it’s pretty quick just fill out the BIR 1905 form. In around 1 week, processing should be done and your TIN should now be registered in your new RDO. 🙂

Hi, ano po requirements aside 1905 sa change of rdo.. Yun mga employee ang ililipat ng rdo po..

I believe just 2 valid ID’s. And you’re all set. 🙂

My Concern is I need to transfer my Tin From RDO31 to RDO 114. it is impossible for me to go to my old RDO due to this pandemic. I visit the RDO 114 to cater my concern but they suggested to email my old RDO for their response.

my concern is they request valid ID’s and I don’t have any valid/government ID’s, what is the other alternative for that sir?

need pa ba ng id kung transfer rdo lang naman po? pede magutos?

Most of the time po, it really depends on your RDO.

Hello sir. Ask ko lang po if pwede tao ko mag process ng form ko sa paglipat ng rdo o dapat personal. Please reply. Thank you

Honestly, it depends on your RDO. We have processing partners who know how to do it but it really differs per RDO. You can call your RDO to make sure.

May bayad po ba talaga yung pagtransfer ng RDO? how much po?

I was charged P500 when I did it last year. 🙂

Hello, Ma’am/Sir. Can you help me? How to correct my middle name in TIN ID? And How much?

Nag punta po kasi ako sa BIR sabi mag babayad pa daw po ng 1 Thousand pesos sa bangko para ma correct yung name. 1 letter lang po ang mali sa name ng tin id ko. I need your help

Hi. Iam currently employed to a new company, however, parehas lang yung rdo kung saan nakaregister yung previous company ko. Ano pong process yung gagawin?

Thanks.

Should be no need to do anything in that case. 🙂

Hi, question po pwede po ba ako magpa RDO kahit hindi pa po ako nakakapag clearance sa dati kong job?

Hi Josephine, yes you can register your profession/business and get a COR from your RDO regardless of the status of your previous/current employment.

Hi sir what if yung RDO na kung saan registered ang Tin ko ay nasa cebu pa? So kailangan ko pa pumunta ng cebu para lang makapag submit ako ng form ng 1905? Kailangan ko kasi ipalipat sa bulacan Wala bang ibang way para mapalitan ko pa rin yun?

Hi Karen, yes, ganun na nga ang mangyayari. That’s a result of the BIR decentralizing their operations. 🙁 Taxumo does have processing partners who are based in Cebu who may be able to do that for you. Just send us a note via the chat button on our site or via Facebook and we’ll see if we can help you. 🙂

Hi . Sir . Nag work po kasi ako before sa manila . And lately i found out my rdo registered in cebu city rdo 081 . Ngayon po nasa pampanga napo ako . Paano ko po mapapa transfer yung rdo ko po dito sa pampanga ? And yung previous job kopo dito sa pampanga april 2019 is nag awol po ako . . Paano po gagawin ko sir?

hi good day,

bakit sobrang bagal serbisyo ng BIR mahigit two weeks na ung FORM 1905 submitted & accept sa Negross occ. , my TIN no. change address from Negross occ. to Calamba laguna hangang ngayon wala parin, nasubmit form 1905 Jan. 14, 2020 hangang ngayon wala pa feb. 3 , 2020

Hi! I am in the process of transferring my RDO. My former RDO was in Baguio and will transfer it to Mandaluyong. I was able to have someone receive Form 1905 and was stamped by BIR na. I was informed that my case was open but I was unemployed since 2015. BIR asked me to sign a Transfer Commitment Form. I am unsure if I should put my new business as my new employment? My business is still unregistered in BIR. The main reason I am transferring my RDO is to register my business.

Hello po. Yung employer ko po kasi ay may dalawang branch: Cebu and Tacloban.. Cebu po yung Head Office but they planned to make the Tacloban branch as the Head Office.. Ano po ba ang dapat naming gagawin?

Hi! Panu ko po malalaman if nachange na po ni BIR yung RDO ko, from pasig to Makati

hi po sir Ej tamong ko lng po ang lumakad p odati ng tin ko is my first job in intramuros then nakapasok nmn po ulit ako sa qc nmn and resigned again saan po ang RDO ko sa intra o sa qc sir?

Ask lang po, nag aaccept po ba m ang bir ng online request of rdo transfer? Thank you.

How to transfer po yung old RDO ko po ay 040 transfer ko sana sa RDO 057 ?

Hi Benedict! Your question is answered by the article, actually. 🙂 Unless you have a specific/particular question?

Hi Sir just wanna ask, I’m currently employed but will leave the company on the last week of October. My first day on my new employer will be on the first week of November. I was told that I need to process the transfer of RDO.

Is it fine if I already process it before my final day on my old company? Will the old company know it since I’m still their employee? It worries me because it might be illegal?

