Hello, April! April is also one of the busiest months here at the Taxumo Headquarters. And, you probably know the reason why… it’s because everyone’s thinking about their ITR.

Everyone’s scrambling and asking us how to prepare, file and pay for their Annual Income Tax. With this, to help you understand the 101s on filing your Annual Income Tax Return, we created this guide.

What is the Annual Income Tax Return or ITR for?

The Income Tax Return or ITR that most people refer to is actually the annual tax form that individuals file every April 15th of the following year. This form summarizes all of the income (or loss) you have incurred for the past year.

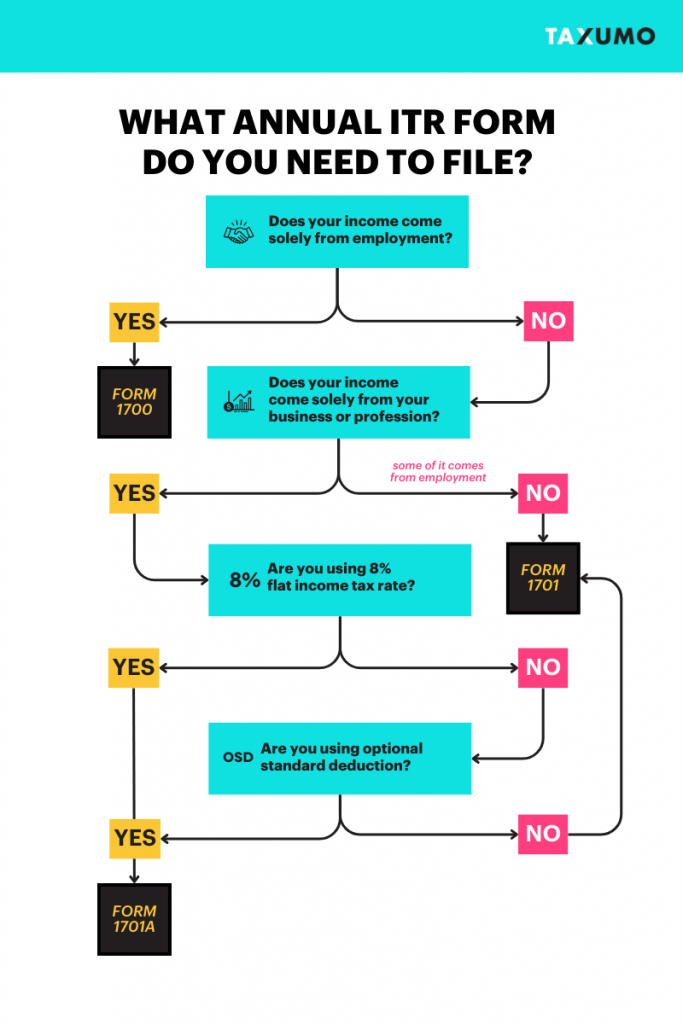

With the new Tax Reform Laws (TRAIN), there are now 3 types of forms available for you to file your annual ITR. Note that all these forms are NEW FORMS that were just recently launched.

- Form 1700 – Please use this form if you have no other sources of income other than employment income. With this form, you’ll need to add all employment income and deduct all payroll taxes withheld by your employer(s) and pay the remaining tax due (if any). Since this is used by individuals who had two or more employers within a year, they are no longer qualified for substituted filing (substituted filing means that the employer files taxes on your behalf).

- Form 1701 – Use this ITR form if 1) you are a mixed-income individual, meaning you are an employee AND also earning income from a business or side profession (ex. consultancy work, freelance writer, etc.) or 2) if you’ve chosen Graduated Tax rate with an Itemized Deduction Method

- Form 1701A –Use this form if you are earning purely business income or income from your profession. This is a new form released by the BIR for those who chose the Optional Standard Deduction Method (OSD) or opted in for 8% GRT in the previous year.

You can also refer to this handy flowchart that we made:

* Note: The Annual Income Tax Return (regardless of form) is just one of a series of quarterly tax forms you have to file. It is highly recommended that you also make sure you file your Quarterly Income Tax Forms aside from your Annual. You can read more about how to do so via Taxumo here.

Want to learn how to file your Quarterly Income Tax Forms using Taxumo?

Sign up for FREE to learn how!

