Remember that trademark scene from Jurassic Park, the one with the glass of water moving with the vibrations because something big is coming? Then better hold on to your glasses of water for this update!

Well it is not that big, nor dangerous. More Barney than Jurassic Park, get it?

In the business landscape of the Philippines, adhering to BIR rules on receipts is paramount. It’s akin to following a well-marked trail through a dense jungle – necessary for smooth operations and compliance. Just like in Jurassic Park, change is inevitable, and a shift from Official Receipts to Invoices is on the horizon.

So, what exactly do these BIR rules on receipts entail? Let’s break it down:

The BIR defines an “Invoice” as a written account of goods or services sold to customers. This includes various types like Sales Invoice, Commercial Invoice, and more.

“Invoice – it is a written account evidencing the sale of goods and/or services issued to customers in the ordinary course of trade or business. This includes Sales Invoice, Commercial Invoice, Cash Invoice, Charge/Credit Invoice, Service Invoice, or Miscellaneous Invoice. It is also referred to as a “principal invoice” and is categorized as follows:

1.1 VAT Invoice- it is a written account evidencing the sale of goods, properties, services and/or leasing of properties subject to VAT issued to customers or buyers in the ordinary course of trade or business, whether cash sales or on account (credit) or charge sales. It shall be the basis of the output tax liability of the seller and the input tax claim of the buyer or purchaser.1.2 Non-VAT Invoice – it is a written account evidencing the sale of goods, properties, services and/or leasing of properties not subject to VAT issued to customers or buyers in the ordinary course of trade or business, whether cash sales or on account (credit) or charge sales. It shall be the basis of the Percentage Tax liability of the seller, if applicable.

Invoice may also serve as a written admission or acknowledgement of the fact that money has been paid and received for the payment of goods or services.”

Now, let’s address the burning question: who needs to issue invoices? The answer is clear-cut: any business operating in the Philippines.

Here are the key guidelines outlined in BIR’s Revenue Regulations (RR) No.7 2024:

- Businesses subject to internal revenue tax must issue registered invoices for sales or services valued at P500 or more. This threshold is adjusted every three years based on inflation.

- Sellers must issue invoices upon buyer’s request, regardless of transaction amount. Even if individual sales are below P500, if total daily sales reach P500, one invoice for the total amount can be issued. VAT-registered businesses must issue invoices regardless of transaction amount.

- The word “Invoice” must be clearly printed on the document, with options for indicating cash or charge sales. Official Receipts are no longer mandatory but can be issued optionally.

Understanding the BIR rules on receipts is crucial, but equally important is knowing what information to include in an invoice:

- Seller’s registered name, TIN, and business address.

- Statement of VAT registration status.

- Clearly labeled as an “Invoice.”

- Date of transaction.

- Space for buyer’s details (not mandatory for Business-to-Consumer transactions).

- Prominent serial number.

- Quantity, unit cost, and description of goods or services.

- Total sale amount, with VAT shown separately.

- Breakdown of sales if applicable.

- Additional information for specific transactions.

- Guidelines for manual and system-generated invoices.

But what about those unused Official Receipts collecting dust? Here’s what you can do:

- Businesses can continue using their remaining Official Receipts as supplementary documents until they’re used up. These receipts must be stamped with “THIS DOCUMENT IS NOT VALID FOR CLAIM OF INPUT TAX.” upon the regulation’s effective date.

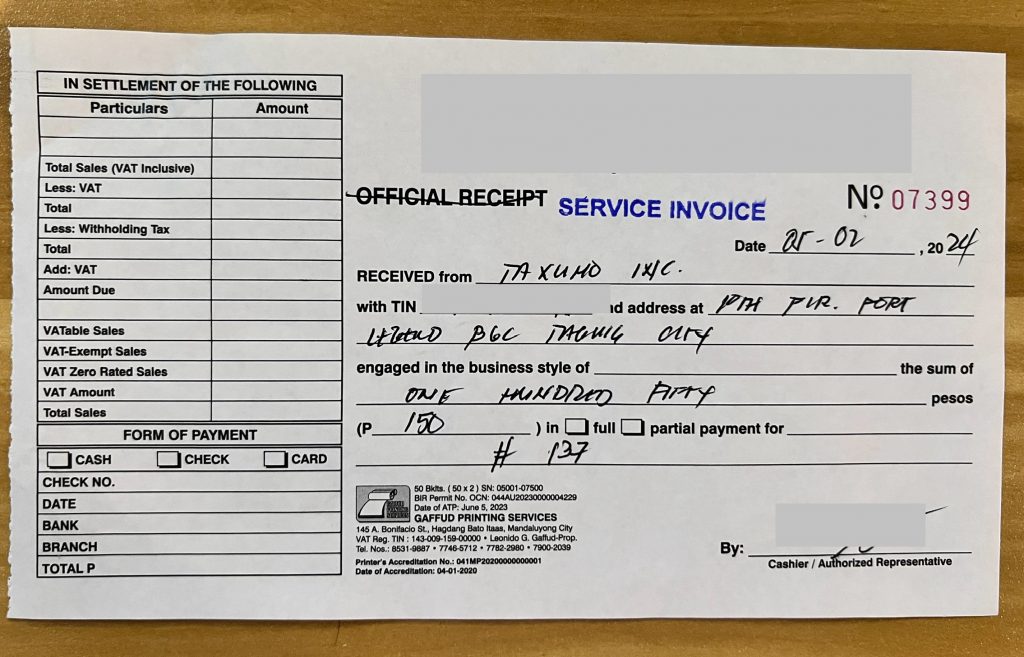

- Alternatively, businesses can convert unused Official Receipts into invoices by striking through the term “Official Receipt” and replacing it with “Invoice” or similar terms. These converted documents are valid for input tax claims until December 31, 2024, provided they contain required invoice information.

- The conversion of Official Receipts to invoices does not need approval but must follow specific guidelines.

- New invoices with an Authority to Print (ATP) should be obtained before December 31, 2024, or before fully consuming converted Official Receipts.

