Throughout the years, changes have been implemented to the country’s tax systems to ensure fairness and efficiency. In addition to updating guidelines for tax filing, the Bureau of International Revenue (BIR) has introduced new forms as well.

Today, we’re highlighting one of the latest forms introduced by the BIR: Form 0619E or the Monthly Remittance Form of Income Tax Withheld (Expanded).

What is BIR Form 0619E?

BIR released Forms Package Version 7.1 back in May 2018. The three different forms on this package include forms 0619F, the updated 1701Q, and 0619E.

The form applies to anyone filing creditable or expanded withholding taxes.

Unlike withholding tax on compensation, expanded withholding taxes apply to certain incomes where there’s no employee-employer present. Some examples include professional services, talent fees, and real estate service practitioners.

Who is required to file BIR Form 0619E?

Based on the definition of EWT, the entities required to file BIR Form 0619E are withholding agents. As a withholding agent, you’re also required to remit the total tax amount to the government.

Note that withholding agents can also apply to self-employed individuals since they’re not signed to a specific employer. If you happen to be self-employed – all income you gain from your profession is subject to 8% tax rate as opposed to the previous 10% to 15%.

If you’re a mixed income earner, you’re also required to file your expanded taxes using BIR Form 0619E.

Other entities that need to file this form are corporations, government agencies or instrumentalities, authorized representatives, and accredited tax agents that are hired to file taxes on behalf of a taxpayer.

When do I need to file BIR Form 0619E?

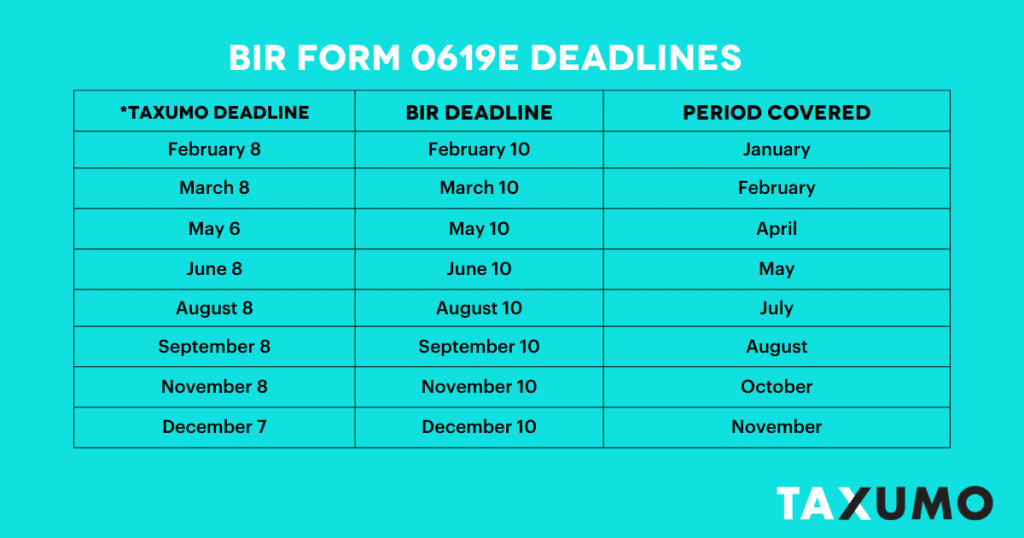

BIR Form 0619E is to be filed in the first 2 months of each quarter:

Note that you won’t be able to file this form during the months of March, June, September, and December. You will have to use the BIR Form 0619F instead, which is for your final withholding tax.

*Taxumo’s deadlines are marked a few days before BIR’s deadline. This is to ensure that you never miss out on submitting your taxes!

Where do I submit BIR Form 0619E?

The BIR Form 0619E must be filed with an Authorized Agent Bank (AAB) located within the jurisdiction of the Revenue District Office (RDO). If there are no AABs within the area, then the form must be filed with a Revenue Collection Officer (RCO) of the RDO who will issue an Electronic Revenue Official Receipt (eROR).