I’m earning less than ₱250,000 annually

Under the new TRAIN law, those who earn less than ₱250,000 annually are exempt from paying income tax returns. So if you fall under this bracket, you don’t have to pay your annual ITR — BUT you still have to file.

My annual income is more than ₱250,000

The TRAIN law gives you two options for filing and computing your taxes. You can either follow the 3% percentage + income tax (use the graduated income tax table) or use the new 8% Gross Receipt Tax.

Now, the 8% Gross Receipt Tax might sound easier for you, but keep in mind that it’s not for everyone. To know if you’re making the right choice, check out this tax calculator that we made for you.

If you decide to use the 8% Flat tax rate, you can use the 1701A form in Taxumo.

How to compute your Annual Income Tax or ITR dues

Before you begin, you’ll need to check whether you’re on the 8% Income Tax Rate or the Graduated Income Tax Rate. The easiest way to do this is to check your Certificate of Registration from the BIR. This will indicate which tax schedule you’re on.

I’m on the 8% Income Tax Rate

- Income Solely from Business / Profession

Total Income Tax Due = 0.08 * (Gross Sales - ₱250,000)- Mixed Income Earner

Total Income Tax Due = (0.08 * Gross Sales) + Tax Due on CompensationAs you can see, the ₱250,000 deduction is NOT applied for Mixed-Income Earners. The reason for this is because the ₱250,000 has already been deducted from the tax due based on compensation so it no longer applies to the tax from your business.

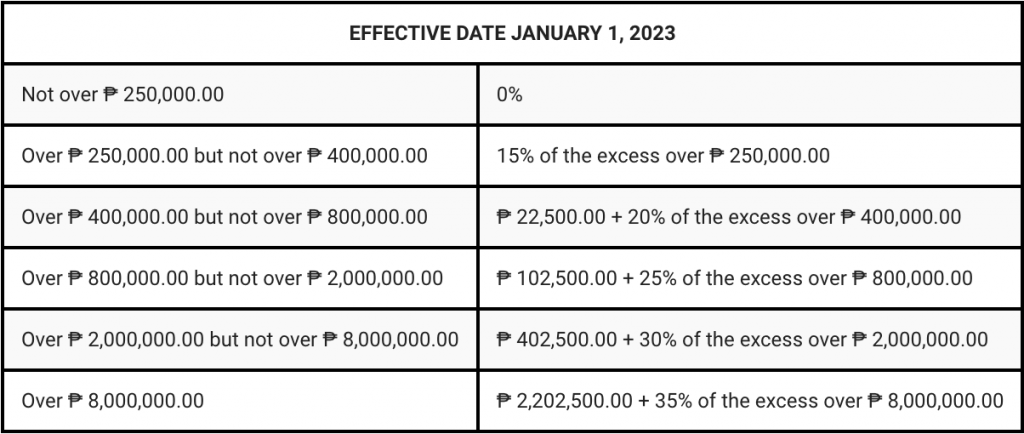

I’m on the Graduated Income Tax Rate

If you’re on the Graduated Income Tax Rate, you’ll need to check first whether you’re on Itemized Deduction or Optional Standard Deduction (OSD).

Here’s the difference between the two if you’re confused:

-

OSD: This allows you to claim a deduction of 40% from your gross sales or receipts for the quarter.

-

Itemized Deduction: You have to identify and deduct all the ordinary and necessary expenses from your gross income. These expenses must attribute to the development, management, and operation of your business like travel and salaries.

Take note that neither of these options is available for you if you opt for the 8% IT rate.

Now, both of the deductions have different formulas for computing your taxable income so check your Certificate of Registration to confirm which one applies to you.

With that being said, calculating your tax payable for Graduated Income Tax Rate takes two steps:

-

-

-

Compute your taxable income.

-

Based on the taxable income, refer to the tax table for how much tax you’ll need to pay.

-

-

Formulas for Taxable Income

- Itemized Deduction

Taxable Income = Gross Sales - Gross Purchases- Optional Standard Deduction

Taxable Income = Gross Sales * 60%

Computing for Tax Payable

Did you know that you can use Taxumo to automatically calculate your tax dues already? No need for you to compute manually. Sign up for FREE here to learn how.

Deadlines for filing BIR Form 1701, 1701A and 1700

We do recommend that you file your annual ITR as soon as possible to avoid any unforeseen problems.

What are the attachments required for filing ITR?