There you go! Be sure to check out the official BIR RR for the complete details.

If you are in need of an online invoicing solution – join our waitlist to get early access through this reservation link.

May I add. You still need to present your unused OR to your RDO after stamping them with “service invoice” they still need to check the inventory list. In my RDO they said no need to present the “receipt book” just the newly stamped OR.

Good day. Just want to ask if a supplier can now use Sales Invoice even the transaction is service?

Since only SALES INVOICES (invoices) are the only ones considered valid docs for input taxes, and have now been considered as the primary and only document required by BIR, under this new BIR RR 7-2024, and Collection receipts (CR), Official receipts (OR) and Payment Receipts (PR), Acknowledgement Receipts (AR) are NOW OPTIONAL and are just supplementary documents to be issued upon customer/ client request.

Question:

1. Are we still required to have these registered with BIR prior to printing? Do we have to request and apply for Authority to Print (ATP) to have them printed under an accredited Printer?

2. Can we just go ahead and have them printed anywhere without going through BIR?

interested on the reply to this question, by any chance were you able to get your answer? thank you!

Pingback: Frequently asked questions on RR 7-2024 (from ORs to Invoices)

Will you be sharing an article for the latest sales invoice format?

For the new invoice, on 7-2024 Section 6.B 16 states “Taxpayers whose transactions are not subject to VAT or percentage tax shall issue non-VAT invoice indicating at the face of such invoice the word EXEMPT”.

This wasn’t a requirement for the previous non-VAT OR. Little confused on this part–does it mean that the word “EXEMPT” is printed on the new sales invoice wherever?

Thank you.

Hi Say! 🙂 Sharing this: https://www.taxumo.com/blog/frequently-asked-questions-on-rr-7-2024/ For the word exempt, it’s not clearly state if this will be written or printed. We assume that the accredited printers know where to put it together with “THIS DOCUMENT IS NOT VALID FOR CLAIM OF INPUT TAX” once they print out new invoices. To be safe, if you’re using your old receipts, you can 1) cross out “official” receipt and stamp on “service invoice / sales invoice” then 2) write “EXEMPT” or “VAT EXEMPT” on the face of receipt, maybe near the breakdown. 🙂

Hello,

Do i still need to present an inventory of unused official receipts to the BIR if i intend to use it as supplementary receipts? Thanks

Hello Dennis,

If you already have a new set of sales/service invoice, there’s no need to submit an inventory of unused ORs to your RDO. 🙂

anu pong gagawin sa mga natirang or? d na po gagamitin? itatabi nlng po ba? i have two bundles nlng po eh.i have new sets of sales invoice already

Hello Anne,

Puwede panga gamitin ito hanggang full consumed mo na yung booklets mo. But before that you have to submit the inventory list to your RDO.

May i ask pwd po va ako pa tatak ng, inventory list, kahit di ako nakapag filing sa BIR, somebody help me hu3

Pwede po mag ask if,need po bang ipasa sa BIR ang mga past Sales Invoice na hindi ginagamit?

What’s the rationale behind this change?

What’s wrong with official receipts?

Hello Rand,

The new Revenue Regulation 7-2024 (RR 7-2024) primarily focuses on the implementation of electronic official receipts and electronic sales invoices. The regulation mandates the use of electronic systems for generating and issuing official receipts and sales invoices, aiming to modernize and streamline the invoicing process while enhancing transparency and efficiency in tax administration. 🙂

But the new sales invoices are not in digital/electronic format.

If you are using a POS provider, contact your POS provider about this and see if you need to do anything. This guide are for those who are issuing physical ORs / Invoices printed by BIR accredited printers. For those who have loose leaf invoice accreditation, you’ll need to submit the new format for your new Sales Invoices.

In this case, is it better to do the electronic sales invoice route than to reprint?

Hello Pam,

It depends on how convenient it will be for your business but the important part here is that we comply to the new invoicing rules of the BIR. 🙂

Hi Rand.

The rationale behind this is the timing of the computation and filing of tax due.

Previously, when businesses issued sales invoices, the output tax had to be filed during the month when the invoices were issued but had no payment yet. In short, they are following the accrual basis of accounting. Conversely, when businesses issue OR, the output tax must first be deferred until collections are made. Simply stated, it is a cash basis of accounting.

With this new BIR regulations particularly under RR 7-2024. These differences will be eliminated by using only an Invoice. From now on, Businesses will follow the accrual method of accounting.

How about down payments? Do we issue invoice for DP’s? I didn’t see any guidelines whether we can issue like a collection receipt first then DP will be included in the progress billing invoice.

Hello Claire,

For this one, you can issue one sales invoice for the whole amount of sale then issue two collection receipts. One for DP and second is for the remaining balance. 🙂

Hi,

Is RR 7-2024 applicable only to VAT-registered entities? Is this applicable to Banks and Finance companies who offer financial services?

Hello Dante,

This applies to all types of businesses and organization registered in BIR. 🙂

What happens next year? starting Jan 2025, should we need to print new booklets for INVOICE?

Hello Mae,

Based on the update related to RR 7-2024, you can use your ORs as your Sales Invoice until your current ORs are fully consumed. 🙂

How do we report the unused receipts to BIR? we will just go there with the receipts?

Hello Gil,

You can submit your inventory list through the TRRA portal of the BIR. 🙂

https://web-services.bir.gov.ph

Not accessible po link. I am new to the business world. Can I still submit inventory list to BIR? 🙁

Pag nagkapag submit po online, no need na to submit sa RDO? Thank youuu po!

Hi po, can I still submit now the inventory of unused list of OR? I haven’t submitted it last year po kse hindi ko po nabalitaan agad.

Hi Christine! You can still try and submit. We don’t know lang if there will be penalties na 🙂 Maybe others who read this will be able to help out and share their experience.

Are the collection receipt should also be converted to invoice?

or just the official receipt?

Hello Rose,

Good day!