Thanks in advance 🙂

HI JR, nope, that’s not a problem. Be aware, though, that you need to move your TIN from your old employer’s RDO to YOUR HOME ADDRESS. Yup, you read that right. You do not move your TIN to the RDO of your new employment. You move it to the RDO of your home address. This was a change from RMO 37-2019 (link) issued last year.

Hello po. Clarification po dito. For example po, same situation pero “would be” government employee, would that mean from RDO 050 I need to transfer my TIN to Cavite, where I live, not in Parañaque where I am supposed to work? Thank you po sa sagot. Then sa 2305 po, sa RDO ng Cavite ko sya ipapasa?

You are right. Transfer your RDO from your previous employer’s RDO to the RDO of your residence. You can read more about it here: LINK TO RMC 37-2019

You submit the 1905 to the “source RDO” — normally the RDO of your previous employer.

Be aware: some HR, understandably, aren’t updated with respect to this rule, so sometimes you might have to educate them about this change. 🙂

Hi sir I have this situation that I emailed my old rdo and ask to transfer my rdo to a new rdo and replied that the rdo number is already transferred. Is it really transferred or I need to wait a week for my rdo to fully transfer?

Thank you in advance.

Hi Dave, to be honest this is the first time I heard them doing a transfer based off of an email. I mean I can email any RDO, given anyone’s information and ask them to move TINs, so I doubt they’ll process a request over email.

I would recommend you verify a little bit more — call your destination RDO and ask if your TIN is already there. If another independent party (in this case, the other RDO) says it’s already transferred, I guess it already is transferred. (For all I know, this could be an adaptation to the pandemic – good intent naman.)

Hi,

I am currently processing my 1905 for change in registered address within the same RDO.

I am just confused if the registered address I am going to put will be the address of my new employer, or will it be my home address (different RDO from my employer’s).

Thank you.

It’ll be your residence address na po. If it’s a different address, it’ll get transferred to the new RDO. 🙂

I’m sorry Sir, I’m still confused. I would like to clarify again Sir, if it’s okay.

1. Should the registered address match with the RDO?

2. My previous employer advised me before to change my RDO from my residence (Cavite) to their RDO(047). So I did and put my previous employer’s address as my registered address. Is this still the case now Sir? Or do I have to change my RDO again back to my residence even if my new employer’s RDO is also 047?

Hi Jelai,

1. The registered address should be in the RDO under the jurisdiction of said RDO.

2. The way the RMC is written, that seems to be the case. BUT, it may be better for you to call the RDO just to make sure. 🙂

Hi! Would you know if there’s penalty for late changing of RDO? Been too scared to go to the RDO during the pandemic so I’ve delayed the move for 6 months already…

Hi Cara, are you doing the update as an employee? If so, there should be no issue naman, just change it as soon as you can.

If you’re changing info as a professional/sole prop, as long as you’ve been up to date with your ORs and filings, then should be no problem as well. Do note that if you’re changing address, that may mean that your ORs in your old COR will need to be surrendered to the BIR and you’ll have to get new ones printed. 🙂

Hi Sir. Just to clarify, ano po mga requirements to request for transfer to new RDO? Another thing po, pwede po ba magrequest for transfer through representative? Like, father?

The requirements are in the article po. 🙂 As for the representative, you should be able to do so as long as you provide a letter of intent and a notarized special power of attorney to your representative. 🙂

Hi! May tanong po ako, I hope someone can help me… I’ve been using an incorrect tin for the past employer ko lasted 2 years and 9 mos. I dont know how it got mixed up… Its an honest mistake.. magkaiba dulo ng numbers nila… instead na 978 ung last 3 numbers eh ung nagamit ko is 097. Do I still need to correct this? nung nagpaverify kasi ako ng tin ibang tao lumabas, so they gave me my correct tin… nagulat nlng ako… Can anyone enlighten me how should I fix this? Do I still need to fix this since wala naman nako s company? or should I just start using the correct one moving forward sa new company? Please I need help… Thank you…

Hi Mari, for your new employer, make sure to provide the correct TIN that you got. As for the old one, chances are the taxes they remitted are not tagged against you. It may mean there are liabilities for you or your old employer. To be sure, it would be best to talk to one of our CPA partners via Taxumo Consult (link). They can help you in more detail.

Hello po sir same question with chicky. Transfer po sana from mandaluyong to tabuk city kalinga. Hoping for ypur asap response. 🙂

WRT the representative, you should be able to do so as long as you provide a letter of intent and a notarized special power of attorney to your representative. 🙂

Hi, what if I resigned 3 mos ago sa work ko and 3 mos din po aq walang work then I just found a new job ngayon, i know i nid to transfer my process and transfer my rdo sa old rdo ko w/c is in Ortigas, bali magkakaroon po ba ng prob/issue since wala akong work ng 3 mos at hindi nkapag hulog ng tax? Kindly pls advise. TY

Hi Renz, your case is perfectly normal. Wala pong kaso yan. 🙂

Good day po Sir,

Tanong ko lang po regarding sa processing of BIR 1905, I was told by my incoming/new employer na kung saan naka-register yung TIN, doon ka din magpa-process of transfer to another RDO.