Here are the documents you’ll need to prepare:

-

- Certificate of Income Tax Withheld at Source (BIR Form 2307), if applicable.

- Certificate of Income Payments not Subjected to Withholding Tax (BIR Form 2304) if applicable.

- Duly approved Tax Debit Memo, if applicable.

- Previously filed return, if an amended return is filed for the same quarter.

Do I need to have a COR before I can use Taxumo?

Taxumo does not require you to upload your COR. This means you can already start filing even without your COR on hand.

When can I start using Taxumo for 1701 / 1701A / 1700 Forms?

1701A and 1701 forms are in the system already.

For 1700, you may email customercare@taxumo.com to request for this service. Kindly indicate 1700 Taxumo Service as the subject of your email.

How do I fill out the Fields in Taxumo for these forms?

Make sure that you have created an account in Taxumo. Uploading of the Certificate of Registration and the Signature is not necessary. What is necessary though is for you to have a subscription with Taxumo. Check out our plans and inclusions here: https://taxumo.com/pricing

For those who are new to Taxumo, make sure the you encoded the income and expenses for Quarter 4 of last year. Don’t worry, the form will ask you for income and expenses prior to that, too, if you don’t want to encode each and every entry in Taxumo.

If you have been a customer of Taxumo since the time you started your business, then you’ll have the details automatically shown in the Annual Income Tax form. If you just shifted or will shift to Taxumo, have your past Quarterly Income tax forms by by your side as you fill out the form.

