When you run a business in the Philippines, one of the important requirements from the Bureau of Internal Revenue (BIR) is to maintain Books of Accounts. These are the official records of your transactions, sales, purchases, expenses, and other financial activities. Books of Accounts typically include a General Ledger, General Journal, Cash Receipt, Cash Disbursement, Sales Journal, and Purchase Journal (last two are required for VAT Registered individuals and entities).

All taxpayers, whether individuals or corporations, are required to keep these books updated for the entire duration of their business operations. The law in the Philippines requires us to write on our BIR stamped books of accounts. But, if you want to make books of accounts reporting easier, you can apply for Loose Leaf accreditation (your transactions will be printed rather than written). And with this decision to go digital, you can use Taxumo’s Books of Accounts as your official records. You will use your extracted report from Taxumo, submit all required information, etc. to secure BIR approval to use a loose-leaf format.

Applying for PTU Loose-Leaf Books of Accounts

To use Taxumo’s reports as your official books, you need to apply for a Permit to Use (PTU) loose-leaf books. This can be done manually or through ORUS.

1. Manual Process

- Go to your assigned Revenue District Office (RDO).

- File an Application for Permit to Use Loose-Leaf Books of Accounts.

- Submit the following:

- BIR Form 1900 (Application for Authority to Use Computerized Accounting System or Loose-Leaf Books of Accounts)

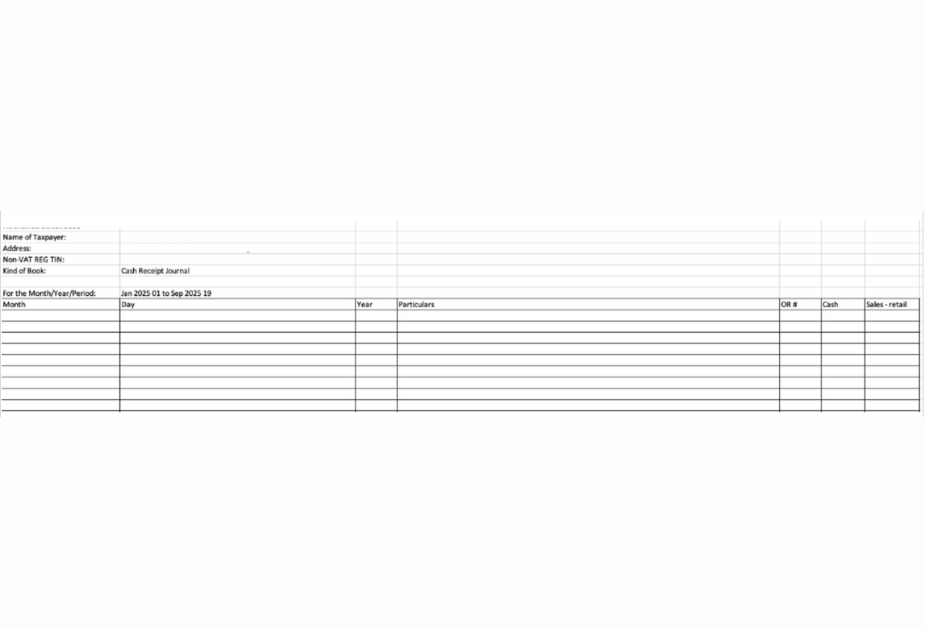

- Sample format of your loose-leaf reports (download the blank template from Taxumo)

- Other standard requirements (valid IDs, Certificate of Registration, etc.), Consult with one of our CPA partners to clarify on the requirements and process. Consult here: https://www.taxumo.com/taxumo-consult/

- Wait for approval of your PTU.

* Check with your assigned RDO if they can register your permission to use loose-leaf books of accounts.

2. ORUS Registration of Loose Leaf

- Log in to your ORUS account.

- File your Application for Authority to Use Loose-Leaf Books of Accounts online.

- Upload the following:

- The sample format of the loose-leaf reports (from Taxumo)

- Other supporting documents as required:

For Individuals (if a representative is filing for you):

– Special Power of Attorney (SPA)

– A clear, valid government-issued ID of both the taxpayer and the authorized representative.

