Navigating the complexities of payroll and tax compliance is a significant challenge for businesses. However, Taxumo’s Compensation Tab revolutionizes this process by offering a simplified solution to manage salaries and ensure adherence to the withholding tax on compensation regulations of the Bureau of Internal Revenue (BIR) with ease and efficiency. This guide will walk you through utilizing this powerful feature to maintain tax compliance effortlessly.

Efficient Salary Expense Management

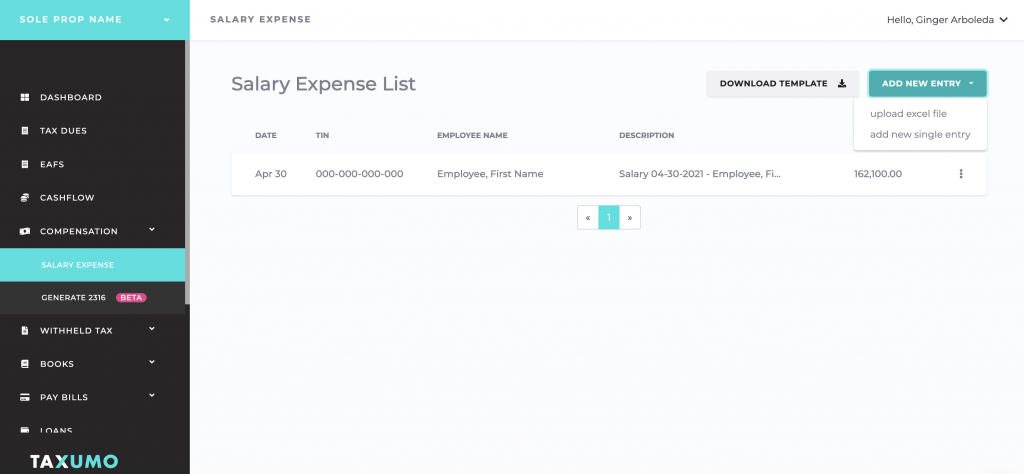

Taxumo’s Compensation Tab is designed to automate the payroll process, ensuring accurate management of employee salary expenses and the calculation of the withholding tax on compensation. Here’s how to leverage this feature:

Step 1: Recording Salary Expenses

- Individual Entries: For single entries, utilize the ‘ADD SINGLE ENTRY’ option for manual data input.

- Bulk Upload: To process multiple entries simultaneously, click ‘DOWNLOAD TEMPLATE’ to obtain the excel spreadsheet template, then choose ‘upload bulk entries via excel or spreadsheet’ after completion.

Step 2: Employee Information Input

For each entry, accurately fill in the employee’s details such as name, Tax Identification Number (TIN), and contact info in the designated ‘Employee Information’ section.

Step 3: Compensation Details

Precisely enter the salary details:

- Indicate if the employee is on a minimum wage.

- Input the posting date, salary period, basic salary, any 13th-month pay, and select the salary frequency.

Step 4: Include Allowance

Improve how you record employee allowances. Clearly state the type of allowance and its amount. Feel free to add extra tabs if needed.

Step 5: Adding Contributions

List any government contributions, specifying the type and amount for both employee and employer shares.

Step 6: Additional and Non-Taxable Compensation

Include any non-taxable benefits and additional compensations like hazard pay or overtime.

Step 7: Reviewing Compensation Summary

Verify all data to ensure the withholding tax on compensation is accurately computed.

Step 8: Finalizing and Submission

Submit the entry and view all recorded entries in the ‘Salary Expense’ tab. Use the ‘TaxumoEmployeePayrollTemplate.xlsx’ for bulk uploads.

Simplifying Form 2316 Creation

Form 2316, crucial for Philippine tax compliance, reflects an employee’s compensation and the withholding tax on compensation. Taxumo simplifies its generation:

Step 1: Accessing 2316 Records

Go to the ‘2316 beta’ tab in Taxumo to generate your employees’ 2316 forms.

Step 2: Preparing the Template

Download and fill in the Taxumo 2316 template with employee compensation details.

Step 3: Uploading the Template

Save your completed template and upload it in the ‘2316 Records’ section by clicking ‘UPLOAD TEMPLATE’.

Step 4: Generating 2316 Forms

Taxumo will then generate the 2316 forms for each employee, which are needed for tax filings.

Step 5: Form Review

Ensure the withholding tax on compensation is calculated correctly before distribution. If any errors pop up upon uploading the xls file, please check the error code and adjust your entries accordingly.

Step 6: Record Keeping

It’s recommended to download and keep a secure copy of all 2316 forms, both digitally and in print, for your records.

Taxumo’s Compensation Tab significantly eases the complexities of managing salaries and ensuring compliance with the withholding tax on compensation. With straightforward steps, you can keep your payroll precise and tax-ready, letting you focus more on growing your business while Taxumo handles the meticulous aspects of payroll and taxes effectively and simply.