Kindly update and use the Sales Invoice as your principal documentation for your sale upon receiving the order of item/service. The collection receipt can be used once you already received the payment from your clients. 🙂

Hi, if i have received the payment from my client

What can i give them as an acknowledgement that i have received the payment?

Hello Marie,

You can issue a collection receipt as a documentation of the collected payment. 🙂

our rdo already received the inventory list. but we changed our office address. can we strike the address in the converted invoice and stamp the new address?

Hello Cherry,

Good day!

In your case, you need to update your registration and update the registered business address too. It is best to have new sales invoice printed so your information on the issued sales documentation will be updated as well. 🙂

So I am just about to have my invoices printed and I was told I have to surrender my old booklets? Does this include the booklets Ive used or just the ones i havent used?

Hello Hans,

Good day!

Kindly surrender the unused ORs only. 🙂

Hi your sample OR coverted to Service Invoice has no quantity, unit cost and description of transaction indicated hence the sample OR format can not be converted to Service Invoice. Is this correct?

Hello Raymondo,

Good day!

The sample Service Invoice is actually an OR from the BIR that is being converted into temporary sales invoice. There is a field where you can add the item description, sum of the total price and item description. As long as these information are indicated, it is okay to use this as your guide if you will be using your OR as your temporary sales invoice.

Just make sure that the information for the quantity, unit cost and description of transaction will be indicated on your proposed Sales Invoice format once you’re ready to print your new sales invoice booklets. 🙂

hi is this implemented nationwide? or per RDO only?

Hello Chiori,

This is applicable and implemented nationwide. 🙂

Can I use a custom stamp called “Invoice” instead of “Service Invoice”? Or does it need to be specific like “Service Invoice”

Hello Nap,

Good day!

You can use the Invoice stamp too but is is better to use Sales or Service Invoice instead. 🙂

I accidentally issued my client an or without an “invoice” stamped. She is asking if she can be the one to have it stamped, will that be okay?

If I do not want to convert the unissued ORs to invoices, do I still need to submit inventory list? Is it possible to just apply for destruction of ORs in BIR and get a new ATP for invoices?

Hello Kristine,

Even if you decide not to convert the unissued ORs to Sales Invoices, you are still required to submit an inventory list of the unissued ORs to the BIR. This is necessary to account for all the official receipts that have been printed and issued to you. 🙂

May I know deadline if submitting inventory list?

What are the requirements for submission of remaining ORs?

Hello Jed,

Just submit your inventory list and you’re all good. :0

Can you still submit the inventory list after July 31 deadline

In our business, we are using sales invoice if we sell goods and official receipt if we render our services. If we are not planning to convert our OR to Service Invoice, are we required to get Service Invoice or can we use Sales Invoice on services?

Hello Gayle,

Good day!

You will need to convert your Official Receipt into Service Invoice too. 🙂

Upon collection sir, anong resibo ang iissue namin,. if wala po kami collection receipt.

Hello Roselie,

If you have an OR po pwede ppo yun. Collection receipts are optional po and is a supplementary documentation only. 🙂

Hi,

Is it allowed to just manually strike through and write “Service Invoice”? Or does it have to be stamped?

Hello Sheena,

You have to strikethrough the word official receipt and stamp it with Sales Invoice 🙂

Hi,

Currently we issued Billing Statement for services rendered. We also issue Statement of Account for reimbursement of advances, what form to use now ?

We hope for your guidance.

Thank you.

Hello Edzel,

You should issue a Billing Invoice instead of Billing Statements 🙂

Would you need to file a BIR form for this new regulation? What form would that be?

Hello Eric,

Good day!

You only need to submit an Annex D for the inventory list of your unused OR. Here is the template that we prepared for your reference: https://docs.google.com/document/d/1XmbUc7zbwI151r5M8Q3fFSmMKOvGoGz2i7-0DdbMP34/edit 🙂

Hi! how about for the CAS issuances? shall we still include the corresponding unused series of the CAS to the inventory list that we will provide apart from the unused manual official receipts vat exempt/vat?

Hi Arlene,

Yes, you should still include the corresponding unused series of the CAS (Computerized Accounting System) in your inventory list, in addition to the unused manual official receipts (both VAT-exempt and VAT). This ensures that all types of receipts and invoices are accounted for correctly and comply with BIR regulations.

Make sure to maintain an accurate and comprehensive record of both CAS and manual receipts for proper documentation and compliance.

Hi Eric,

Good day!

You just need to submit an inventory list of unused ORs. You can check our prepared template for this here: https://docs.google.com/document/d/1XmbUc7zbwI151r5M8Q3fFSmMKOvGoGz2i7-0DdbMP34/edit 🙂

Hello for clarification lang, if the business is vat registered and the buyer didn’t ask for invoice, Can I accumulate all my sales in a day in 1 invoice?

Hello Joann,

If your business is VAT-registered and the buyer didn’t ask for an invoice, you generally cannot accumulate all your daily sales into a single invoice. Each sale should be documented with its own invoice. However, if the buyer requests a summary invoice, you could issue one but it must still be based on the individual sales made. It’s best to ensure you issue a separate invoice for each transaction to comply with BIR requirements.

Hope this clarifies things!

Is this applicable to freelancers?

Hello Ryuu,

Good day!

Yes it is! Basically, the Sales Invoices are now the main documentation for sales, while official receipts are just supplementary.

I’m using official receipts before and writing on cash receipts journal. I transitioned to Service Invoice, which book of accounts should I update?

Hello Sarah,

The books of accounts will remain as is. The changes is only within the usage of ORs as our main documentation for our sale. For our books, we should still use Cash Receipt Journals for our sales/income entries. 🙂

HI,

Query only, We collected payment from our client and issue strikethrough official receipt with stamp of “service invoice”, and then they are still asking for issuance of Official receipt as a proof of payment.

Is this correct? Isn’t it issuance of “service invoice” suffice our collection?

Thank you very much for your answering our queries.