For my case kasi po, my previous employment has its registered address in Cebu but the office and plant facility is located in NCR (specifically Malabon and Navotas, respectively).

Tanong ko lang po kung need ko pa pumunta sa existing RDO (which is in Cebu) to process the transfer of RDO to the new RDO (located in Pasig City)? Sana may other easy way po to do this lalo na po at where still in pandemic situation.

Sana po matulungan ninyo po ako sa query ko. Thanks

May I ask lang Sir may consideration po ba ngayon lasi pandemic need pa po ba talaga pumunta sa old RDO para magpatransfer sa new RDO?

Sir what if awol ako 3yrs ago then di ko sya naasikaso. Pero balak kong ipatransfer ngayon at di ko po alam yung rdo ko. Pano po ba yun?

HI Gud am/sir RICHELLE TIGAS SAMSON pede po bang magpapatransfer po ako

ng tin number sa BAYPASS ROAD. TIAONG 3015 GUIGUINTO BULACAN RDO 25B

Hi I hope merong sasagut sa tanong ko. Mag tatransfer sana ako ng RDO 42 to 82. Tatanong ko lang sana ano ba ilalagay dun sa transfer register address? yung address ng Company na patatrabahuan ko o yung adress ng RDO na paglilipatan ko?

Hi I hope merong sasagut sa tanong ko. Mag tatransfer sana ako ng RDO 42 to 82. Tatanong ko lang sana ano ba ilalagay dun sa transfer register address? yung address ng Company na patatrabahuan ko o yung adress ng RDO na paglilipatan ko? sana masagot thankyou

How many copies of Form 1905 do they require? Is a photocopy of an ID required?

I am changing job from employer A to employer B. After rendering 30 days notice, I am currently on Terminal leave with Employer A. I have also joined employer B while on Terminal leave with employer A. Questions:

1) I will get final pay from employer A after 1 month. In the meantime, I am already getting pay from employer B. For 2 weeks, I will get salary from both employer A and B. When shall I transfer my RDO? If RDO is changed before receiving final pay from employer A, will that be a problem? OR, shall I wait until I get final pay from employer A before transferring RDO?

2) I read online that many people have changed RDO by email. Can I send email to old RDO to request transfer?

3) If email is acceptable, what documents to attach?

My TIN is registered with old employer’s RDO. I have changed job to new employer. I need to transfer TIN to my home address RDO. Is there any deadline to transfer RDO within a certain time period after starting new job? What if I transfer to new RDO after 2 months of starting new job? Is that ok?

Hello po

I am currently employed po in Makati, thus, my TIN is registered in RDO 47. But I started my part time job as a professional which requires me to apply for Cert of Registration. My place of business for my part time job/business is my home address in Manila. Do I have to transfer my TIN to the RDO in Manila? What would be the impact po considering that I’m still employed in corporate and the Company is the one filing for our taxes on our behalf. Thanks in advance!

Hello. Current employer ko and address ko is both 045 (Marikina). Ngayon po lilipat ako ng work sa Eastwood, QC and lumipat rin ako ng residence address sa Antipolo. Ang sabi po sa tinawagan ko sa BIR, same RDO code pa rin naman ang current residence address ko (Antipolo) at previous address (Marikina). Need ko pa po ba magfill up nitong 1905 for at ipasa sa BIR?

Sir my current company require me to transfer mg rdo, sa pag fill up ng 1905 kaninong address po ang ilalagay ko? Sa akin or sa company ko po?

Sir my current company require me to transfer mg rdo, sa pag fill up ng 1905 kaninong address po ang ilalagay ko? Sa akin or sa company ko po? Sa lipa pa po kasi ang old rdo ko po. Salamat po.

Good day Sir. Inquire lang din po. Kasi yung tin number RDO mng wife ko is in Iloilo RDO 072 and we want it to transfer to RDO 042 and sabay na for change status. Kaso NASA UAE po kami and di namin sya maasikaso. May pwede po kaya makatulog samin.

Hi! I would like to ask the email address for RDO 126? I’m asked to transfer my TIN from RDO 126 to my new address but apparently, it doesn’t appear on the list in the website.

