With our many conversations with individuals, we are surprised that some of them don’t actually know if they are legitimately employed in the companies that they are working in. They would ask us, “how would you know if I am employed versus hired as an independent contractor?”. Aside from checking your contract, one clear indication is if your employer gives your a BIR 2316. Surprisingly, some of the people we talk to ask us how to get BIR Form 2316. You should get this from your employer.

With all of the confusion, understandably so, navigating through tax obligations is a crucial aspect of financial management for both employees and employers in the Philippines, but it’s not that easy. Among the myriad of forms and requirements, BIR Form 2316 stands out for its importance in summarizing an employee’s compensation income, deductions, and the income tax withheld for a particular year. If you’re pondering over how to get BIR Form 2316, this article is tailored for you, providing a step-by-step guide to ensure you’re well-prepared for this essential document.

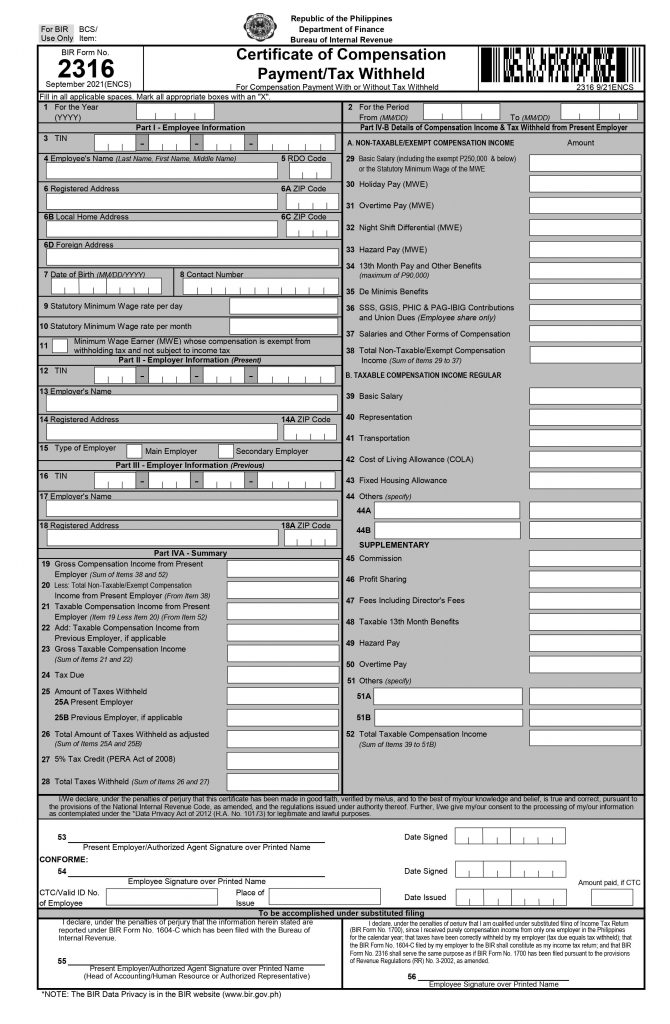

Understanding BIR Form 2316

BIR Form 2316 is a Certificate of Compensation Payment/Tax Withheld, a necessary document for employees earning purely compensation income. This includes salaries, wages, and other forms of remuneration. It serves as a detailed record of an employee’s income and the taxes withheld by their employer throughout the taxable year. It’s not only a crucial document for the tax filing process but also serves as proof of tax payment and income earned, which can be necessary for loan applications and visa requirements.

How to Secure Your BIR Form 2316

Step 1: Familiarize Yourself with the Form

Before anything else, understanding the contents and purpose of BIR Form 2316 is crucial. This form is usually prepared by your employer and should reflect your total income earned and the taxes withheld within the taxable year.