If you’re planning on filing with an AAB, make sure to accomplish and submit a BIR-prescribed deposit slip to validate your remittance. Bank tellers use a machine to do this and also stamp the form with the word ‘received’ as evidence.

You can also opt for online payment/remittance via online banking or accredited tax compliance platforms like Taxumo.

Penalties for Improper Filing

If you fail to submit the BIR Form 0619E or violate any withholding tax provisions, you will be penalized. The penalties will be in the form of heavy fines – depending on the scale of the violation.

- Failure to file any form and pay any amount – installment or due – on or before the deadline will receive a surcharge of 25%.

- The same penalty (25% surcharge) is also imposed for filing a form with an individual that is not authorized to perform such actions and for failure to remit the deficiency tax within the time prescribed.

- A surcharge that amounts to 50% is imposed upon individuals who neglect to file the form or commit tax fraud.

There are other penalties, but it’s best to avoid them altogether and file your expanded withholding taxes appropriately.

Key Takeaway

The country’s tax system will keep updating, so it’s crucial to be in the loop to avoid any penalties. To save time and increase efficiency, sign up for a tax app that keeps you updated on your tax dues.

Taxumo is a BIR-accredited tax automation platform. You can sign up for free and start exploring its many features to make filing taxes a worry-free experience.

Dear Evan, I looked up your site to find out about the actual due date. Now all I can read is either the 10th OR the 15th. Which one is it and when – you may add this to your article.

Need to know more about bir forms and deadline

Hello Maria,

Great day!

You may send us a message to customercare@taxumo.com so we can further discuss this with you. Thank you and we shall be waiting for your email. 🙂

What if the actual deadline falls on a weekend say for example for Group E Tax EFPS tax filers, the due date is 11th and it falls on a Saturday, will it move to Monday (13th)? or not?

Thank you!

Hi Cath,

Yes, it will be moved on the next business day 🙂

Hello.i have question, what if the landlord of the building refuses to have the 5% deduction? Do i have to pay the 5% on top of my rent? Thank you in advance for answering.

Hello Juan,

Yes, the renter will have to add on 5% (by dividing the net amount paid by 0.95) to show that they withheld 5% from the payment. If he wants to declare the rent as an expense, he has to show that she is withholding.

Example: If they are paying the landlord PHP 100 in cash, then they need to show the BIR that this is the net amount. That means they also need to declare that they withheld PHP 5.26 (PHP 105.26 = P100 cash + P5.26 EWT).

Hope this clarifies 🙂

Hi, what if I mistakenly paid and filed for 0619E instead of 1601EQ? Do I need to pay again or should I just amend the form?

Hello Raisa,

I think you should file for both forms because the EWT is filed monthly and quarterly. I would be happy to assist you further if you can send a copy of your COR(just over the other confidential details such as your name, address and etc) via the chatbox of Taxumo or via email at customercare@taxumo.com

Thank you and hope to talk to you soon! 🙂

May i ask, when can I report and file taxes withheld covering the months of March, June and September using BIR Form 0619E?

Hello Dan,

We’d be glad to assist you on this. Can you send us a message via customercare@taxumo.com?

Thank you!

What if i forgot to pay on the 10th day of month.can i pay on the 11thday

Hello Elisa,

It is ideal that you file and pay on time. You may always file beyond the deadline of BIR, however, kindly expect to pay for penalty fees.

how much the penalty cost?

Hello Noemi,

You may ask for a computation directly from your RDO if you have any penalty fees to pay 🙂

May I ask when is th due date of year end filing of ewt ?

Hello Luz,

BIR’s deadline is March 01, 2023 🙂

Hi po..

I am currently renting and the BIR Agent asks me to file 0619E for my rental. tama po ba na kami ang magfafile ng 0619E since kami nman po ang lessee

Hello Jen,

On your Certificate of Registration, do you have Expanded Withholding Tax? We can assist you to double check this, kindly send us a copy of your COR via customercare@taxumo.com.