Hello readers! Just email your old RDOs first to save all the hassle. For so long I was thinking about how I can go to my old RDO if there are restrictions because of COVID! I thought I would have to go through an entire ordeal, but it was actually a quick process! I emailed my old RDO in Camarines Norte that I wanted to transfer to my new RDO in Binan, Laguna. They replied the next working day informing me that it is done. Just send them an email with the form 1905 and a valid ID attached. 🙂

Hello Maam! This is actually my problem. My future employer(Gensan) wanted to transfer my rdo address from 031(Manila) to 110(Gensan). My problem is, would rdo 031 accepts email request for change of rdo address? Given this time of pandemic, its really impossible to go to manila from nindanao just for this. Is your email scanned or pdf filled? Thanks!

Hello. How were you able to get the processes 1905 form from BIR?

this is the conformation i needed. thank you so much

Hi. Saan ako magpprocess ng 1905 if nalipat ako ng RDO, from RDO 39 to 28? Nalipat kasi yung barangay where I live sa RDO 28. Thank you 🙂

Bat ganun po Sir almost 1 year and a half na akong nag request ng transfer of RDO From RDO 50 to RDO 99 until ngayon wala paring action. Nag verify ako last week only to find out wala parin. Twice na ako nagpaLBC but same parin wala. Tanong ko lng may tao ba talaga ang rdo 50? Or sadyang deadma lng cla.

Hi sir! What if it’s the other way around? I want to retain the business TIN but at the same time I am employed. What should be the process? Do I still need the form 1905 to transfer my RDO to my employer’s office? Thanks.

I am planning to send an email first to my old RDO. I am now working as temporary work from home. My new office is in Makati, I reside here in Pasig and my current employer is located in Eastwood, Quezon City. How would I know the RDO of Eastwood, Quezon City? Eastwood is not included in the RDO list. So that I can also get the right email address. Thanks and more power!

Hi, saan ko po kaya pwedeng makita RDO, address and email address ng Concentrix, Eastwood QC? Previous employer ko sila. Nasa Makati na ko ngayon but I am residing here in Pasig. Thanks in advance po!

Gusto ko lng po malaman.. king ang current RDO ko ay s binondo manila at mag start n po ko mag work s bagong employer ko which is located in Mandaluyong kailangan ko pa ba mag xfer?

hello, nalilito ako sa RDO po..please help me clear it out.. SA las pinas ako nakatira dati then hired sa pasay, so ung rdo ko from las pinas to pasay ngtransfer ako.. then ngaun po ulit nahired ako sa Quezon City. Sabi patransfer ako rdo accdg sa address ko which is muntinlupa na ko nakatira now..Tama po ba from pasary rdo to muntinlupa rdo gagawin ko? or pasay rdo to quezon city rdo? please help me with this…thank u”

good pm sir paano po malalaman if na transfer na talaga ang RDO ko magpaprocess sana ako nga tax exemption

Hi sir tanong ko lang po,

Gusto ko sanang ipabago yung name ko s tin. tatanggalin ko po yung surname. bale yung magiging surname ko is yung kay nanay, .

Nahired ako last year s montalban rusi, kaya yung rdo ng employer ko is dumaguete, need ko pa bang ibatransfer rdo ko dto s navotas ? w/c is dto ako nakapagwork ulit. or no need to transfer yung rdo kasi change name lang po ipapaupdate ko.

Salamat

sir pano po kung dating OFW tpos nagbalik work po dito sa pinas??

Good Day!

please advise po pano yung process ngayon ng Change of RDO code from RD 40 to RD 56 may online transaction na po ba? thank you!

Hi

Can I have someone submit the form 1905 to my old RDO? Do I need to issue an SPA for that person? Thanks

Hi! I want to ask if I will need to present my BIR 1905 to my new RDO? Kasi inasikaso na siya ng accountant namin sa OLD RDO ko and then she sent me a copy of BIRD 1905. I don’t know if I should still submit the form to my new RDO?

Hello Sir, How will I know if my RDO was already transferred po? Thank you!

Hello,

I hope you can help me clarify about this po:

Ung previous employer ko po within this year of 2021 eh binigyan na ako ng 2316 pero ung rdo code po is iba na compared sa rdo code na nklagay sa Itr ko galing sa knla ng year 2020. Ganun po ba tlga un, possible na mag change nlng ng basta si rdo code nla? Ung ITR ko ng 2020 rdo 081 pero based ung company sa pasay manila tpos ung 2316 ko rdo 44 na which is Taguig branch I think.

Thank you po.

Hi Sir, good morning. Ask ko lang po yung sa case ng father ko. namatay po kasi sya last April and nagpoprocess po ako ng tax clearance nya sa Valenzuela. nung nasa approval na po, sabi may business daw sya sa Paranaque. Wala pong nakakaalam sa family namin. hinihingian po kami ng affidavit na wala daw kaming receipt of books nung business para matransfer yung RDO. Ano po twag dun sa affidavit na yun? pwede po kaya ako na lang gumawa tapos panotaryo ko na lang?

Thank you po. Stay safe and healthy.