For employers, you can check out this guide:

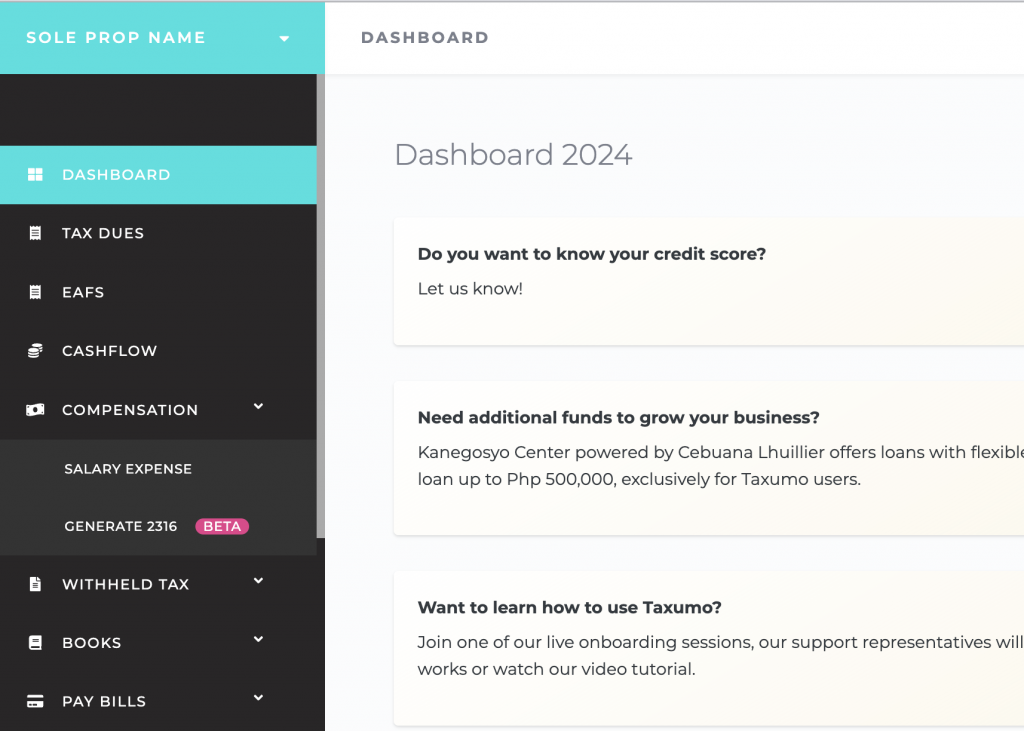

For those who need help filing it out, Taxumo has a 2316 generator for our subscribed users. You can check use this 2316 generator which you can find in this tab:

If you have any questions about the Taxumo 2316 Form generator feature, feel free to reach out to customercare@taxumo.com.

Step 2: Coordinate with Your Employer

- Requesting Your Form: The primary step in obtaining your BIR Form 2316 is to request it from your employer. Employers are required to provide this form to their employees on or before January 31 of the following year.

- Verification: Once you receive your Form 2316, verify all the information to ensure its accuracy. Check your personal details, total income earned, exemptions, and the amount of tax withheld.

Step 3: Rectifying Discrepancies

If you discover any discrepancies or inaccuracies in your Form 2316, report it immediately to your employer’s accounting or HR department for correction. It’s imperative that all information on the form is accurate and reflects your actual earnings and withholdings.

Step 4: Safekeeping

Once you’ve verified the details on your Form 2316 and made any necessary corrections, be sure to keep the document safe. It’s an important document that you may need for various financial transactions and future tax filings.

Step 5: For Previous Employment within the Same Tax Year

If you’ve worked with multiple companies within the same tax year, you’ll need to secure a Form 2316 from each employer to consolidate your income tax details accurately.

To “consolidate” these 2316 forms, you will need to file your own annual income tax form called BIR Form 1700. More information here: https://www.taxumo.com/form-1700/

Why is BIR Form 2316 Important?

Understanding how to get BIR Form 2316 and ensuring its accuracy is more than just a compliance matter. This form plays a significant role in:

- Tax Filing: It simplifies your annual income tax return filing, serving as a reference for the income earned and taxes withheld.

- Financial Documentation: Form 2316 is often required when applying for loans, credit cards, or when processing visa applications, as it proves your income level and tax compliance.

Conclusion

Securing and understanding your BIR Form 2316 is a critical aspect of managing your tax obligations in the Philippines. Follow the outlined steps to obtain and verify your Form 2316, helping you manage your tax responsibilities more smoothly and prepare for your financial needs. Staying proactive and informed about your tax documents empowers you to manage your finances effectively and stay compliant with Philippine tax regulations.

In summary, securing your BIR Form 2316 involves timely coordination with your employer and diligent verification of the document’s accuracy. This ensures that you’re well-prepared for any financial scrutiny, loan applications, or tax-related processes that require a clear record of your income and tax compliance.