Hello Gina,

The issuance of a “Service Invoice” is generally sufficient for documenting the collection of payment, as it serves as both the billing document and proof of the transaction. However, if your client is requesting an Official Receipt (OR) as proof of payment, it’s important to consider their request to maintain good client relations.

The strikethrough and stamp on the Official Receipt to indicate it as a Service Invoice might not be sufficient if the client or their accounting policies specifically require an Official Receipt. It’s best to issue an Official Receipt if requested, or clarify with the client to ensure that both parties are aligned on documentation practices.

Hi,

Good day!

We are a non-stock non profit school, and we are planning to completely stop using ORs and solely use the invoice and receipt generated from our accounting software, thus, wanted to know as follows:

1. Do we need to register or submit any documentation related to using the invoice and receipt from our accounting software? If so, may we know the process and requirements?

2. What should we do with the unused ORs since were planning not to use them?

Thanks

Hello Marlo,

You need to register your accounting software with the BIR to use electronic invoices and receipts. This involves submitting a request to the BIR with a letter, proof of software registration, sample documents, and your school’s Certificate of Registration. For the unused Official Receipts (ORs), you must submit an inventory list to the BIR and follow their guidelines for safekeeping or disposal.

Question:

Do we really need to provide stamp or can we manually strikeout the word official receipt and Write – “invoice”

somehow the last statement/paragraph on RR 7-2024 section 8 sub 2.2 was very misleading.

Hello Eliezer,

When converting a document from “Official Receipt” to “Sales Invoice,” you should:

Strike through the term “Official Receipt.”

Stamp or clearly mark the document with “Sales Invoice.”

This ensures that the document is properly classified and complies with BIR regulations.

hello. our company used billing statement to billed clients and Official receipt if we collect cash.is it possible that we can strike out our billing statement to sales invoice and the Official receipt to Collection receipt?

Hello Jay Ar,

Yes, you can update your documentation as follows:

Billing Statement to Sales Invoice: You can replace your billing statement with a sales invoice. The sales invoice will serve as the official document for billing clients, documenting the sale of goods or services, and including necessary details such as the amount and taxes.

Official Receipt to Collection Receipt: You can replace the official receipt with a collection receipt to acknowledge the payment received. This collection receipt should confirm that payment has been received and may not need to be BIR-registered if used as a supplementary document.

Regarding the supplemental document, does acknowledgment receipt need to be B.I.R. registered? or we can just make our own template and present it once payment has been received?

Hello Nicole,

The acknowledgment receipt does not need to be BIR-registered if it is used only as a supplementary document. You can create your own template for acknowledging receipt of payment and present it once payment has been received.

However, make sure that this acknowledgment receipt aligns with BIR requirements and includes all necessary details.

Hi,

Good morning. We are a non stock non profit school and are using manual ORs but wanted to fully transition to electronic invoice and receipts generated by our accounting software. We would like to inquire as follows:

1. Do we still need to send the BIR the Inventory of unused ORs?

2. What is the process / requirements / documents that needs to be submitted to BIR to fully use the electronic invoice and receipts generated by our accounting software?

Thank you

Hello Marlo,

Here’s what you need to know:

Inventory of Unused ORs: Yes, you need to submit an Inventory of Unused Official Receipts (ORs) to the BIR when switching to electronic invoices.

Process for Electronic Invoices:

Apply for Authority: Request permission from the BIR to use electronic invoices and receipts.

Submit Documents: Provide a request letter, proof of registration for your software, sample electronic invoices/receipts, your school’s Certificate of Registration, and any required fees.

What will we write in the “the sum of”? Gross or net of CWT?

Hello Alvin,

In the context of BIR forms and invoices with BIR, it typically means the total amount due or payable.

Here’s how you should handle it:

Gross Amount: This is the total amount before any deductions or withholdings.

Net Amount (after CWT): This is the amount after deducting any applicable tax withholdings (Creditable Withholding Tax, or CWT).

For BIR purposes, you usually need to report the gross amount on your invoice. The net amount after CWT is what the payer actually pays after the tax has been deducted.

So, for the “sum of” field on an invoice, write the gross amount. Any CWT or other deductions should be separately indicated if required.

What would be now the receipt that the supplier must issue to us when we received the sale of services from them and the receipt when they received the payment?

Hello JC,

The Service Invoice will serve both as the record of the sale of services and as confirmation of payment. It includes details about the service provided, the amount, and any applicable taxes.

If i convert our Official receipts to service invoice, can we also change the word “received” to “invoiced” releasing OR’s signifies service rendered.

Hello Ross,

Yes, you can convert your official receipts to service invoices and change the word “received” to “invoiced” to better reflect the service rendered. This adjustment can help clarify that the document represents an invoice for services provided, rather than just a receipt of payment. Just ensure that all other details and terms on the invoice accurately represent the transaction and comply with any relevant regulations or accounting practices.

Pingback: New BIR Ruling on Issuance of Official Receipts (RR 11-2024)

I read somewhere that unused ORs printed 2023 can still be used until consumed as long as invoice is stamped in place of official receipt. Pls clarify

Hello Lourdes,

Yes this is correct. BIR already approved of this 🙂

included din po ba dito ang non-profit organization. in case po na included, dadalhin po ba namin ung mga OR nmin sa BIR para po tatakan ng sales invoice. tnx po in advance in your reply

Hello Rowena,

kasama sa requirement ang mga non-profit organizations. Kailangan nyong dalhin ang mga unused Official Receipts (ORs) sa BIR para i-update at tatakan, kasabay ng pag-aaplay para sa Authority to Print (ATP).

hi,

how will this affect non-VAT registered taxpayers?

Hellpo Danielle,

So, about that new invoice rule, RR 7-2024? It’s all about going digital with receipts and invoices to streamline things. The goal is to update the process and make it smoother for everyone.

Basically, the Sales Invoices are now the main documentation for sales, while official receipts are just supplementary.