Hi, if I apply for change of registration address sa old RDO ko and as you’ve said, I will be given a 1905 received copy to submit to my new RDO, do i have to wait for the 10 days processing period before I submit my 1905 receiving copy to my new RDO? Thank you

If your old RDO will tell you to check after 10 days then you should follow their instructions. The stamped 1905 is only presented to the new RDO if you will register as a self-employed individual. 🙂

Good day, just an inquiry.

I’m a professional that recently registered with BIR (July 2021).

I’m now moving to a new residence but within the same area/RDO (old & new address is still in Malate).

Am I required to submit form 1905 to BIR? If so, do I need to submit another form 1906 to print receipts with my address, or can I use my current receipt with the old address?

Thank you & God bless!

Hi Julius, regardless if it is the same RDO but you changed business address you need to update your COR details together with the ATP and your receipts. 🙂

Sir ,halimbawa po sa Las Pinas po registered nya at di naman po sya lumipat ng residency, nagwork lang sya sa Paranaque then lumipat sya ng work dito sa Las Pinas, need pa nya magprocess ng BIR1905?

Hi Penelope, no need na posince same RDO lang. 🙂

Can someone else (like my spouse) file the change RDO for me? I am currently not in Manila but would need to file change in RDO for a new job. I already have the BIR Form 1905. What other papers are required so that my husband could file it at my old RDO on my behalf? Thanks!

Yes he can. Just provide a notarized Special Power of Attorney.

Hi Ma’am/sir,

I need your help to transfer my RDO from RDO 44 to RDO 90. Pls send me an email at jozefeufer@gmail.com

Thanks & regards.

Hi Jozef! Are you aware that you can transfer your TIN via email? There are RDO’s who allow such transaction done online. Just send them an email at rdo_44css@bir.gov.ph and write your intention to have your TIN transferred.

Hi good pm. Magtatanong lang po. Pwd Po bang ang kapatid q ung papupuntahin q sa Cubao pra mag process ng 1905 na form ksi hindi aq pwd dahil may 6 months baby aq. Magpa change po aq ng RDO code from Cubao to Negros Oriental? Maaari po ba iyon?

Yes pwede po. Make sure lang na may dala syang SPA and copy of your valid IDs.

Hi,Ask ko lang po since i need to transfer my RDO but confuse po ako kasi upon checking my form 1902 I can see two RDO code the first one is 043 which is indicated on the first part of the form 1902 and the second RDO code is 126 which is indicated sa employer information. I dont know which one to follow.

Do you also offer assisstance in transferring RDO since I am unable to travel and how much it cost. I plan to transfer to RDO 055.

Hi Ria, RDO Code 043 is where your TIN is at while the RDO code 126 is where your employer is registered. To answer your question about TIN transfer yes we may assist you. Kindly send us a message at customercare@taxumo.com to provide further assistance. Thank you!

Hello, I have a question balak ko po sanang kumuha ng TIN ID pero yung nag process is yung prev employer ko Bali ang alam ko lang is yung tin number at since nag resigned na ako sa prev employer ko possible po na yung RDO CODE location ng tin ko is sa RDO din ng prev company ko. Pwede ko po ba kunin yung TIN ID sa pinagregisteran ng prev company ko, tsaka na lang ako magtransfer sa local RDO na malapit sa tirahan ko?

Hi Rochelle, yes pwede mo naman gawin yun. Punta ka lang sa RDO at magpagawa ng TIN ID. 🙂

Hello,

What are the requirements of updating civil status/changing from maiden name to married name? I am currently put out of the country and I’m going to ask my sister to update it to BIR for me.

1. BIR FORM 1905 (signed by me or my sister?) How many copies?

2. Authorization Letter with my signature and a photocopy of my id (both maiden and married)

3. Photocopy of my PSA marriage certificate

Is there any fee to be paid?

I appreciate your reply.

Hello,

What are the requirements of updating civil status/changing from maiden name to married name? I am currently out of the country and I’m going to ask my sister to update it to BIR for me.

1. BIR FORM 1905 (signed by me or my sister?) How many copies?

2. Authorization Letter with my signature and a photocopy of my id (both maiden and married)

3. Photocopy of my PSA marriage certificate

Is there any fee to be paid?

I appreciate your reply.

Hi!

For the BIR Form 1905, this may be signed by your sister. With regards to the Authorization letter, some RDOs would require it originally signed and of course notarized.

Yes include a photocopy of your ID and your marriage certificate>

There is no fee for the update of your name with BIR. 🙂

Hello! Magtratransfer po sana ako ng RDO, recently hired sa national government, sa form 1905 yung part po na maglalagay ng address, kaninong address po yung ilalagay ko, sa government employer ko po or home address ko po? Thank you

Ideally you need to transfer your TIN to the RDO within your residential address. You may also check with your employer. 🙂

Hi, what’s the rule now for RDO, should you follow the RDO of your office address or your place of residence?

my last employment was 2018 in Makati so my rdo is 050. i am recently hired and will be working in Taguig but my place of residence is in Marikina. Should I transfer my RDO to taguig (044) or Marikina (045)?