For Corporations/Non-Individuals (if a representative is filing for you):

– Board Resolution or Secretary’s Certificate

– A valid government-issued ID of one of the company’s signatories and the authorized representative.

- After submitting, print the QR code from ORUS as proof of your online application. It’s also recommended to print your loose-leaf format in case the RDO requests a physical copy for review or presentation.

Yearly Submission of Loose-Leaf Books of Accounts

Once approved for loose-leaf books, you must submit printed and bound copies within 15 days after the end of the taxable year or within 15 days from the closure of your business, whichever comes first. Submission can be done either manually or through ORUS.

1. Manual Submission

- Log in to your Taxumo account.

- Download your Books of Accounts report covering the taxable year.

- Print and have the reports hardbound according to BIR standards. Consult with one of our CPA partners to clarify what details are needed for each of the books of accounts. Consult here: https://www.taxumo.com/taxumo-consult/

- Submit the bound books to your RDO before the January 15 deadline.

2. Submission via ORUS

- Log in to your ORUS account.

2. From your Taxumo account, download your Books of Accounts report for the taxable year.

3. Upload the required report in ORUS.

4. Confirm submission and make sure it is completed before January 15.

5. Keep a copy of the acknowledgement from ORUS for your records.

How Taxumo is Used in This Process

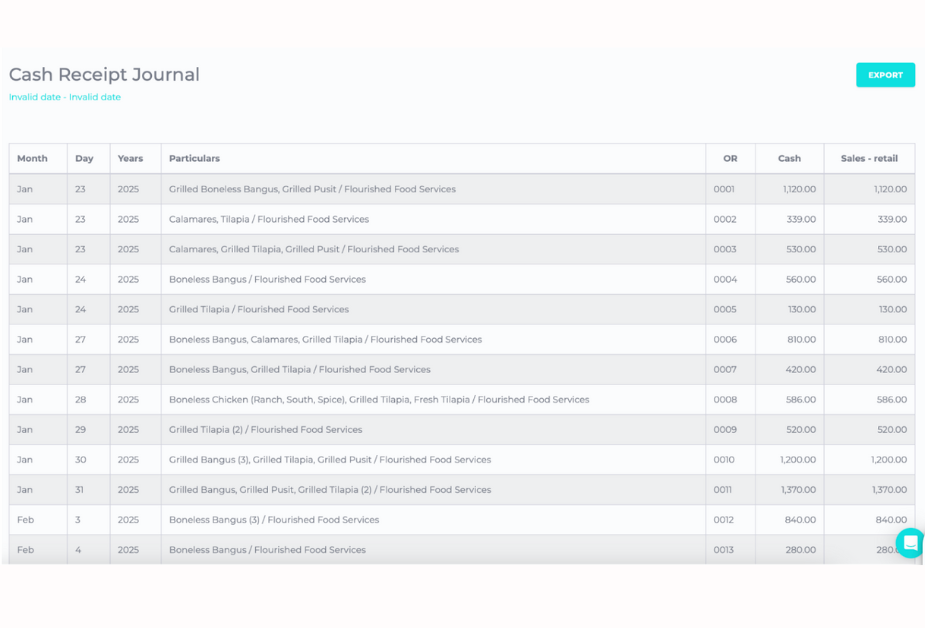

- Templates for Registration: Download the books of account report from Taxumo for each type of book that you’d like to apply for. Once downloaded as excel, submit the report with only the field names shown. This will be the blank report format you can submit as part of your PTU Loose Leaf Books application.

- Easy Report Generation: With just a few clicks, you can generate your annual Books of Accounts report, formatted according to BIR standards.

- Supports Both Manual and ORUS Submissions: Whether you’re submitting manually at the RDO or uploading through ORUS, Taxumo makes it simple to download the right reports.

- Keeps You Compliant: By maintaining accurate and updated Books of Accounts through Taxumo, you avoid the hassle of manual entries and reduce the risk of penalties.