Thank you!

Hello po! My question is if our monthly rental is in the amount of P7,000.00 and base on our contract we, the Lessee, our willing to pay the 5% with holding tax means that aside from our monthly rental fee to the Lessor we will pay P350.00 using the BIR Form 0619E? Thanks po

Hello Jian,

Good day!

As per RR No. 19-86, si Lesee po ang pwedeng mag bawas ng 5% from their rental payment kay Lessor. Yung nabawas po na 5% will be the value na ilalagay natin when we file for 0619E 🙂

Hello po,

Nag file and process po ako sa bank ng payment before the due date. After ng due date di pa po nag clear, binayaran ko nalang po po via GCash kaso after due date na po pumasok. Masubject padin po ako sa penalty/surcharge?

Thank you so much!

Hello Anika,

Good day!

You can check it po sa inyong RDO since they also have posting dates din po when it comes to payment. You may check their contact information here po: https://www.bir.gov.ph/index.php/contact-us/directory/regional-district-offices.html

Or you may also call the BIR’s Customer Assistance Division (formerly BIR Contact Center) at Hotline No. 8538-3200 or send an e-mail to contact_us@bir.gov.ph.

Hello! What if si lessor po hindi willing magbayad nung sa tax nila, rent ko po is 10,000 and full ko po sya binabayaran. Should I file it as zero sa Form 0619E?

Hello Irene,

Good day!

Yes, you may file your form 0619E under 0 dues since wala po kayo nakukuhang withholding taxes from your lessor. 🙂

Good Day!

I just paid my 0619-E thru Gcash on May 8, 2023 for the month of April. However, in my return period, I put 04302023 (April 30, 2023) which should be 04102023 (April 10, 2023).

What should I do po? Is there something I can do to correct it?

Hello Chelsea,

Good day!

You may have your data fixed by your RDO po. If you are within Manila area, you may ask Taxumo’s assistance for this and we will refer you po to our CPA partners to assist you with this. If kaya nyo naman po magpunta sa RDO ninyo to fix this directly, you may also do it po. 🙂

Hi, what if I mistakenly paid and filed for 0619E (3rd month of the quarter) instead of 1601EQ? Do I need to pay again or should I fill up 1601-EQ amended return? Pls. Advise. Thanks

Hello Jocelyn,

Good day!

You should still file your form 1601EQ. Failure to submit this form may lead you to have an open case in BIR. You can simply summarize the amount that you paid for the monthly EWT remittance on the quarterly remittance form so BIR will be notified of this accordingly. 🙂

Hindi po ba tama naman na end of the month yung return period sa gcash or maya? Like for paying 0619E na april is 04/30/23 talaga?

Hello Zhaira,

Yes it should be end of the month/quarter 🙂

Hi, good day! question what is the possible tax exposure if you don’t pay for income taxes?

Hello Tiffany,

Good day!

Failure to file and pay our income taxes will result to us having open cases in BIR. Please note that the compromise fee for unfiled forms with ZERO dues is 1k already. If you have dues, the penalty will be based on BIR’s tax table. 🙂

Hello, we are newbie foodcart owners. We failed to file our 1601C (zero dues) and 0619E, for 2 months 🙁

How do we file late filing for 1601C and 0619E?

Hello VC,

Good day!

In Taxumo, all you need to do is to select the form 1601C and 0619E on your settings, add your income, expenses, withholding tax information and the platform will properly calculate your tax dues and penalty on your behalf. Then you can simply file your late filings on your Tax Dues> Current Filings tab. 🙂

Hi, question lang po. start of filing po namin is Mar 2023. pero ngopen po tlga kami May 01, 2023 na. mg ffile lang po ba kami ng 1601eQ starting May to june?

Hello FC,

Good day!

As your registration date falls within the first quarter (Q1), it is still necessary to file the 1601EQ for Q1 (January to March), indicating zero dues. This step is essential to inform the BIR that during that period, your business did not generate any revenue yet. 🙂

hi po,

What happen if i mistakenly filed 0619-f online instead of 0919-E?