Hello Nicole,

Your RDO should actually be the place of your residence. You may refer to Revenue Memorandum Order No. 37-2019 by BIR 😊

Hello, sana po masagot niyo.

Alam niyo po ba kung anong sinusundan na RDO pag employed? RDO ng office ng work or RDO po ng home address? Salamat po

Hello Kamille,

Your RDO should actually be the place of your residence. You may refer to Revenue Memorandum Order No. 37-2019 by BIR 😊

Just to clarify, for transfer of RDO, I just need to bring Form 1905 plus a valid ID? Thanks

Yes, though some may ask for proof of billing to the address where you will transfer your TIN. 🙂

Hi! My personal TIN is applied in the RDO (say RDO-1) of my home address and my first job. However, I’ve been employed for 15 years in a company belonging to a different RDO (say RDO-2). Now, I need to apply for a COR, where do I apply for?

My 2316 po, which is filed by my last employer, indicates RDO-2. Now I need a COR, can I apply in RDO-2 instead of RDO-1?

Hi Freed, ideally if you will register with BIR as a self-employed individual you need to register where you currently reside. 🙂

Hello Fred,

Kindly prepare the following requirements:

Form 1905 (3 copies)

Proof of Billing

Special Power of Attorney SPA (3 original copies)

Authorization Letter

Photocopy of 2 Valid IDs with 3 specimen signature

Hello Fred,

You should transfer your RDO first to your place for Residence. After you have processed this, you may now proceed with your registration with BIR and acquire your Certificate of Registration or form 2303 🙂

hi po. need help. san po ang address ng RDO 126? i have worked in a BPO company for 15 years and recently resigned. will have new work this february and they asked me to transfer my TIN to new RDO kung san city ako nakatira currently. how to find out the location of RDO 126? or pwede na ko rekta punta sa RDO ng Imus Cavite? and process the request from there? Thanks po sa sasagot.

Hi! As per checking online this is RDO 126’s address: Rm. 211-A, BIR National Office Bldg., Agham Road, Diliman, Quezon City, Metro Manila You need to process the TIN transfer from this RDO. 🙂

Hi po, I live in Las Pinas but my work is in Bacoor. I am also a real estate agent, can I transfer my RDO in Las Pinas with out leaving my current job in BAcoor?

Hi! Yes you may transfer your TIN to your current address. Do inform your employer about the transfer so that they may update their records. 🙂

Hello SIR EJ! Sana masagot po yung tanong ko.

Scenario:

Way back 2016 inapply po ako ng employer ng TIN. Then this 2022 i’m applying na for JOB ORDER. Nag verify po ako ng RDO CODE ko which is 052, Nung nalaman ko po yung RDO CODE ko kinumpleto ko po yung mga requirements including payments already paid na. Pag pasok ko po sa BIR-052 hindi daw po ako naka registered dun eh naka pag bayad na po ako, tapos po pinapalipat ako sa RDO 029 kasi dun daw ako residente, ang question ko po is sino po mag rereceive ng payment ko (mag tatatak ng received sa form 0605 bukod sa banko kung san ako ng bayad) yung OLD RDO ko na 052 or kung san ako pinapa transfer sa 029 , my sense pa din po ba yung binayad ko kahit na sa OLD RDO ko sya bayad through online bank po Or else mababalewala yung payment ko?

Sana po masagot yung question ko. SIR EJ Thankyouuu!

Hi! naipakita niyo po ba sa kanila ang ibinayad ninyo na registration fee? Meron po ba kayo proof of payment, Form 0605 and the BIR Form 1901 to prove na na-process mo na ang registration mo sa BIR nuon?

Hello sana po matulungan nyo po ako.

Nag verify po ako ng RDO CODE ko which is 052, Nung nalaman ko po yung RDO CODE ko kinumpleto ko po yung mga requirements including payments already paid na. Pag pasok ko po sa 052 hindi daw po ako naka registered pinapalipat ako sa RDO 029 kasi dun daw ako residente, ang question ko po is sino po mag rereceive ng payment ko (mag tatatak ng received sa form 0605) yung OLD RDO ko na 052 or kung san ako pinapa transfer sa 029 , my sense pa din po ba yung binayad ko kahit na sa OLD RDO ko sya nalagay? Or else mababalewala yung payment ko?

Sana po masagot yung question ko. Thankyouuu!

Hello,

Hopefully you can send us an email regarding your concern so we can further assist you. You may send it to customercare@taxumo.com/

Thank you!