RE: WITHHOLDING

At the time ba na mag issue ng INVOICE dapat mag withhold na rin ba? Example the invoices were issued but had no payment yet, pwde na bang magwithhold?

Hello Ragnarok,

No, withholding tax is typically applied at the time of payment, not at the time of issuing the invoice. So, if the payment has not yet been made, withholding tax should not be applied. Withholding tax is generally deducted when the actual payment is processed, regardless of whether an invoice has been issued.

“Alternatively, businesses can convert unused Official Receipts into invoices by striking through the term “Official Receipt” and replacing it with “Invoice” or similar terms. These converted documents are valid for input tax claims until December 31, 2024, provided they contain required invoice information.”

I have emailed my inventory report. Do I still need to go to my RDO for the stamps?

Before this new regulation, we issue Billing Statement to indicate that we are collecting payments for the said service. Then we issue Official Receipt upon receipt of payment.

With the new new guidelines, we are worried that if we issue the Service Invoice to indicate that we are requesting that payment of the service be processed by the client, what is our protection if the said service is not paid by the client?

Our clients have 45 days to pay for the services. However, we have clients who has history of losing billing documents. In this case, we had to cancel previous documents and submit new ones.

Hello Sally,

To protect yourself under the new guidelines, ensure that your Service Invoice clearly states payment terms, including due dates and any penalties for late payment. Keep thorough records of all communications related to invoices and payments, and follow up with clients before and after payments are due. If you need to issue a new invoice because a client lost the original, make sure to reference and cancel the previous invoice to avoid confusion. Additionally, consider including payment terms in your contracts and seek legal advice if needed to ensure you have proper protection in case of non-payment.

So as a proof of payment, we still issue “OFFICIAL RECEIPT”

Pero, di ba naconvert na sila sa INVOICE

So, where do we get this secondary document official receipt Kung naconvert na sila sa INVOICE?

Hello Donnie,

If you’ve switched to Sales Invoices, you don’t need an Official Receipt anymore. The Sales Invoice is enough for official records and VAT claims. Just make sure to follow BIR rules for issuing them.

Hi,

May I know the handling of VAT invoicing requirements for a transaction that transpired in 2023 but payment was collected after the effectivity of the EoPT act?

Can we still issue OR? CAS enhancements were already made.

Thank you.

Hi DM,

For transactions that occurred in 2023 but where payment was collected after the EoPT Act’s effectivity, you should issue an Official Receipt (OR) with the updated CAS enhancements. The EoPT Act allows for the continuation of issuing ORs for transactions that were completed before its effectivity but have payments made afterward.

Is it necessary to put the EWT amount in OR/INVOICE? Per understanding invoice is for claiming of input tax/vat only so we just put the EWT amount in acknowledgement receipt / upon payment

Hello Eyy,

It’s not necessary to include the Expanded Withholding Tax (EWT) amount in the Official Receipt (OR) or Invoice. Typically, the invoice is used for VAT and input tax claims, while EWT is handled separately. You can document the EWT amount in an acknowledgment receipt or at the time of payment.

For our business, can we use “service Invoice” stickers instead of rubber stamp pasted on top of “official receipt”?

Hello Cris,

It should be stamped po as indicated in RR 7-2024 🙂

Hello, I operate a small online business selling tsuno bags priced at 249 and 269 pesos each. I would like to know how many booklets you would recommend if we sell an average of 30 units per month. I am also concerned about the number of pages per booklet and the following statement: “Businesses subject to internal revenue tax must issue registered invoices for sales or services valued at P500 or more.”

Hello Melvin,

Good day!

The standard number of booklets is 10 and per booklet a minimum of 50 pages are included. For the “Businesses subject to internal revenue tax must issue registered invoices for sales or services valued at P500 or more.” this means that if your sale is above PHP 500.00 a sales invoice must be created and issued to your client. Sales below PHP 500.00 can be recorded into groups under one sales invoice only. 🙂

Hi, our documentation currently consists of Delivery Receipt, Billing Statement, and Official Receipt. We followed the mandate to cross out the OR and stamp INVOICE on it.

However, our Client mandated that the Billing Statement (Non-Input VAT document) should be the one that’s crossed out and stamped with BILLING INVOICE and be used as primary document, instead of the OR (Input VAT doc) which they said does not need to be crossed out. How should we address this?

Hello Tin,

Good day!

The client is correct with this one. Since you have a Billing Statement, this should be changed to Billing Invoice which you will issue the soonest that the income is earned and the Official Receipt is considered as collection receipt once the item has been paid. 🙂

Our client is requiring us to issue BIR registered Collection Receipts upon collecting payment. My understanding is since this is only a supplementary document, we don’t need to have them registered to BIR. Is that correct?

I can no longer use our remaining ORs since we reported them as SI. We are still waiting for the ATP to be released. What do we need to do?

Hello Maia,

Good day!

For this one, even if its just a supplementary documentation, you should have a BIR Collection Receipts printed as well as a documentation for the collected payment. 🙂

Hello good day,

May I ask when should an invoice be issued? Is it before the payment or after the payment? Because I need to pay something and we require an invoice to serve as proof of bill esp. taxes, but the supplier only issues invoice after they received the payment . Thank you

Hello Drew,

AS per the RR 3-2024, the issuance of invoice should be done once the income is earned, not when the payment is collected. 🙂

Hi,

Some shops give receipt without proper customer information. Is it OK/allowed that the customer is completing his/her own information like name, address TIN nr? Thanks for clarifying.

Hello Peter,

It is okay as long as the receipts are issued with complete payment information. 🙂

Can I use sales invoice on services?

Hello Julie,

If you’re a professional it should be Service Invoice. If you’re registered as a business (Sole Prop, Partnership, Corp) it should be Sales Invoice. 🙂

What is the workaround for official receipts issued for reimbursement? Employees will be on the losing end if employers will simply say that their receipts are now “invalid”? What are the valid “workarounds”? Thanks!

