In the realm of business operations, understanding and managing tax obligations are crucial components of success and legal compliance. One essential document that plays a pivotal role in this process is BIR Form 2316. This form is integral for employers in the Philippines, serving as a certificate that details an employee’s compensation and tax withheld within a calendar year. Here’s what you need to know about this form, including the compliance steps for hiring and maintaining an employee.

What is BIR Form 2316?

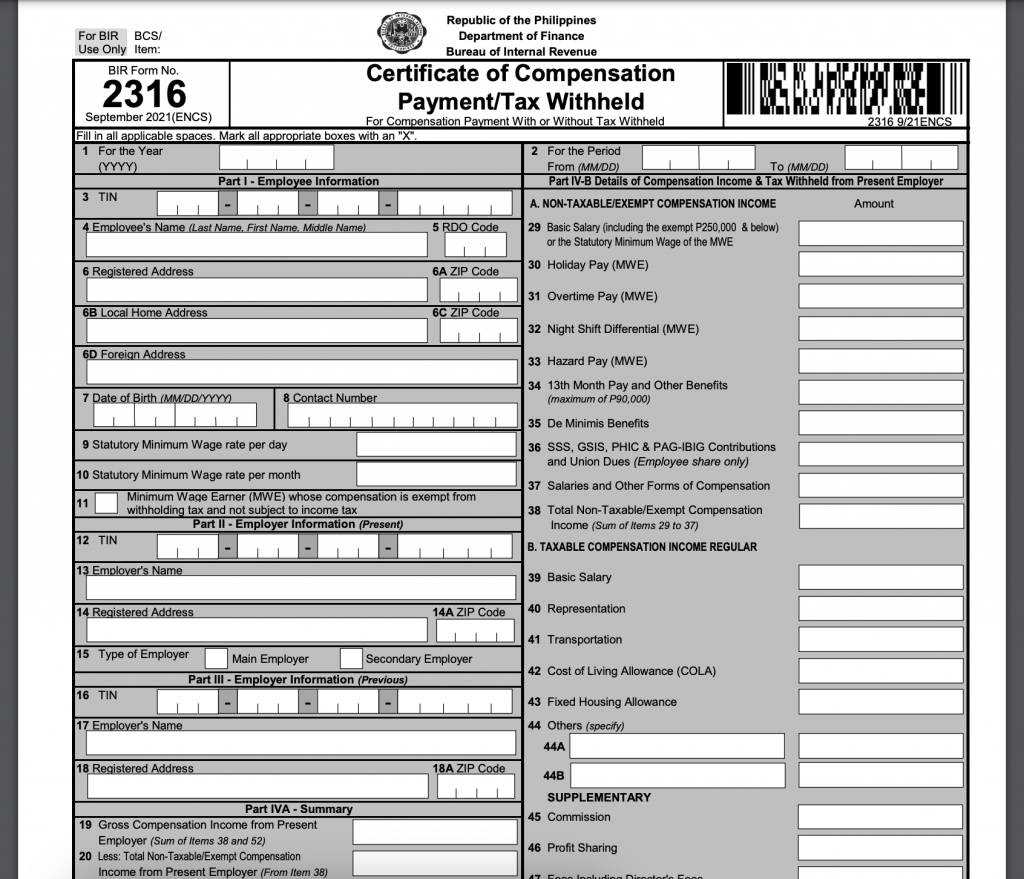

BIR Form 2316, known as the Certificate of Compensation Payment/Tax Withheld, is a document issued by employers to each employee whose income is subjected to final tax declaration. This form not only summarizes the amount of compensation paid to the employee but also details the taxes withheld by the employer throughout the taxable year. For employees, this form is crucial when filing their annual income tax returns, serving as proof of income and taxes paid.

Compliance Steps for Employers

Understanding and correctly managing the process surrounding BIR Form 2316 is a testament to an employer’s commitment to lawful business practices and the welfare of their employees. Here are the key compliance steps involved:

1. Upon Hiring an Employee

- TIN Verification: Ensure that every new hire has a Tax Identification Number (TIN). If not, assist them in applying for one with the BIR. Here are the steps to verify your TIN:

- Employee Registration: Register the employee with the BIR, detailing their employment in your company. For guidance, you can have your employee read this: The Essential Guide on How to Get TIN Number for Employees

2. Throughout the Employment Period

- Withholding Taxes: Diligently withhold the correct amount of taxes from the employee’s salary based on the BIR’s withholding tax table.

- Monthly Remittance: Remit these withheld taxes to the BIR using BIR Form 1601-C on or before the 10th day of the following month.

3. End of the Fiscal Year

- Prepare BIR Form 2316: For each employee, fill out this form, accurately reporting their total compensation and the taxes withheld throughout the year.

- Distribution: Distribute the completed BIR Form 2316 to all employees on or before January 31st of the following year.

- Submission to BIR: Submit a copy of all issued BIR Form 2316 to the BIR, accompanied by the Annual Information Return of Income Taxes Withheld on Compensation and Final Withholding Taxes (BIR Form 1604-C) on or before February 28th of the following year. For 2024, BIR actually moved the deadline. to know more about it, refer to this BIR Circular: RMC No. 29-2024

Best Practices for Employers

- Keep Accurate Records: Maintain detailed payroll records to ensure accurate tax withholding and reporting.

- Stay Updated: Keep abreast of any changes in tax laws and BIR regulations to ensure compliance.

- Employee Orientation: Educate your employees about their tax obligations and the importance of BIR Form 2316 for their tax filings.

Conclusion

BIR Form 2316 is more than just a document; it’s a critical component of your business’s compliance with Philippine tax laws. Additionally, it serves as a reflection of your commitment to your employees’ welfare. By adhering to the steps outlined above, you can ensure a smooth process for issuing this important form, thereby upholding your duties as a responsible employer.

Understanding and implementing these guidelines around BIR Form 2316 will streamline your tax compliance efforts, ensuring that both you and your employees are well-informed and prepared for tax season.

Are you looking for a form generator for the form 2316?

Send us a message at customercare@taxumo.com

Pingback: Payroll and Tax Compliance streamlined with Taxumo's Compensation Tab