Hi po,

I just resigned this December from my employer, now I’m hoping to be a full time freelancer. Okay lang po ba na mag pa register na ako as a freelancer kahit na wala pa akong client? And yung RDO ko po is same area pa din kung saan ako nag work, is it mandatory to change pa din since I will be a freelancer na?

Salamat po in advance 😊

Hi Tatiana, yes you may start processing your BIR registration as early as now even if you do not have clients yet. 🙂 We can share with you an infographic guide on how to register with BIR. You may check it here: https://www.taxumo.com/business-registration/ 🙂

Hello sir. May i ask po if legit po ba yung TIN verifier ni BIR? Im planning to change my RDO po kc from 049 into 032 and according po kay TIN verifier ni BIR is my TIN number was valid and registered under 049 po. Sana po masagot ito. Salamat po 🙂

Hello! Of course it is legitimate 🙂 If you’re in doubt, you may actually coordinate with your RDO directly. You may check for your RDO’s contact details here:

https://www.bir.gov.ph/index.php/contact-us/directory/regional-district-offices.html

hello po ask ko lng sana if need ko pa ba mgtransfer ng RDO if ngrerent lang ako ng apartment. Nsa las pinas po kase RDO ko and ngrerent lng ako sa pasig dahil sa pasig ang work ko. Thank you

Hello Lou,

Your RDO should actually be the place of your residence. You may refer to Revenue Memorandum Order No. 37-2019 by BIR 😊

Good day, I’m a self-employed physician. I don’t have my own clinic and I’m being “employed” in a clinic in the hospital with a fixed salary. I receive 2307s from my “employer”.

My question is, if i will be transferring residence, is 1905 all that i have to submit? How will my current COR (from old RDO) be converted to show my new residence? Is this automatic? How about my receipts (showing my old address)? Thank you

Hello Ivan,

Your RDO should actually be the place of your residence. You may refer to Revenue Memorandum Order No. 37-2019 by BIR 😊

Some RDOs allow transfer of TIN via email request. Though if you do this process it may take a while before for the RDO respond to you so it is better done personally if you are in a hurry.

If you wish to send an email request for RDO transfer, you may check for your RDO’s contact details here:

https://www.bir.gov.ph/index.php/contact-us/directory/regional-district-offices.html

If you can not do it, you may ask someone to do it for you, or if you wish to avail of our services, we can assist you also.

If interested to avail services and see the rate, kindly fill out the form so we can assist you better.

https://www.cognitoforms.com/Taxumo/BusinessRegistrationForm

Our team will send you an email referral once we receive your response.

Thank you and have a great day! 😊

I’m an individual, self-employed, physician (Professional). I receive 2307s from my “employer”, and I’m receiving a fixed salary. I do not have my own clinic, hence my “business address” is my residence address. I currently have CORs ATPs etc. in my current RDO. I currently live in Manila (current RDO) and plan to move to Pasig (planned new RDO).

My question, is form 1905 all that i need to submit to transfer RDO? What will happen to my current COR/ATPs? How will it “convert” to the new RDO?

Clarifications would be much appreciated. Thank you;

I’m an individual, self-employed, physician (Professional). I receive 2307s from my “employer”, and I’m receiving a fixed salary. I do not have my own clinic, hence my “business address” is my residence address. I currently have CORs ATPs etc. in my current RDO. I currently live in Manila (current RDO) and plan to move to Pasig (planned new RDO).

My question, is form 1905 all that i need to submit to transfer RDO? What will happen to my current COR/ATPs? How will it “convert” to the new RDO?

Clarifications would be much appreciated. Thank you!

Good day sana may makatulong Yung employer ko po kasi ay may dalawang branch: LAGUNA and GENSAN. LAGUNA po yung Head Office but they planned to make the GENSAN branch as the Head Office.. Ano po ba ang dapat naming gagawin?

Hi! I just resigned from my job and I am now a full-time Youtuber. How do I go about the tax registration being a former employee and now a self-employed individual? I also earn from affiliate commissions but di naman kalakihan around 1k lang yata every 3 months but I am still earning so, do I need to file a separate thing for this? Pls enlighten me. Thank you

Hello Marie,

First of all you have to be registered with BIR as a non licensed professional/freelancer and acquire the form 2303 or Certificate of Registration. Let me share with you an article written by our COO, Ginger Arboleda. This article will answer freelancers’ frequently asked questions. https://mommyginger.com/freelancers-questions-taxation-answered.html. You may also check and download the guide on how to register as a professional or non-licensed professional from this page: https://www.taxumo.com/business-registration/

If you need more help, you may send us a message via customercare@taxumo.com. Thank you!

Hi,

Question about 1905 Part I – 2 (rdo code) so in there po ung old ang ilalagay tama po ba? Also, yung highlighted part lang po ba ang sasagutan (part 1, 7, and declaration)? Sorry for my question, first time to do this po.