Hello Jeddski,

If official receipts issued for reimbursement are now deemed invalid, there are several workarounds to consider. Employees should first try to request new receipts from vendors or service providers that comply with the latest BIR requirements. If obtaining new receipts is not possible, employees might need to provide alternative documentation, such as a detailed statement or invoice from the vendor, along with proof of payment. It’s also a good idea to consult the BIR or a tax professional for specific guidance on handling these receipts under the new regulations. Additionally, employers might review and adjust their internal policies to accommodate these changes and ensure that employees are not unfairly disadvantaged.

This new regulation is very confusing. Does BIR want to fully automate invoicing, meaning businesses don’t need to issue physical receipts anymore?

I’m a freelancer with a lot of unused ORs.

Do I need to surrender all these to BIR? What are the steps I have to do to comply with the regulation?

Hello Bea,

So, about that new invoice rule, RR 7-2024? It’s all about going digital with receipts and invoices to streamline things. The goal is to update the process and make it smoother for everyone.

Basically, the Sales Invoices are now the main documentation for sales, while official receipts are just supplementary.

Formerly we are issuing Delivery Receipt, Billing Statement to our clients upon rendering our services… then Official Receipt upon collection (terms)

With this new set up..

At the moment, our clients are requiring us already of SERVICE INVOICE (formerly Official Receipt)… eventhough they have terms of payment like 30, 45, 60 days.

And requesting us to issue either Collection Receipt or Acknowledgement Receipt.

Do we need to have a Collection Receipt printed by BIR Forms Supplier?

I ask the officer of the day at our area, she mentioned that no need to do these since this is part of of the the change (reduce the forms) but how can we satisfy our client and have our normal collection?

Hello Emer,

Although the principal documentation for our sales/income are Sales/Service Invoices, you can have a collection printed for these clients asking for this documentation to satisfy your clients. For those who do not ask for collection receipts, you can just issue a Sales/Service Invoice. 🙂

If a company issues a charge sales invoice, does the collection receipt, as a supplementary document, also require an Authority to Print (ATP) from the BIR?

Hello Jennifer,

Issuance of collection receipts are only optional but you can buy this through your RDO for instances that the clients will require you to issue this receipt. 🙂

Hello,

Usually, We issued Billing invoice for our client to give notice of how much they will pay since we area manpower services. and if the paid us we issued service invoice. May I ask or any idea as to how do we do it now since it must be service invoice only daw as per BIR. also, the printer said that di na daw pwedi, either to used Service or billing invoice. but our client is asking for a billing invoice, what should be used as replacement for the BI? need your opinion on this.

Hello Cha,

What you can do is to issue a billing invoice/service upon orders completion then issue a collection receipt once you collected the payment na po from your clients. 🙂

In business with CAS permit. Bill of Charge or Charge Invoices is issued to customers, when they paid for the charge invoices, the Official Receipt was the one with a strikethrough and stamped with Service Invoice.

Does the Bill of Charges forms also stamped with Service Invoice along with the Official Receipt?

Hello Thadeus,

The Bill of Charge should be changed to Charge Invoices instead. This shall be issued to customers once they ordered the item or service. Collection Receipt of Official Receipt (without the Service Invoice stamp) shall be issued once the payment is collected already. 🙂

Hello Thadeus,

In a business with a CAS permit, when you issue a Bill of Charges or Charge Invoice and the customer makes a payment, the Official Receipt should be used to acknowledge the payment.

Regarding your question:

The Official Receipt is the document that should be stamped with “Service Invoice” after the payment is received.

The Bill of Charges or Charge Invoice is typically not stamped with “Service Invoice.” It remains as a record of the charges and is used to request payment.

So, only the Official Receipt should be stamped with “Service Invoice” upon payment.

I hope this clarifies things!

We are filing our leasing of real property and space rentals for registration at the BIR. May we know what should be the invoice for this since it can’t be a Sales Invoice nor a

Service Invoice, can we label it as Leasing Invoice? What would be the proper Invoice format for leasing of real property and spacerentals. Please share your knowledge or

information regarding this matter. Thank you

Hello Teresita,

Based on BIR guidelines:

Invoice Label: For leasing of real property and space rentals, you can label the invoice as “Leasing Invoice” or “Rental Invoice.” This helps specify the nature of the transaction.

Invoice Format: Your invoice should include:

Invoice Number: Sequentially numbered.

Date of Issuance: The date when the invoice is issued.

Landlord’s Information: Name, business name, address, and TIN.

Tenant’s Information: Name, address, and TIN (if applicable).

Description of Property/Space: Detailed description of the leased property or space.

Rental Period: The period covered by the invoice.

Amount Due: Rental amount and any applicable taxes.

Terms and Conditions: Payment terms, due date, and any additional conditions.

Make sure the invoice format is registered with the BIR. It’s best to clarify with your RDO or consult a tax professional for specific compliance requirements.

If a day’s sales total is only 500 pesos below and the customer did not request a sales invoice, am I still required to issue one?

Hello Jenny,

Under BIR regulations, if individual sales are small and do not require a separate sales invoice, you can issue a consolidated receipt for various customers for the day, provided that the total amount of sales does not exceed a specific threshold (which is often set at 100 pesos per transaction).

So, if a day’s sales total is only 500 pesos and individual sales are below the threshold, you can issue one consolidated receipt instead of separate invoices for each customer.

Good day! May question lang po. Is it possible po to amend the incorrect unused OR inventory? Na mislook po kasi yung sa series no. ng mga booklets.

Hello Kristine,

It is best to contact your RDO po for correction. 🙂

Hello Po, Good day, included po ba dito ang pagiissue ng service invoice instead po na collection receipt?and saan po kaya pwede makita if ever sa memorandum ng BIR, I hope for your help regarding this po.

Thank you and best regards,

Hello Alvic,

You should issue po yung Service Invoice as a main documentation of your sale/income. Collection receipt is just a supplementary documentation. This is in reference of RR 7-2024 po. 🙂

How about if you issue AR (acknowledgement receipt) sa customer need pa po ba yung AR naka register sa BIR may sariling ATP? may ruling po ba si BIR na need ipa register sa BIR ang AR? TIA.