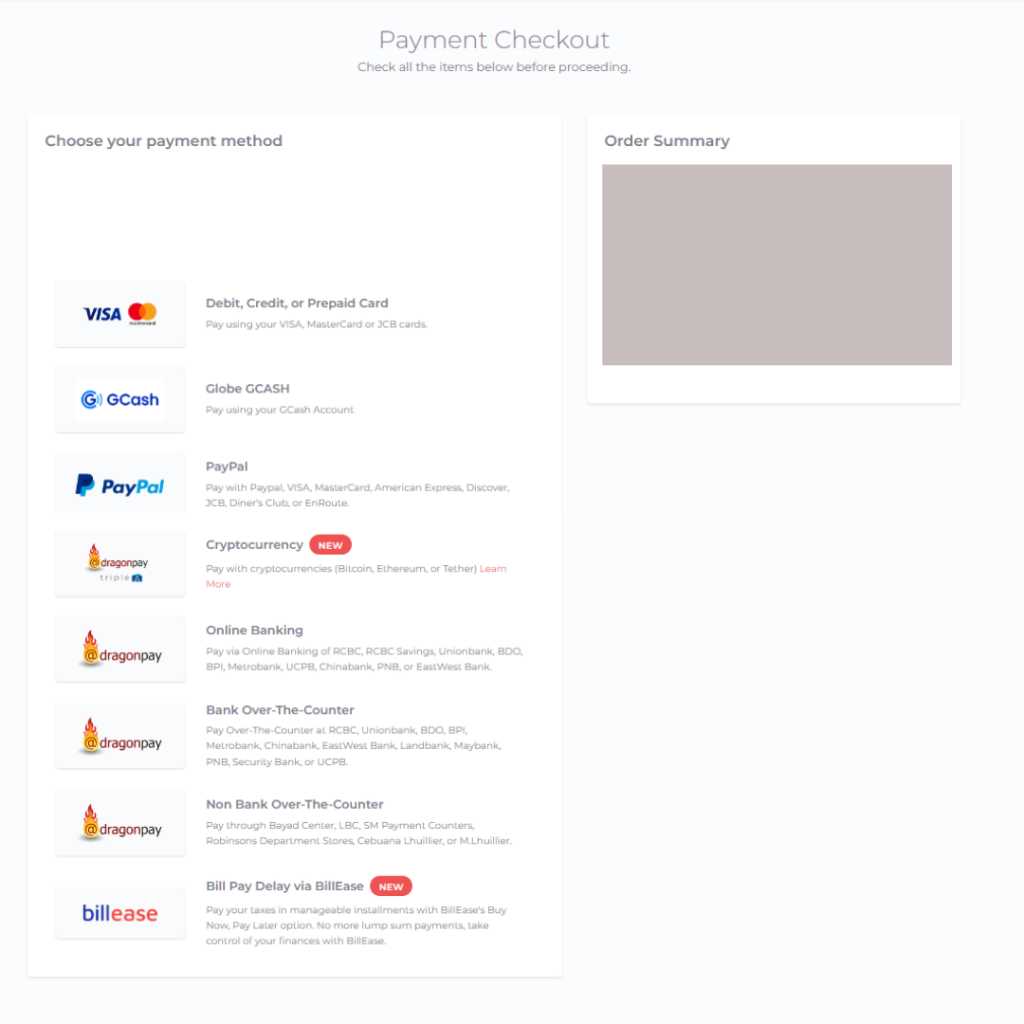

Do I need to fill out the form in eBIR Forms?

If you use Taxumo, no need to fill out the forms in eBIR Forms. You will be able to access your BIR confirmation in your past filings tab. You will also be able to pay for your taxes using the different payment channels that we have provided. You can then access the copy of your payment record in your past filings tab.

So again, these are the things that you can download and keep a copy of which you can get from your TAX DUES > PAST FILINGS Tab:

- Copy of your filled out tax form (1701A or 1701)

- Copy of your BIR Confirmation

- Copy of your payment record (if you had tax dues to pay for 1701A or 1701

Do I need to have the form stamped?

It is not required (if you are not submitting an Audited Financial Statement or AFS) along with your forms. However, if you really really want to have a “Stamped Form”, print out a copy of these forms:

-

Copy of your filled out tax form (1701A or 1701)

-

Copy of your BIR Confirmation

-

Copy of your payment record (if you had tax dues to pay for 1701A or 1701

-

Request for the SAWT confirmation (from Taxumo) via customercare@taxumo.com and print it out

-

Collate all 2307 or Creditable withheld tax certificates that you have received

How much is Taxumo's ITR Preparation service?

- For 1700: The service fee is Php2,000 (VAT-inclusive). This covers computation, filing, and remittance of your tax dues (if any). Get your quote and assistance in filing here.

- For 1701A and 1700: Preparation, filing and payment is included in all subscription plan.

When do I get a BIR Confirmation?

You will get a BIR Confirmation one week after the Taxumo filing deadlines. Read HERE for more information about the confirmation that you will receive. Note that for “peak seasons” for tax filing, the BIR may send us delayed confirmations, but rest assured that Taxumo will always help follow this up with them. We go the extra mile for our subscribers!

Here are the Taxumo deadlines you have to take note of:

-

1701 and 1701A – Taxumo’s deadline is on April 11, 2024

-

1700 – Taxumo’s deadline for submission of requests and payments is on April 11, 2024

To be clear, you can still file AFTER these dates — penalty calculations of the BIR will be included though as Taxumo will assume the filing will happen after the April 15 deadline of the BIR.

When I use Taxumo for filing and paying for my 1701 and 1701A, when do I know that Taxumo has submitted or filed my form to the BIR?

After you have submitted your tax form via Taxumo, you will see the form’s progress in the “Past Filings” tab. This is where you will get the BIR Email Confirmation and the Payment record.

The status will be “Completed” within a week after the Taxumo deadline of filing. We highly encourage you to FILE EARLY.

If you have other questions about your Annual Income Tax, please do chat with us by pressing the chat button on the lower right side of this page.

Happy Filing!

File your Annual ITR now:

subscribe to a Taxumo Subscription Plan today.

Hi. I’m a property specialist(agent) and I’m a non vat sales personnel. I already have 2307 from my company and planning to get ITR for 2019. Kindly send me all the documents needed and fees for the said ITR processing.thanks

Hi Bryan! We sent you an email 🙂

Sir,nag process Po Ako ng ITR ko kasi need ko for loan sa pag ibig at nagpagawa Ako ng ITR at Napa stamp ko n Po Ang kaso late ko n napansin n 00 pla Ang nakalagay sa form kaya ang Sabi file ulit Ako ng amended return,Ang tanong ko Po need ko 0o b magbayad p kahit percentage tax payer Po Ako.

Can I ask how to properly fill out the 1700 form. I have my 2 previous employer. And upon filling out the form by the downloaded eBIR form, there are fields there that should only be filled out. What should I do? one of my colleagues says that it should be 0.

how to get my tin number?

how to get my tin number?

