Taking on a new career path as your own boss, whether as a freelancer, licensed professional, or entrepreneur, is thrilling. To ensure your financial affairs start on the right foot, a crucial initial step is to transfer your RDO – moving it from your employer’s RDO to one that reflects your current working status. This guide simplifies the Transfer RDO process, leveraging BIR Form 1905 for a hassle-free update.

Steps to Seamlessly Transfer Your RDO

Discover Your Current RDO: Identify where your Tax Identification Number (TIN) is registered, usually under your previous employer’s RDO. For confirmation, the easiest way is to chat with Revie. Revie is the chatbot of BIR in their site (lower right side of the screen). You can check it out here: https://www.bir.gov.ph/

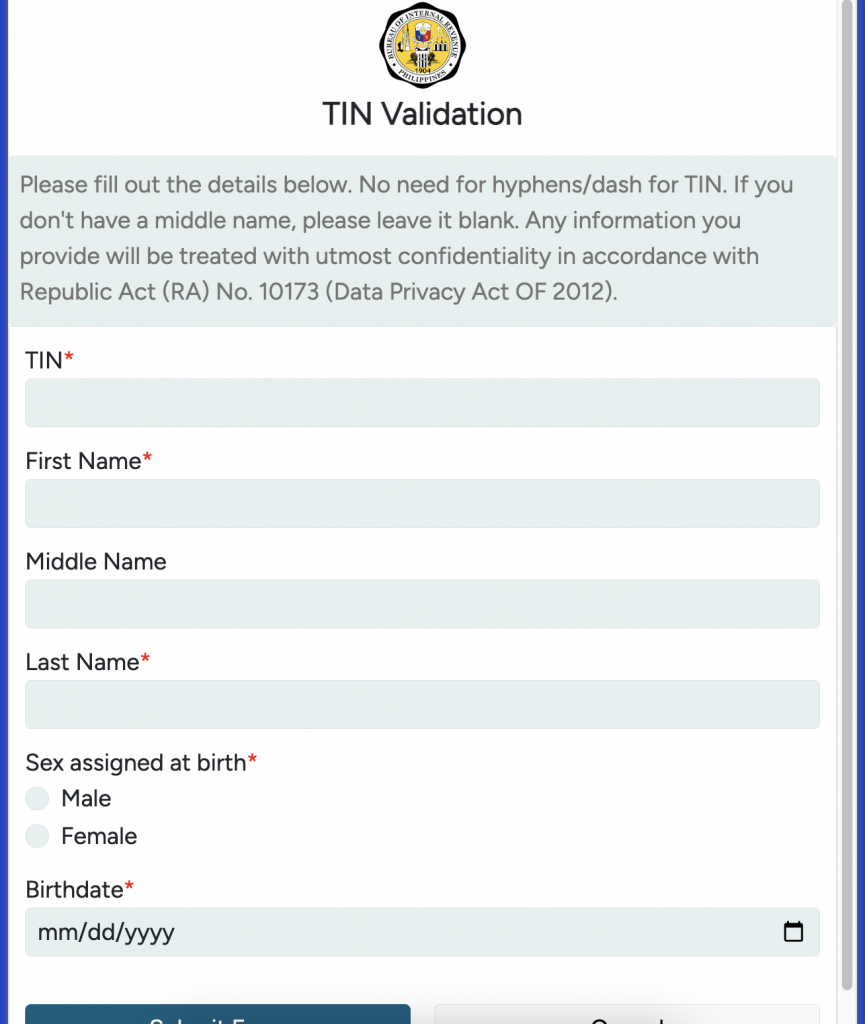

Click on TIN Validation and then fill out with the information needed.

If this doesn’t work, you can contact the BIR Contact Center at numbers such as 981-7003 or 981-7046, or visit the nearest RDO for immediate assistance.

Fill Out BIR Form 1905: If you need to transfer RDO, start with this. Access and complete the BIR Form 1905, ensuring you download the latest version from the BIR website. Key sections include:

- Part I: Taxpayer Information – Fill in your TIN, RDO Code, contact details, and registered name.

- Part II: Change in Registered Address – In Section 7, select “Correction/Change/Update of Registration Information,” specifying if you’re moving to a new RDO or updating your address within the same RDO. Provide your new address details, including zip code and telephone number.

Submit the Form to Your Previous RDO: Hand in the completed BIR Form 1905 to your old RDO for processing, which typically takes about a week or two. Following this, your TIN will be registered under your new RDO, marking a pivotal step in legitimizing your business or professional endeavors.

Additional Steps Post-Transfer

After successfully transferring your RDO, take the next steps for registration. Fill out BIR Form 1901 as a professional or business. Then, secure your Certificate of Registration (COR). Get your official invoices and account books stamped. With your COR and stamped documents, you are ready to file taxes. This includes the annual income tax returns.

Transferring RDO Online

Currently, the BIR does not offer an online option for RDO transfers. This process requires direct submission of the BIR Form 1905 to your current (old) RDO for processing. If you need help submitting this form to the BIR, just send a message to customercare@taxumo.com for assistance.

Streamlining Your Business Registration

Transitioning to a new RDO is just the beginning. For those looking to focus more on business growth and less on bureaucratic processes, consider using the services of Taxumo partner CPAs. For manual and on ground services like business registration, we have CPA partners and processors to help you out. All you need to do is visit Taxumo.com and use the chat box to inquire and be matched to a partner. This service simplifies business registration, allowing you more time to dedicate to your business’s success.

Once you have successfully moved your RDO designation, take the time to kickstart the digital way of filing and paying your taxes. Create a FREE Taxumo account and experience a new world of automated taxation. Visit www.taxumo.com