Hi Po,

Good Day! We have this Charge Sales Invoice given to our clients once they purchase on terms like 30 days or 45days, then upon payment we issue Collection Receipt. This is our process since the issuance of RR 7-2024 but yesterday upon collecting their payment, they wont accept the Collection Receipt they want Sales Invoice based on the new MEMO of BIR daw. But CHARGE SALES INVOICE was already issued to them from the beginning of their purchase on terms. As far as I know there is no wrong on our process. Would you help me explain to our client?

Hello Fercy,

Under the EOPT law and the guidance of RR 7-2024, your process of issuing a Charge Sales Invoice upon granting terms (such as 30 or 45 days) is correct. The Charge Sales Invoice serves as the primary document for the sale, while the Collection Receipt is meant to acknowledge the payment against that invoice.

It’s important to communicate to your clients that since they have already received the Charge Sales Invoice at the time of purchase, it is the appropriate documentation to reference for the transaction. The Collection Receipt confirms the payment and should be accepted as such.

If you need more clarity on this, you can do a consultation with one of our partners via https://www.taxumo.com/taxumo-consult/.

Thank you!

Hi,

Is it allowed to apply for two types of invoices i.e. Sales Invoice and Billing Invoice?

Hello Frances,

Yes, it is allowed to apply for both Sales Invoices and Billing Invoices in the Philippines. Each type serves a different purpose:

Sales Invoice: This is issued for the sale of goods or services and is typically used for transactions where payment is received immediately or shortly after the sale.

Billing Invoice: This is often used to request payment from a customer for services rendered or goods delivered over a period of time, especially if payment is not received at the time of service.

Just ensure that both types of invoices are properly documented and comply with BIR regulations. If you have specific concerns or need further clarification, it might be a good idea to consult with your accountant or the BIR directly.

Hello Frances, Yes, it is allowed to apply for both Sales Invoices and Billing Invoices in the Philippines. Each type serves a different purpose:

Sales Invoice: This is issued for the sale of goods or services and is typically used for transactions where payment is received immediately or shortly after the sale.

Billing Invoice: This is often used to request payment from a customer for services rendered or goods delivered over a period of time, especially if payment is not received at the time of service.

Just ensure that both types of invoices are properly documented and comply with BIR regulations. If you have specific concerns or need further clarification, it might be a good idea to consult with your accountant or the BIR directly.

Let me know if you have any other questions!

We are currently issuing SALES INVOICE (details are complete) for sale of goods and COLLECTION RECEIPT upon payment. Some clients are requesting for Official receipt stamped with “INVOICE”. How can we address this?

Hi Mae,

Thanks for reaching out!

To address your clients’ request for an Official Receipt stamped with “INVOICE,” it’s important to clarify your current process. You can explain that you issue Sales Invoices for the sale of goods and Collection Receipts upon payment.

Additionally, it may be helpful to educate them about the new eOPT law, which emphasizes the use of Sales Invoices and Collection Receipts in documenting transactions. This process ensures compliance and transparency in your accounting practices.

Encourage them to consider this format, as it serves the same purpose while adhering to legal requirements.

Let me know if you need more assistance or have further questions!

Hi,

Inquiry/ clarification.

Before: We issue billing statements once the service is done then when we collect the check payment, we will issue an official receipt then they will give us the BIR 2307.

Now, clients are requiring us to submit the Strikethrough Official Receipt as Service Invoice before they can process the payment. Then once we issue the Invoice this will now count as our Sales of that month right?

However, how can we assure that they will pay us? And also with the issuance of 2307, how will it match our Sales for the Month or that taxable year if they will only process the payment once the Invoice has been issued.

Hi VM,

Thanks for reaching out!

Yes, you’re right—once you issue the Service Invoice, that will count as your sales for the month. It can be tricky when clients want the Strikethrough Official Receipt before processing payment. To help ensure they pay on time, you might want to:

Set Clear Payment Terms: Make sure your Service Invoice states when the payment is due.

Follow Up: A friendly reminder after sending the invoice can go a long way in prompting payment.

Use Contracts: If possible, have a contract in place that outlines payment expectations.

As for the BIR Form 2307, it will match the payments made against your sales. Just keep your records updated to reflect those sales and payments accurately. If payments are only processed after invoicing, it’s a good idea to discuss with your accountant how to best align those records.

Let me know if you have any other questions or need more help!

Hi,

Question.

Our company is on CAS. Manual strike out was done on the invoice instead of the OR. Do we need to provide hard copies to the buyers or will the soft copy of the manual strike out invoices do?

Thank you.

Hello, is it okay if I issue an invoice upon payment of service rendered in previous month?

For context, working as consultant and company deducts withholding (2307 provided after each quarter). They’re the ones computing my consultation fee (which is given in the following month of service rendered), so I only know if there are other incentives/deductions upon payment. Therefore, prior to payout, I do not know the exact amount to put in invoice if I were to follow accrual basis.

Can I use my O.R. both as a billing and service invoice? A client required me to send an invoice prior to payment, so I sent them a service invoice. Upon payment collection, they are again requiring another service invoice. Is this okay? When I clarified this with them they said it was okay since they wont submit the 1st invoice for tax claims. Moving forward, Can I use my booklet both as a billing and service invoice for this purpose?

Hello,

Our client requested to use the Service Invoice to bill them the 50% down payment for the services that we provided. We just received the said payment, and we would like to bill them again for the remaining balance, is it okay to use the service invoice again for the billing? How can we input the applicable taxes for the total amount, since we use the service invoice for the down payment and we will use another one for the remaining balance?

Hi,

Im so sorry if im a bit confused. We are a small cafe owner. Do we need to replace/stikeout the “Official Receipt” and put “Service Invoice” or “Sales Invoice”? does it make any difference?