Hi, I had 2 employers within the 2019 calendar year, could you help me how to file BIR 1700?

ask ko lang po. 1) last year ang gamit ko is 1701 this year 2020 ang file na ng accountant para sa akin is form 1701A. does it make differece, although tama din na naman na purely sa negosyo lang ung tax (non vat single prop) 2) may problem kaya un sa COR kasi nakalagay sa COR ko is 1701 and 1701Q ang mga activities. 3) paano po kaya iyon. salamat po sa reply

Baka nag opt yung accountant mo ng 8% in lieu kaya naging 1701a na yung in-file nya. Sa akin kasi pina-8% ko pero hindi nila binago yung cor ko. May note nalang sa baba ng cor ko na nag avail ako ng 8%.. ask mo sa iyong accountant..

Pingback: May 2020 Annual ITR (1701 and 1701A) Filing, Now More Affordable & Easier with Taxumo | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: Guide for BIR Form 2307 for Tax Computation in the Philippines | Taxumo Blog

Pingback: How To File BIR Form 1701Q (A Complete Guide For 2020)

Greetings! I am a student and I need my parent’s non filling income tax return to apply for a scholarship. We have sa sari-sari store. How can I get a certificate?Thanks you!

Hi, good day, is filing of AFS financial statements mandatory for proprietorship? When it is required? Thanks

What will happen if i dont pay annual registration fee but filed my ITR?

Hi, after filling my 1701A using eBIR and getting the stamp at my RDO, do I still need to upload it somewhere allong with the required attachments. Where should I upload it in case it is needed?

Good pm, how to file 1701 if you have to business plus 2316 tnk u

Good pm, how to file 1701 if you have 2 business plus 2316 tnk u

I’m a household worker here in the Philippines and i need an ITR to for my application abroad. Ano po ang mga kailangan kong i-file?

Hello Taxumo Team!

I hope you are doing well and safe.

If we choose to avail the “Portion of Tax Payable Allowed for Installment” option when filing the 1701A form, how do we pay for the second installment, or what form should we use?

Thank you for your time.

Best Regards,

Filipino Tax Payer

If i’m a freelancer/self employed now but employed Q1 earlier this year, am I considered mixed income earner?

Yes, when you file for your 2021 Annual ITR you need to indicate that you are a mixed-income earner. Then for 2022, you may file as purely earning from business/profession.

Pingback: (2022 Updated) BIR Form 1701: How To File & Pay Annual Income Tax

hi po. what could be the consequences if incorrectly filled out the BIR form 1701 that instead to have a zero tax due, it resulted to an overpayment?

hi po. what could be the consequences if incorrectly filled out the BIR form 1701 that instead to have a zero tax due, it resulted to an overpayment?

Hello Charlene,

Great day!

Have you filed this via Taxumo? Please send us an email to customercare@taxumo.com so we can assist you accordingly.

Thank you!

I have a question, If I’m a mix income earner will there be issues or updates that my main employer will see or need to update if I file 1701 voluntarily?

Hello Ev,

We would like to know more about this. Can you send us an email via customercare@taxumo.com or via chat on our website?

Thank you and we look forward to hearing from you! 🙂

Hi I’m a freelancer and I just received my COR last January 23. Can I still file my taxes for 2022 of there will be a penalty if it exceeds 250k?

Hello Jen,

Yes you can still file for late filings for the year 2022. However, there are already penalty fees since the tax filings were not done on time.

Can I ask for online filing of 1701A?

Hello Dan,

Yes you can definitely file it online and you may file it via Taxuumo. Please send us an email via customercare@taxumo.com so we can discuss further. 🙂

Thank you!

I have question regarding deductions like SSS, Philhealth and Pag-ibig can this contributions be less when filling 1701a under 8% Income Tax Rate?

Hello Anne,

Basically, when you’re under the 8% income tax rate type, you’re already exempted to pay for percentage tax. Thus, your expenses won’t matter with the computation of your income tax 🙂

How can I file 1701

Hello Natasha,

We’d be happy to assist you on this. Can you send us a copy of your certificate of registration via customercare@taxumo.com. We would like to double check which Annual ITR do you need to file. If it’s 1701 or 1701A.

Thank you!:)

Hi,

If I’m a professional opting for the 8% tax and I decide to file jointly with my spouse, will our deduction be p500k since both of us are combined?

Thanks!

Hi Taxumo,

Do I need to submit the BIR Form 1700 and my proof of online payment to BIR?