Thank you Taxumo for your efficient guide on how to transfer my OLD RDO to NEW RDO. I just filled out the form 1905just like you explained above and emailed it directly to my old RDO together with my 2 valid ID (Passport and UMID) and I was happy for their quick response, I think it’s just within 2hrs of timeframe waiting and the transfer was successful.

You’re welcome, Zhel! Thank you also for your update and may you have a great week ahead!

My TIN was originally registered (2005) in Makati City when I landed my first job. Recently (2023), I registered my business in Pasay City (where I work also). I did not fill up any “transfer to new RDO” data. I just filled the form up with the current address I have and successfully registered my business. That same day, I got my COR and NIRI. I already have my books of accounts stamped the next day. I did not submit anything to my old RDO.

Hello Romz,

Thank you for sharing your BIR registration journey with us! 🙂

Hello po! I’m currently residing in Quezon City but my previous employer registered my RDO in San Juan City (042) should I go to BIR San Juan Office? or to Any BIR near me?

Hello Anna,

Good day!

Revenue Memorandum Order No. 37-2019 by BIR, Your RDO should actually be the place of your residence. If magpapa transfer po kayo, you need to process it from your CURRENT RDO to your NEW RDO.

Some RDOs allow transfer of TIN via email request. Though if you do this process it may take a while before for the RDO respond to you so it is better done personally if you are in a hurry.

If you wish to send an email request for RDO transfer, you may check for your RDO’s contact details here: https://www.bir.gov.ph/index.php/contact-us/directory/regional-district-offices.html

Hello!

I just want to ask since kumuha po akong Tax Identificatiin number ko thru ORUS and under 1o04 (e.o 98) since di pa nman ako employed nun. but now na rmployed na ako need pala 1902 dapat na form. As is na po ba yun? or nay need pa dapat na gawin??

Thank you!

Hi Love,

Good day!

Okay na po yung nakuha ninyong TIN sa ORUS. Please note that we are only allowed to have 1 TIN information per taxpayer po. 🙂

Hello!

I just want to ask since kumuha po akong Tax Identificatiin number ko thru ORUS and under 1o04 (e.o 98) since di pa nman ako employed nun. but now na rmployed na ako need pala 1902 dapat na form. As is na po ba yun? or nay need pa dapat na gawin??

Thank you!

Hi Love,

Good day!

Okay na po yung nakuha ninyong TIN sa ORUS. Please note that we are only allowed to have 1 TIN information per taxpayer po. 🙂

Pingback: The Essential Guide on How to Get TIN Number for Employees | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: Your Guide to Navigating BIR RDO for Tax Compliance | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: How to Register Your Medical Practice With the BIR | Taxumo

Hi, can I build an office different from my RDO? Example current RDO is Cebu. But my office is in Metro Manila.

Do i need to transfer my RDO? Thanks

Hello Rona,

If you’re a registered Professional, your RDO should be in the place of your current residence. 🙂

Hello po! Asking for help. I’m currently in the process of getting a BIR TIN for my pre-employment requirements. However, while creating my ORUS account, I made a mistake by selecting the wrong taxpayer type, choosing ONETFC instead of EO98FC. I haven’t completed my registration yet and don’t have a BIR TIN.

Hello Tal,

For TIN application, this should be processed through your RDO directly. 🙂

Can I ask someone to transact the transfer of RDO to my relative? What documents she will be needing to transact my RDO transfer?

Hello Jona,

Sure. You can avail this service via this link:

https://marketplace.taxumo.com/products/rdotransfer

Thanks!

After transferring to another RDO, can you still use your old manual book of accounts or need to register new manual books of accounts?

Hi Aj,

If you moved to a new RDO, you need to bring your manual books of accounts to that new RDO so they can stamp or register them again—even if there are still blank pages left. This is important so your books will be officially recognized under your new RDO. It’s best to visit or call your new RDO directly, as procedures can slightly vary depending on the office. 🙂

After transferring to another RDO (as Professional), can you still use your old manual book of accounts or need to register new manual books of accounts? Thanks!

Good day po!

How to do Transfer BIR RDO from previous/old RDO to place of residence for Pre-employment po? Salamat po in advance. 😊

You can seek out help from any of Taxumo’s partners here: https://marketplace.taxumo.com/products/rdotransfer?_pos=1&_sid=bd811b4b6&_ss=r

Good day po!

Pano po kapag RDO 116? located po sa General Trias Cavite Yung past company then need for transfer from previous/old RDO to place of residence para sa Pre-employment. Pwede padin po ba online or walk in? Thank you po!

Hi Vincent! Yes, you’ll need to transfer sa place of residence na. Pupunta ka ng RDO. As of now, wala pagn online transfer of RDO.