Hi Mark,

Yes, you’ll need to strike out the term “Official Receipt” and replace it with “Sales Invoice” or “Service Invoice,” depending on your transactions. This is important because, according to the new BIR ruling, Sales/Service Invoices are the recognized documents for sales transactions, while Official Receipts are now only considered as supporting documents.

Also, make sure to submit an inventory list of your Official Receipts to BIR so they can approve using your old receipts as Sales Invoices.

Hello,

I have some clarifications lang po for the issuance of a receipt for rendered service.

This is our receipt issuing system before.

If goods/item: Sales Invoice and Collection Receipt (for payment)

If services: Billing Statement and Official Receipt (for payment)

Q1: Can we convert the billing statement to a billing invoice and pair it with the OR? or we stick to a billing statement and then pair it with a service invoice if the payment has been made?

Q2: Before converting the OR to a Service Invoice, do we still need to submit an inventory list of unused ORs?

Which is more acceptable po to the BIR. Sana po masagot.

Thank you.

We are currently using loose leaf receipt for VAT-exempt transactions and bound receipt for VAT-able transactions. If I update our PTU Loose leaf and detail that we will be using Invoice- VAT Exempt and OR (as supplementary doc). Can we still consume remaining receipts until Dec 2024? Or will there be penalty now?

Also, how long is the allowable time to apply for ATP once updated PTU is released?

Hi po, Gusto ko lang itanong. Currently we are using SALES INVOICES for Cash, On date Payments & Credit Terms. May option kasi sa Sales Invoice namin kung Cash or Credit. So kapag credit sya ibig sabihin utang yung transactions sa amin. And once na nag bayad na ang customers namin, nag iisue kami ng COLLECTION RECIEPT. Ngayon po, need pa rin po bang palitan nga Collection INVOICE ang Collection RECIEPT namin? Need pa rin po bang mag file ng Inventory List sa Coll. Reciept Namin po?

If need magfile magkano ang Late penalty po nya?

Thank you.

Good day! Pwede po ba na mag issue ng stamped previously O.R as sales invoice instead of service invoice? We are an events management company. Na bili ko po kasi na pantatak was sales invoice? Can they be used interchangeably or dapat service invoice po? Thank you!

Pingback: 2024 BIR Registration Guide for Freelancers & Self-Employed

How about consignment relationship between distributor and retail store? Do our delivery receipts have to be registered by the BIR? Or do we need to issue a separate sales invoice

How about consignment relationship between distributor and retail store? Do our delivery receipts have to be registered by the BIR? Or do we need to issue a separate sales invoice everytime we send a delivery

Hi,

Can we use our unused OR’s as collection receipts?

Thanks

Hi Fe! These two are different kinds of documents 🙂 Unused ORs can be used as Invoices. You can read more here: https://www.taxumo.com/blog/bir-rules-on-receipts-transitioning-to-invoices/

For a private school, should the new invoice head be SERVICE INVOICE or SALES INVOICE?

Since Private schools are more service-based, we recommend to have it as SERVICE INOVICE. However, kindly double check with your nearest RDO to confirm if receipts should be Service Invoice.

wla po bang magiging problema sa BIR if iba ang total amount sa resibo ng customer sa resibo ng company na ipapasa sa BIR?

Good day! I would like to inquire about the new service invoice. We mistakenly entered 30 days in the terms instead of COD. Can we strike through the incorrect information and countersign it?

Hi Cookie! Based on BIR invoicing regulations, any corrections on a Sales Invoice (SI) or Service Invoice (SI) should follow proper documentation to maintain compliance.

Yes, you can make a correction, but it must be done properly:

– Strike through the incorrect “30 days” term without erasing it.

– Write the correct term (“COD”) beside or above the incorrect entry.

– Countersign next to the correction to validate the change.

Good day,

May I ask , if in case i want to issue a Service Invoice to a guest or buyer and resist to give his information or details.

What would be my alternative and best thing to do.

Thank you

Hi Sergio! You may check with the BIR what should be done. Some people place “buyer refused to give information” but the important thing is that you still issued an invoice for the transaction.

Pingback: How to Receive your Payouts and Issue Invoices as Lazada Affiliates

Hello Every One, I just would like to ask for clarification and better understanding, regarding “Official Receipt Number” do it need to be color “RED” to identify or Xerox Copy of its original Receipt? I would like to ask for a better understanding and more clarification. I am working in the National Government Agency and I have observed several of Official Receipt Number is color Black and its hard to distinguish if it is official or xerox copy.

Hi Zander! There are no provisions on the color, actually. What is important to know if it is a valid Invoice is if it has the BIR Accreditation below and the ATP number. Check also if the TIN is valid. 🙂

Hi. If sole proprietorship, our supplier should indicate my name on the invoice or my DTI registered name? Magkaiba kasi… But my BIR for my business is under my name

Hi JC! It should follow what is indicated in your COR. Usually, for DTI registered sole proprietors, they use their trade / business name in the invoice. Thanks!

Hi,

My receipts expired just this February, do I need to go to my RDO and have them converted/stamped? Or could I just continue using them as is until they run out?

Hi Mac! There is no expiration for invoices already. The removal of the five-year validity of receipts and invoices took effect on July 16, 2022, which is fifteen (15) days from the date of publication of RR No. 6-2022 on July 1, 2022. Since this IRR took effect on July 16, 2022, all receipts/invoices expiring on or before July 15, 2022 are no longer valid.

Just make sure that you have submitted an inventory of your unused receipts to be converted to invoices (by stamping, etc.).

Pingback: Do YouTubers Pay Tax in the Philippines? Key BIR Takeaways | CloudCFO

We’re using Service Invoice since we’re at a hotel industry. May I ask why the BIR branch where we submitted our Invoice told us to remove the SC/PWD discount portion?

Hi there. I have unconsumed receipts left. Can I still continue using them or should I get new receipts printed?

“Based on the update related to RR 7-2024, you can use your ORs as your Sales Invoice until your current ORs are fully consumed.”

Is this still applicable?