Hello Che,

No need to submit it directly to BIR if you processed it via Taxumo. Your next step is to submit it via eAFS portal: https://eafs.bir.gov.ph/eafs/

Here’s the step-by-step guide on how you can submit your attachments thru eAFS webpage: http://help.taxumo.com/en/articles/4196871-submission-of-attachments-via-the-eafs-submission-portal

Sir,nag process Po Ako ng ITR ko kasi need ko for loan sa pag ibig at nagpagawa Ako ng ITR at Napa stamp ko n Po Ang kaso late ko n napansin n 00 pla Ang nakalagay sa form kaya ang Sabi file ulit Ako ng amended return,Ang tanong ko Po need ko 0o b magbayad p kahit percentage tax payer Po Ako.

Hello Taxumo, I came across with your blog. I am earning 250k below. I’ve read about being exempted for paying the 8% tax but need to file my itr. My question are 1. How to file ? it is ive scanned the forms and I’m overwhelmed with all of it. 2. Do I need to pay penalties since i am already late with the deadline.

Thank you so much for the time.

Hello Princess,

Good day!

May we ask if you’re already registered in BIR and have a form 2303? If not yet, then that is the first step that you should do so you’ll know what forms are you required to file and how often should you file it.

If you are already registered, all you have to do in Taxumo is to set up an account and input your Taxpayer’s Details including the Business Profile for the year your are filing for on the SETTINGS and the platform will automatically fill-out your form for you.

With this, you will be selecting the tax forms that you intend to file for each year.

Then you can input the Income and Expenses for the period you intend to file taxes for on CASH FLOW. You can also upload any 2307s issued to you if you have them.

Then you can go to TAX DUES>Current Filings and find the tax card you intend to file. Each tax card will show you the tax due and the penalty computation for late filings. You can click “File Now” and pay through the payment channels you can choose from. 🙂

For the penalty inquiry, please note that our tax obligation starts upon our registration with BIR. If you are not yet registered, then you do not need to worry about the filings that you are unable to comply prior your official registration date. But we highly recommend that you register now as there is a possibility of having penalties for late registration. 🙂

Filing my annual ITR has always been a daunting task, but your blog post has made it much easier to understand. I appreciate the detailed explanations of Forms 1700, 1701, and 1701A and the specific situations where each should be used. The new Tax Reform Laws can be confusing, so having resources like Taxumo to guide us through the process is invaluable.

Hello!

Thank you for your kind feedback! We’re thrilled to hear that our blog post has made filing your annual ITR easier for you. We understand that navigating the complexities of tax laws can be daunting, especially with the recent Tax Reform Laws. We strive to provide clear and detailed explanations of the different forms and their applicable situations. We’re glad to be a helpful resource for you, and if you have any further questions or need assistance, please don’t hesitate to reach out.

Thank you for offering such valuable insights into the world of personal income tax. Your post covers a lot of ground and provides practical tips for optimizing our tax situations. I’ve always been unsure about whether I should hire a personal income tax service, but now I can see the benefits of having professional assistance to navigate through the complexities of the tax system.

Hello Ashikur,

Good day!

We sincerely appreciate your generous compliment! Rest assured, we are committed to delivering a seamless tax filing service not only to you but to all taxpayers and business owners who require our assistance. 🙂

As a small business owner, tax season can be overwhelming. Your post has motivated me to explore tax services tailored to businesses. It’s time to streamline and optimize the process. Thanks for the advice!

Hello Arafat,

We’re thrilled to hear that our post resonated with you! Tackling taxes as a small business owner can indeed be a mountain, but finding tailored tax services is a game-changer. Here’s to streamlining and optimizing – may your tax season be smooth sailing from now on! If you have any questions along the way, feel free to reach out. Cheers to financial efficiency! 🚀💼

Hi I just want to ask? What are the taxes need to be paid by an insurance agent. Can he/she opt to pay 8% tax? Thank you

Hello Norms,

The first thing that you should do to manage your taxes is to have yourself registered in BIR. Let me share with you an article written by our COO, Ginger Arboleda. This article will answer freelancers’ frequently asked questions. https://mommyginger.com/freelancers-questions-taxation-answered.html. You may also check on the attached guide on how to register as a professional or non-licensed professional.

https://drive.google.com/file/d/1-B-sWecmyrTOAfP_HsARKIydvgk-5qad/view

Thank you! 🙂

hello taxumo,

our small business, a sole proprietorship is already enrolled in efps. but am confused in filing 1701 since if i clicked the icon on taxable year in the efps web, it is only up to year 2017, no year follows afterwards.

if we’ll source out your services, what are the docs you’ll be needing then? Thanks

Hello Ness,

Good day!