Hello Rezhel,

If you mistakenly filed Form 0619-F instead of Form 0919-E online, take these steps: promptly file the correct form, notify the tax authority, rectify discrepancies, and keep records. Understand potential penalties and seek professional advice if needed. Swift and accurate correction is crucial for fulfilling your tax obligations correctly, but remember that procedures can vary based on your location and tax regulations.”

Hope this helps! 😊

Regards,

Millicent

Hi, what if the Company has a 0619F to file but upon checking his/her EFPS portal, that tax type was removed. What will be the penalty if they filed this through ebirforms since that tax type was not yet added in the efps?

Thank you

Hello Airam,

If a company encounters difficulties filing Form 0619F through eBIRForms due to its absence on the EFPS portal, the best course of action is to directly contact the local Revenue District Office (RDO). They can provide guidance on the appropriate alternative method for filing this particular form. Engaging with the RDO ensures that the company receives accurate and up-to-date information, tailored to their specific situation and local regulations. Consulting the RDO is the recommended approach to address the issue effectively.

Regards,

Millicent

Hello po.. 4500 po ang rent namin sa stall..

Buo po namin binibigay ung 4500 na rent. Pero nung nag file po ako 225pesos parin binayaran ko dahil sa 5%. Tama po ba un? Bale dalawa kami nung nagpaparent ang nagbabayad ng 5% sa BIR. Kami po na nagrerent nagbabayad kami ng buo sa nagpaparent plus magbabayad pa kami sa BIR? TIA po

Hello Mhay,

If you are a withholding tax agent po, mag babawas po kayo ng 5% from your total rent expense and yan po ang nireremit natin sa BIR. What you can do po is to deduct the 5% equivalent of the withholding tax for rent and issue a form 2307 sa lessor ninyo as a proof na nakapag bawas kayo ng 5% withholding taxes sa kanila.Yung nabawas po na amount will be the dues na ireremit nyo sa BIR every EWT filing. 🙂

Hello!

Gusto ko lang pong malaman kung kasali po ba talaga ang orphanage sa dapat mag-file ng 0619E, 1601EQ, at 1604E?

Hello Maricar,

Ang pag-file ng BIR forms tulad ng 0619E, 1601EQ, at 1604E ay maaaring depende sa uri at kalagayan ng orfanato o orphanage. Maari silang kwalipikado sa ilalim ng iba’t ibang tax exemptions o special treatments batay sa kanilang status bilang isang non-profit organization.

Para sa eksaktong impormasyon, mainam na makipag-ugnay sa BIR o sa inyong RDO. 🙂

Hello!

I’m using EBIR FORMS for filing 1619E and 1601EQ, nakapag bayad kami sa bank before due date but sadly di namin na submit and final copy sa ebir so wala pong email confirmations. Subject parin po ba ako sa penalty?

Hello Jorge,

Hello there!

It’s a bit tricky without the email confirmations, but the important thing is that you were able to make the payment before the due date. However, the BIR usually requires both payment and submission of the final copy for the transaction to be considered complete.

To be sure about your specific situation and whether you’re subject to penalties, I recommend reaching out directly to the BIR or to the RDO directly.

Hope this helps. 🙂

Regards,

Millicent

Hello po! Ask ko lang po sana kung may penalty po ba if quarterly lang po kami nagreremit ng EWT na dapat may monthly po?

Hello Katrina,

It’s great that you’re checking on this. Generally, the BIR requires businesses to remit Expanded Withholding Tax (EWT) on a monthly basis. If you’re remitting quarterly instead of monthly, it might lead to penalties or interest charges, as this could be considered non-compliance with the prescribed schedule.

What is the EWT rate for Goods at source? and Services? and Rent?

Hello RZam,

Good day!

You may check this article to learn about EWT rates per service or goods.

https://www.taxumo.com/blog/expanded-withholding-tax/

https://www.bir.gov.ph/index.php/tax-information/withholding-tax.html

Hope this helps! 🙂

hello, what if accidentally there is an overpayment the 0619e, how will I refund the amount?