Regretfully, we do not have any access to efps as we are only integrated to ebirforms system. We can have you referred to our CPA partners but the pricing for the service will be issued by them and it will be based on your location and the service that you need. 🙂

Hello. This is more of a consultation hope you can still assist. Back in 2022, mid-year I was transferred from Company A to a sister company Company B. Last year, I was told by HR that we would be filing Form 1700 instead of 2316 due to the movement but since it was considered an internal transfer, they offered to file it for me. A few days later I received an email confirmation from BIR and HR sent me a copy of the 1700 form that they submitted.

Fast forward to today, I was reviewing my 1700 from 2022 and noticed that there is a 1 peso payable! Turns out this can happen as the 1700 has a rounding mechanic which doesn’t allow for centavo inputs and asks you to round it up or down. I didn’t check it anymore last year as I had already reviewed the 2316 forms and the 1700 was sent to me after it had already been filed. HR also didn’t mention anything when they sent the file.

Technically the full correct amount was paid/withheld down to the centavos as can be seen in the 2316 forms. But this 1 peso payable exists in the 1700 due to the rounding mechanic. Any thoughts on what I should do (if any)? I assume this happens to a lot to people who file using 1700. Many thanks!

Hello Lenny,

To ensure accuracy and compliance, you may consider the following steps:

Consult HR or a Tax Professional: Reach out to your HR department or consult with a tax professional to confirm whether action is necessary. They can provide guidance on whether this discrepancy needs to be addressed formally with the BIR.

Review BIR Guidelines: Check the BIR guidelines or regulations regarding rounding mechanics for tax filings. This will help you understand if the one-peso discrepancy is a common occurrence and if there are any specific procedures to rectify it.

Assess Impact: Determine if the one-peso discrepancy has any practical implications. If the correct amount was indeed paid and withheld, and this discrepancy is merely a result of rounding mechanics, it may not warrant any action.

Documentation: Keep documentation of your review process and any correspondence with HR or tax professionals regarding this matter. This will serve as evidence of your diligence in addressing the discrepancy, if ever questioned in the future.

Optional: Inform HR: While not necessarily required, you may choose to inform HR of the discrepancy for their records. They may appreciate the notification and may have internal procedures for handling such cases.

Overall, given the minor nature of the discrepancy and the fact that the correct amount was paid and withheld, it’s unlikely to have significant repercussions. However, consulting with HR or a tax professional can provide peace of mind and ensure full compliance with tax regulations.

Pingback: A Guide to Filing Your 2024 ITR in the Philippines | Taxumo - File & Pay Your Taxes in Minutes!

Hello, does Taxumo accomodate late filings? I just need help to file things since I wasn’t able to file close my status as mixed income earner since 2015. I have been an employee since 2016 and have no knowledge about closing my status since 2015.

Hello Jess,

We’d be happy to discuss this further with you. Can you send us an email via customercare@taxumo.com?

Thank you!

Hi Taxumo,

I have been a mixed income earner just last year, I still have employer and I do consulting as a sideline since I am a professional Engineer. I saw in our payslip before from My first employer (2019-2021) that I have been deducted with tax since i am earning beyond 250k due to Overtime wages. Now that I am back to earning below the 250k bracket, I havent been taxed by my current employer. I wanted to start filing my ITR but I don’t know where to start. Can you help me with that po?

Hi Myra! If you are a mixed income earner, you can use Taxumo. All you need to do is get a copy of your 2316 and then add the information in that form when you’re filing your ITR in Taxumo 🙂 For more questions, best to chat with us at customercare@taxumo.com 🙂

Hi!

Just wanna ask, we’re trying to file 1701A, and when we submitted the physical documents to BIR, they were asking for a confirmation sheet. Where are we supposed to get this? For context, this is a delayed filing with penalty. We cannot pay because the confirmation is missing.

I hope you can help! BIR employees aren’t of any assistance, and we’ve been going back and forth because of them.