Hello Paul,

Good day!

If an overpayment has been made, you can process the refund to your RDO or you can use the overpayment for your succeeding EWT filings instead. 🙂

we are using paymaya in paying 0619E and the staff accidentally paid one of the branch twice? how can we refund the amount thank you.

Hello Paul,

Good day!

If an overpayment has been made, you can process the refund to your RDO or you can use the overpayment for your succeeding EWT filings instead. 🙂

Hi, what if hindi po nagbayad ng rent for the month need pa rin po ba mag remit ng wht?

Hello Roanne,

Even if you didn’t pay rent for the month, you might still be required to remit WHT. The withholding tax is typically based on the gross payment, regardless of whether you made the actual rent payment. It’s a good idea to double-check the specific requirements and consult with a tax professional to ensure compliance.

Hello Mary Rose,

If wala po tayong ireremit sa BIR mag fafile pa din po tayo ng WHT forms natin under 0 dues to notify BIR that for that period, wala po tayong rent at wala tayo ireremit sa kanila na Withholding Taxes. 🙂

Hello po if ever po hindi nakapagbayad ng rent for the month, required pa din po ba mag remit ng wht?

Hello Mary,

Absolutely, let’s dive deeper into this. Could you shoot us an email at customercare@taxumo.com, including your COR?

Hello Mary Rose,

If wala po tayong ireremit sa BIR mag fafile pa din po tayo ng WHT forms natin under 0 dues to notify BIR that for that period, wala po tayong rent at wala tayo ireremit sa kanila na Withholding Taxes. 🙂

Hello po,

Tanung ko lng po if ang binabayaran ko po na EWT sa rent ko po kay lessor ay 7000 tapos ako din po nagfifile at nagbabayad nung 0619e at 1601eq.Ayaw po kasi nya ibawas sa rent namin.Pano ko po ito ilalagay sa alphalist.Sa Pangalan at tin ko parin po ba. o kay lessor?

Hello Erc,

Good day!

If kayo po ang binabawasan ng EWT, sila po ang dapat mag remit ng withholding taxes ninyo kay BIR. Kayo po ay kailangan maissuehan ng form 2307 as a proof na nakapag bawas po sila ng EWT sa inyo. 🙂

Hi, if may penalty po due to late filing ng returns, how can I pay it po? error po kasi always if nag proceed payment ako sa EFPS

HI gud day. ask sana ako bakit yong bir form ko na 0619E nilagyan ko nang feb 2024 kasi for the month of february pero nang iclick ko yong validate ayaw magvalidate. Ang sabi ni bir invalid and date ko kasi mobalik sa JANUARY 2024. Anong reason? Please help me. Thank you and more power.

Hi Jocelyn! If finifile mo ng February, yung applicable taxable month nya is usually the month before. So dapat yung date ay January. Hope nakatulong 🙂

Hello po, I want to ask lang po, how about if there is an overpayment for EWT in January and gusto pong icredit for February, is it an amended form po ba to be filed or new filing po ng 0619e? And should the new form po reflect the actual monthly EWT po or mag 0 na po since walang nawithhold for Feb po?

Hello Michelle,

If wala pong nawithhold for the month of Feb, the tax dues should be ZERO po. 🙂

mam gud evng. Again regarding 0619E ang ibig kong sabihin epafile ko sana nang Mach 2024 applicable month for February .pag evalidate ko ayaw magvalidate kasi yong applicable date bumalik sa january 2024 .

Hi. Confused po ako regarding sa RETURN PERIOD. I’m paying compromise fees thru MYEG and it’s requiring the Return Period (which it says the date same as the Return Period in the filed return). I am filing for BIR 0619E for the month of Feb 2024. What date should I place there? 03/10/2024 or 03/15/2024 (late filing) or 03/31/2024?

Hi Cristina,

The return periof for the 0619E for February 2024 should be February 29, 2024 🙂