Thanks!

Hello Chi,

If you filed your form 1701A online and is trying to pay the tax dues and penalty fee via your RDO, you should have a BIR confirmation email sent to your email for the filed form 1701A. Then once you already have your form and email confirmation from your online filing, that is the time that you can pay for your tax dues and penalty fee via the Authorized Agent Banks or the ePay Payment Facilities of BIR. 🙂

Pingback: How to Transfer Your RDO Using BIR Form 1905 (Updated for 2021)

Pingback: Should You Get a Tax Refund? | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: Discover the Unmatched Benefits of Taxumo's Features | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: Filipino Freelancer Tax Guide 2023: File Your ITR this 2024 | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: #FinishStrong: Ending your Business Year Right (and Filing your Annual ITR on time!) | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: How to submit attachments to Annual ITR using eAFS | Taxumo Blog

Pingback: How to Make Your Biz Pandemic-Proof (& Still Pay Your Taxes)

good day! can I still opt to 40% osd in 1701 if my last 3 quarter filing (1701q) -itemized deductions? thank you

Hi Michelle! You can only change your tax rate and even the deduction method at the beginning of the taxable year. If you started the year using the Graduated income tax table – itemized deductions, you will have to continue that until you pay the Annual income tax return. For Q1, you can change your deduction method to OSD na 🙂

HiHi po sana may makatulong

I been working as contractor po for 1 year now. Its my first time po na mav wrok as contractor im earning po 40k, direct sa bank account ko ang sahod. Then this week ko lang nalamn na i need pala ng ITR noon hinanapan ako ng agent para sa visa ko. May penalty po ba ako don non filing ng tax ko. I want to register na po sana this month pede ba na wag ko na mention na i started work last year pa and apply ako this month.

Sana po may makatulong as wala po talaga ako idea.

Thank you

Kindly message customercare@taxumo.com so that they can help you with this. 🙂

Hi May I know what amount should I file for May 15, 2024? Kasi po ung for filing this May 15 (1701Q) is for January – March 2024 sales however, COR was only received this April, should we file zero amount lang ilalagay sa sales at expenses? Please reply, really need advise on this. Thank you!

Hello Thea,

You can file a zero declaration po muna for your Q1 income tax since your income started ng Q2 (April). 🙂

Hi!

I am a BIR registered Professional. However, last few years, I have no earnings from Professional Fee but my earnings come solely from employment.

What BIR annual form shall I use? I only have one employer. Shall I use 1701 and just put in zero for professional income?

Thank you in advance for your advice.

Hi Lei! Even if you have no earnings, you will still need to file your income tax on a quarterly basis. For the form to be used, if you missed filing quarterly forms, kindly file these and pay the penalties and compromise fees and use Form 1701 and yes, just place zero as your professional income.

You may want to check out Taxumo Timeout if your professional business is non operational at the moment 🙂 It might be a solution that’s fit for you.

good afternoon sir/maam:

may i ask, what is SAWT VALIDATION from BIR? And further said that, “please be guided that the generated/dat file should be attached. please delete all special characters in your data.” Before this, we have the Tax Receipt Confirmation- submitted 1701A(2 pages) and 4-2307 forms as attachments as Consultant. We have overpaymnt of taxes due-p38,500-p48t=(p9,5000). Do we have to submit the docs at the RD concern? We tried to submit the docs, BIR said its lacking example alphalist etc. Please send us the opinions/advices. THANK U & MORE POWER.

Hi Leno! As an attachment to your ITR filing, you will need to submit an SAWT .dat file to the BIR if you had 2307 forms declared in the computation of your income tax return. You will need to edit your file and follow the instructions indicated and resubmit.

This is one of the advantages of using Taxumo. That file is submitted to BIR already together with your income tax filing and you will receive the validation via your Taxumo account. Join Taxumo’s FREE onboarding or tutorial session to learn more. 🙂

Pingback: Understanding the 2303 BIR Form: A Guide to the Certificate of Registration in the Philippines | Taxumo - File & Pay Your Taxes in Minutes!

new chocolates trading business june 2024 registered (BIR 2303 COR). 1st time to file for April 25 deadline. should i use 1701 or 1701A?

Hi there! April 25 is the deadline for VAT or Percentage taxes. The Annual Income tax due date was last April 15 🙂 Hope this clarifies everything 🙂